Some Australian investors bemoan the fact the ASX simply doesn’t offer the wealth of opportunities found on US indices like the Dow Jones, the NASDAQ, and the S&P 500.

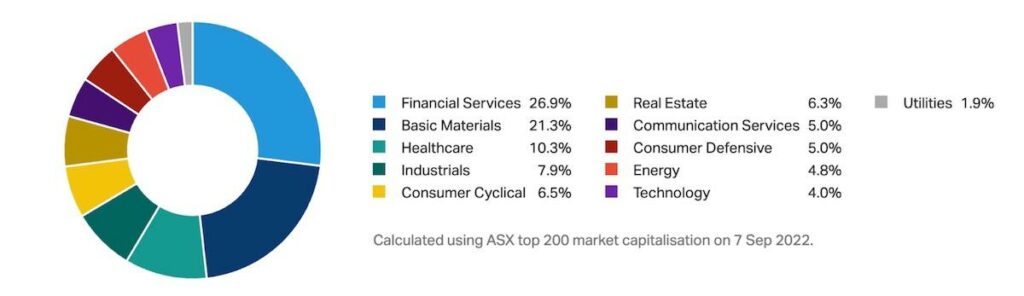

Close to 50% of the stocks listed on the ASX 200 come from two sectors – financial services and basic materials. In short, the ASX 200 is a great place to shop if you are looking for banking or mining stocks.

Source: Syfe Australia

Ask a seasoned US investor where they think Aussies have a significant advantage, and the most likely answer is because of franking. So, what are franked dividends and what is a fully franked dividend?

Top Australian Brokers

- eToro - Social and copy trading platform - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- Pepperstone - Trading education - Read our review

What is a Franked Dividend?

Newcomers to share market investing in the US may be shocked to learn of that country’s dreaded “double taxation”. US corporations are taxed based on earnings. When companies share their profits with investors in the form of dividend payments, the US tax system sees dividend payments to individual investors as earnings, subject to taxation. That means investors pay taxes for corporate earnings twice – at the corporate level and again at the personal level.

In Australia, like in the US, individual investors’ tax burdens vary by income level and other factors. In both the US and Australia, dividends are counted as income. However, in Australia, dividends can be “franked”, which means the company has paid all – 100% franking – or a portion – 30%, e.g., or none of the taxes on the dividends paid to investors. Financial websites should mark dividends as “fully franked” (100%), “partially franked”, with the percentage of dividends paid, or “unfranked”, where the investor bears the entire burden of taxation.

Although there are other considerations to take into account, generally speaking, an investor looking for passive income through dividend payments should gravitate toward fully franked dividend payments instead of unfranked dividends.

What Does Fully Franked Mean?

A fully franked dividend is one where 100% of the taxes of the dividend have been paid by the company, which is done through franking credit.

A franking credit, in whole (100%) or in part (less than 100%), is issued to investors for dividends paid at the time of payment and is submitted along with the total dividend amount in the individual investor’s tax filing documentation. In effect, the franking credit serves as a tax deduction. It can lead to tax rebates, depending on the circumstances of the individual investor filing the return and the corporate tax rate of the dividend-paying company.

The Benefits of Franked Dividends

While there is debate about how franked dividends impact a country’s tax collections, there is little doubt about who benefits – the individual investor. There is debate on the income level of the investor that benefits the most from franked dividends and lower tax collections.

In addition to the cash benefits of fully franked shares to individual investors, there is another less obvious benefit. The decision whether to “fully frank, partially frank, or unfrank” dividends paid to its investors can be a sign of a company’s financial health and its confidence in its future growth prospects.

Dividends are not fixed in stone, nor are franking credits, but companies less sure about their financial outlook in the short term may be less likely to maintain high levels of dividend payments and franking credits.

Fully Franked Dividend Shares

The ASX 200 does not lack high-quality, fully franked dividend shares. Choosing the best varies by investor preferences, but a history of rising dividend payments is a common denominator for most income investors.

Dividend payment history over the last decade is available on some Australian financial websites, as are five-year average yields and dividend payments. Less available is history going back more than a decade.

On that measure, Washington Soul Pattinson (ASX: SOL) is a clear standout, with fully franked dividend payments dating back to 2000. The company has increased its dividend payment each year over the last decade, from $0.46 per share in FY 2013 to $0.87 per share in FY 2023, with a five-year average dividend payment of $0.63 per share and an average yield of 2.41%.

Australia’s largest telecommunications stock, Telstra Group (ASX: TLS), is another dividend favourite, with a decade of uninterrupted dividend payments with some “ups and downs” and a five-year average dividend payment of $0.12 along with an average yield of 3.25%.

Both pale in comparison to the best dividend payer among the Big Four Aussie Banks right now, National Australia Bank (ASX: NAB), with a five-year average payment of $1.38 per share and a 5.36% yield.

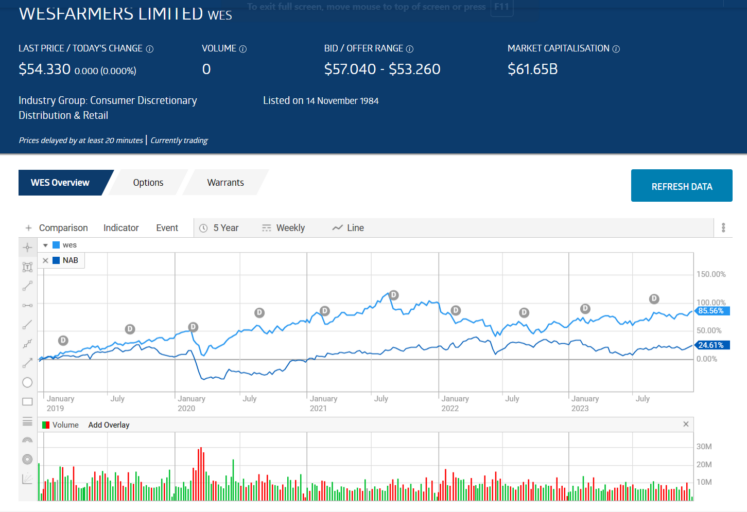

Making an investment choice strictly on dividend yield ignores the added impact on shareholder return of share price appreciation, as evidenced by comparing NAB with another ASX dividend powerhouse – Wesfarmers (ASX: WES).

Wesfarmers has a five-year average dividend payment of $1.78 per share, but the five-year yield of 3.95% trails that of NAB. Over five years, WES has outperformed NAB, with WES up 85.5% and NAB up 24.8%.

Source: ASX

The Best Australian Brokers

The best Australian brokers for online trading of dividend-paying stocks lean towards those with the best research tools. Dividend history is a vital consideration in income investing, as is the franking credits, or lack thereof, that come with the dividends paid.

Investors need to enter a stock code and get as much information about that stock as possible, with dividend history, franking credits, and payout ratio at the forefront of the search list.

Brokers with extensive stock education tools are often better at old-fashioned “stock-picking” than the most high-tech sites catering to the crypto and social media investing crowd.

Here at The Bull we have a side-by-side Broker Comparison Listing and detailed reviews of each broker.

eToro makes virtually every “Best Broker” finder site online today. The site has a comprehensive set of investor education courses and coverage of investing topics of interest.

eToro AUS Capital Ltd ACN 612 791 803 AFSL 491139. OTC Derivatives are speculative and leveraged. Not suitable for all investors. Capital at risk. See PDS and TMD

Interactive Brokers also has an exhaustive list of educational topics in video and article format and in interactive trading labs.

Finally, AvaTrade is yet another reputable online broker with a full suite of educational resources, catering to new investors.

These three and other brokers featured on our website offer demo accounts for practice trading. Here is the best place to test the broker site’s coverage of a given stock’s dividend history and performance metrics.

As opposed to the US “double taxation” system over dividend payments, Australian investors are protected with the optional system of franking credits. In Australia, corporations pay taxes on the earnings from which they extract dividend payments, but they have the option to pay what individual investors would be responsible for in a double taxation system. A corporation that fully franks its dividends pays the government what it’s due, issuing a franking credit to the investor for the amount—partial franking issues franking credits for the percentage of the total paid by the company. Unfranked dividends in Australia are subject to double taxation.

The system has its critics and supporters, with the critics claiming the system benefits wealthier taxpayers; however, advocates point to the ability of all investors to boost their return on investment.