Newcomers to investing in shares are bombarded with platitudes about “becoming part owners” of a company of their choice. They are also advised of the many things to consider before buying into a company, the key among them being the differences between companies that pay dividends to their shareholders and those that choose to invest a percentage of profits into making the company bigger and more profitable.

In the pre-1990s, dividend payments were standard, and investors expected them. Once the fast-moving tech companies arrived, investors and corporate executives preferred growth from the kind of share price appreciation a rapidly expanding company can generate.

In short, dividends were a cash benefit many investors felt they could forgo, but dividends were not the only “benefit” companies offered their shareholders.

What Are Shareholder Benefits?

Stockholder loyalty is a significant reason companies pay dividends. Investors attracted to a company’s long-term dividend potential are more likely to remain long-term shareholders.

In many walks of life, “perks” are offered to customers for the same purpose –brand recognition and loyalty. Today, reward clubs are popular perks offered by many retailers. Take advantage of the perk, join the club, and become a loyal customer.

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

It’s a stretch between retail shopping and investing thousands of dollars into a company, but the perks offered by the few companies that still have them serve the same purpose – loyalty to the brand.

Generally, a minimum number of shares are purchased to qualify for the investor perk. Retailer perks come in the form of discounts on company merchandise. For diversified retailers, a shareholder can use the perk at any brand the company operates.

Property companies sometimes offer purchase discounts or coupons for one month’s mortgage payment; entertainment companies might offer discounts at venues and events under their brand umbrella, and financial companies can offer discounts on mortgages.

Do Australian Companies Still Offer Shareholder Benefits?

Australian companies followed the US trend- fewer companies are offering shareholder perks, with cost being a significant factor. Establishing the infrastructure needed to enrol shareholders and manage dividend distribution and payout has proven too much to bear for many companies in the modern era. In Australia, one of our most recognisable brands – Coles – no longer offers shareholder perks.

Will Shareholder Benefits Ever Come Back?

Given the dramatic changes the digital age has brought to the investment landscape, a return to shareholder benefits is highly unlikely for several reasons.

Individual investors do not play the same role in the markets as they once did. Institutional and high-net-worth investors dominate, with little or no interest in discounts. More and more investors are abandoning the once dominant stock-picking approach in favour of fund investing. Mutual funds started the trend, and exchange-traded funds (ETFs) allowed retail investors to build a diversified portfolio of holdings with an investment in a single ETF.

Australian Companies with Shareholder Benefits

Domino’s Pizza has offered shareholders 40% discount cards for pizza purchases for a limited time as far back as 2006. More recently, in October 2022, the company offered 30% discount vouchers to shareholders, valid until 1 December 2023.

Here are six ASX-listed companies currently offering some form of discount to shareholders.

- Viva Leisure (ASX: VVA) – Health Club Opera

- EVT Limited (ASX: EVT) – Entertainment and Leisure

- Mosaic Brands (ASX: MOZ) – Women’s Apparel Retailer

- Beacon Lighting (ASX: BLX) – Lighting Products Retailer

- Cedar Woods Properties (ASX: CWP) – Residential Property Developer

- AMP Limited (ASX: AMP) – Wealth Management Company

Viva Leisure (ASX: VVA)

Viva Leisure was listed on the ASX in June 2019 and posted its first profit in FY 2023. The company operates 360 health club facilities catering to various needs, from big-box general health clubs to women’s only clubs, swim schools, boutique Pilates and yoga facilities.

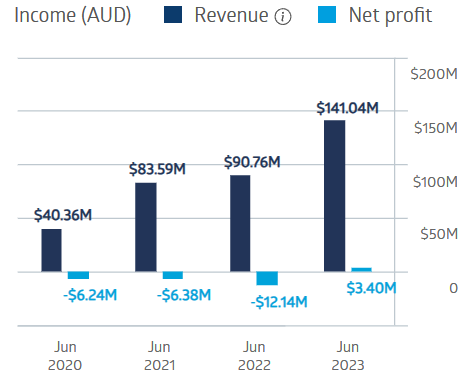

Viva Leisure Financial Performance

Source: ASX

Revenues rose 55.4%, continuing the pattern of revenue growth since listing, while profit shifted upward by $15.5 million – from an FY 2022 loss of $12.14 million to a statutory net profit of $3.4 million.

The company is undertaking facility upgrades and refurbishments. A February report from IBIS World Gym and Fitness Centres shows Viva Leisure having a 50% share of the fitness market in Australia.

With a ninety-day average trading volume of 110,903 shares per day, this small-cap, under-the-radar stock has seen its stock price remain essentially flat.

Source: ASX

The share price did get a 6% boost from a 3 August company announcement of a Shareholder Discount Program. Shareholders with more than 1,000 shares will now be eligible for a 25% discount on their health club membership. The program will be fully automated and run by a technology program created by Viva employees.

The company’s performance to date merits at least a place on an investor watchlist. Perhaps the discount program was enough to bump some potential investors into action. In any case, Viva’s move shows there may still be some value to companies initiating cost-effective discount programs.

EVT Limited (ASX: EVT)

EVT is a diversified provider of entertainment, leisure, and travel experiences. The company operates cinemas, restaurants and bars, hotels and resorts, and Australia’s Thredbo ski and biking resort. The company’s asset portfolio is valued at $2 billion. EVT operates here in Australia, in New Zealand, and Germany.

As expected for all travel and leisure companies, EVT’s financial performance was impacted by COVID-19 border closures and lockdowns, but it has rebounded.

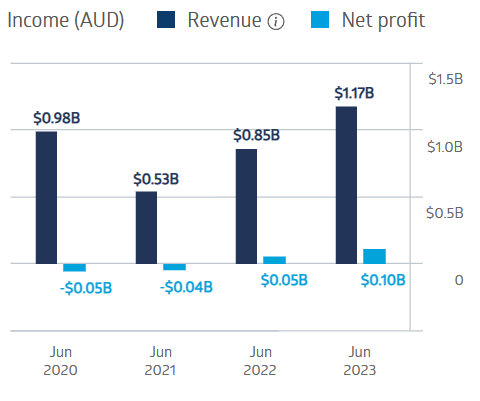

EVT Financial Performance

Source: ASX

Overall revenues were up 34%, with record takings by the Hotels and the Thredbo resort. Management issued a positive outlook and declared a fully franked final dividend of $0.20 per share.

The company did not pay a dividend in FY 2021 but has a five-year average dividend payment of $0.48 per share and a five-year average dividend yield of 4.02%.

EVT’s shareholder benefit varies by category, with a shareholder benefit card issued to all shareholders with more than 500 shares for use at cinemas, hotels, and the Thredbo resort. Hotel discounts include 15% off the best available room rate and 20% off hotel food and beverages.

Mosaic Brands (ASX: MOZ)

Mosaic Brands – once known as Noni B – entered the Australian women’s fashion scene in 1960, adding additional brand names and changing its name to reflect the company’s nine brands with around 1,000 stores across Australia and online digital platforms. Mosaic brands are all company-owned. The business operates in Australia and New Zealand, with the lion’s share of revenues coming from Australia.

Like most retailers with a significant brick-and-mortar store distribution system, Mosaic was hit hard by the COVID-19 Pandemic and has only begun to recover, posting revenue growth and a dramatic profit turnaround in FY 2023.

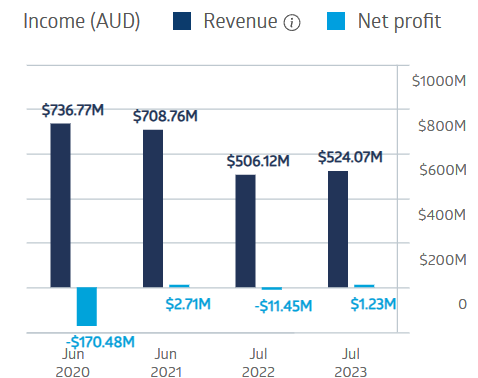

Mosaic Brands Financial Performance

Source: ASX

Revenue was up 3.5% and still well short of pre-COVID levels, while the profit turnaround from a loss of $11.45 million to a profit of $1.23 million represents a shift of 110.8%.

The stock price plunged in the early days of COVID-19 and has continued to trend downward, unlike some ASX retailers. While not an “apples to apples” comparison, the Mosaic share price is down 95% over five years, while diversified Premier Investments (PMV) that offers women’s fashions and accessories is up 99%.

Source: ASX

Mosaic shareholders with at least 2,000 shares in their portfolio are issued a Shareholder’s Reward Card that offers a 10% discount at any of the company’s brick-and-mortar outlets.

Beacon Lighting (ASX: BLX)

Beacon Lighting is global in scope, offering customers an array of lighting and energy products the company designs, manufactures, and distributes. Products range from lighting fixtures and fittings to ceiling fans, solar panels, and various related electrical accessory products. Beacon sells through company-owned and franchise stores as well as online.

Over five years, the share price is up 115.32%, with a brief dip at the onset of COVID-19 and a rapid recovery.

Source: ASX

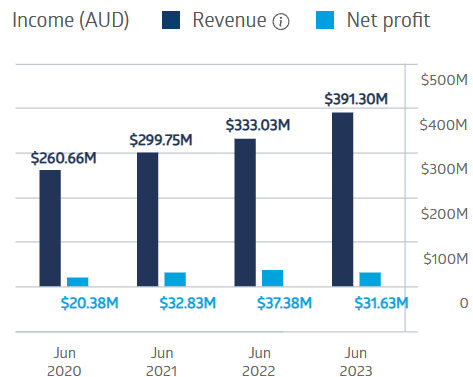

The company’s financial performance over the last four fiscal years defied the COVID-19 impact, maintaining revenue growth in all four fiscal years, with a slight dip in net profit in FY 2023, but still surpassing net profit in the first year’s finances during the early days of COVID.

Beacon Lighting Financial Performance

Source: ASX

The revenue of $312.44 million was a company record, with online trade sales jumping 36%. In FY 2023, the company added two new branded websites – GE Imagine Smart Living and Made by Mayfair – to complement its 16 existing dedicated business websites.

The company has paid yearly dividends over the past decade, averaging $0.07 in dividend payments over five years. The FY 2023 total $0.08 per share dividends were fully franked. The dividend yield over five years averaged 4.25%.

Beacon Lighting invites all investors with a minimum of 500 shares to activate an Investor Pass application that allows shareholders to shop at the Beacon Trade website and buy at trade member pricing with free shipping and same-day delivery.

Cedar Woods Properties (ASX: CWP)

Cedar Woods develops residential communities and commercial developments in four mainland Australian states – Western Australia, Queensland, Victoria, and South Australia. The company has 35 existing projects with a pipeline of more than 10,000 lots for development.

Although the company survived the COVID-19 pandemic, financial performance has been hurt by the current environment of rising interest rates. Revenues increased in each of the last four fiscal years, but net profit dropped in FY 2023.

Cedar Woods Properties Financial Performance

Source: ASX

The total dividends of $0.20 per share paid to Cedar Woods shareholders in FY 2023 were fully franked. Over five years, dividend payments have averaged $0.27 per share, with a five-year average dividend yield of 4.98%.

Cedar Woods Properties offers discounts on residential land lots (5%) and on houses, townhouses, apartments, and strata commercial units (2.5%). (Residential or commercial strata units allow individual ownership of a unit within a larger building where common areas are shared.) To qualify, shareholders need to have held at least 1,000 CWP shares for six months before purchase.

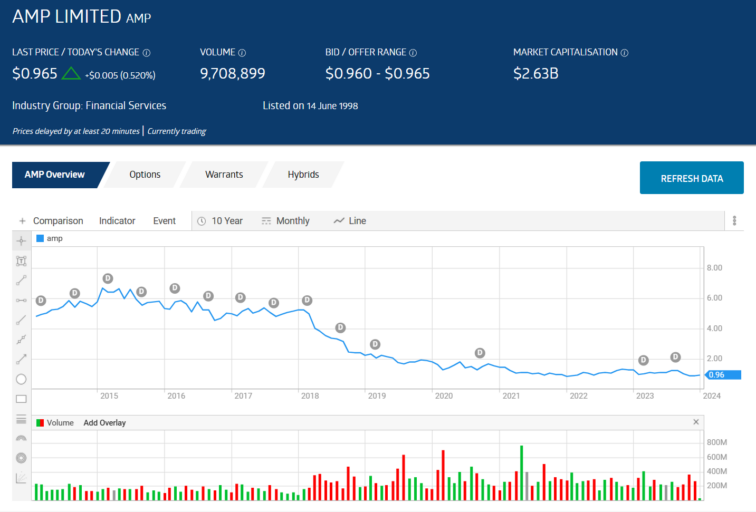

AMP Limited (ASX: AMP)

AMP Limited is primarily known for its wealth management business and network of financial advisors offering AMP and non-AMP investment products. AMP also has a retail banking operation offering home mortgages.

Unfortunately, for its long-time investors, the company is also now known for its “fee for no services” scandal and the resulting fines it was forced to pay. As a result of an ASIC lawsuit against the company, AMP had to pay a fine of $14.6 million in September 2022. By August 2022, the company had already paid out $627 million in remuneration to over three hundred thousand clients.

In November 2023, the AMP management announced a $100 million settlement in a class action suit against the company. The shares were trading above $6 per share when the scandal broke in early 2018 and have remained in freefall since. They are now down 78.02% over ten years.

Source: ASX

The company’s shareholder discounts Australia program is called AMP First and is available to shareholders with a minimum of 500 shares. Home loan discounts are available when applying for a new loan via an AMP Bank. Other perks include eliminating multiple fees associated with traditional mortgage loans.

Publicly traded companies have a vested interest in developing and maintaining loyal customers. Many senior investors are loyal to the traditional ASX big dividend names like Tesla and the BIG Four Banks. Historically, there have been, and there remain, ASX-listed companies that believe providing their shareholders with something extra will build loyalty.

Shareholder perks are discounts on products offered and have minimum ownership requirements.

Sceptics of the influence discounted merchandise may have should review what happened to the stock of Viva Leisure when the company announced the beginning of a Shareholder Discount Program – a rising stock price.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy