Newcomers to stock market investing can be surprised to learn that picking stocks with the expectation they will rise in price over time is not the only stock-picking strategy available. There is a strategy called short selling that allows investors to profit when a stock price falls. Financial websites list the Top Ten or Top Thirty most shorted stocks on the ASX.

Researching the possible reasons for the stock joining the list of the most shorted stocks ASX and possibilities for returning to market favour is essential in picking an ASX stock to short.

When investors identify a prospective target, they can “short” the stock with any brokerage house – online or a brick-and-mortar full service, at its current price. The brokerage then “loans” that investor stock borrowed elsewhere. Shorting 100 shares of a $20 AUD per share stock nets the investor a $2,000 AUD “loan” in their account with the obligation to return the borrowed shares at the time the 100 shares are purchased. The short seller “covers” the short position by buying the stock at a favourable, but lower price, pocketing the difference.

What happens if the stock price goes up instead of down? The risk of loss will not stop until the short seller covers, often at a loss far exceeding the original proceeds from the short. Buying a stock outright limits the risk of loss to the initial investment.

The risk is why most financial analysts recommend that retail investors avoid short selling. The assumption behind the advice to stay away may be the belief that short sellers are “the smartest guys in the room”, given the extensive amount of research needed to predict a stock could be in trouble.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The short sellers sometimes get it wrong, opening the door to significant gains for longer-term retail investors. When any of the most shorted ASX stocks begin a sustained upward movement, short sellers sometimes panic and rush to cover their short positions, resulting in a classic “short squeeze”, driving up the share price.

Some companies that have been shorted may be a good buy, and many will not. Here are shorted stocks from the Australian top ten.

Flight Centre Limited (ASX: FLT)

When the full impact of the COVID-19 pandemic reared its ugly head, it did not take a certified financial analyst (CFA) to predict stocks focused on the travel sector were in deep trouble, so the shorts rushed in. Flight Centre first made the tenth spot on the list in April 2020, eventually climbing to the top; it remains there today.

The World Health Organisation (WHO) downgraded COVID as a public health emergency, although the pandemic is still with us. With opened borders, the Flight Centre Group is gaining some of what it lost, but the shorts are not giving up.

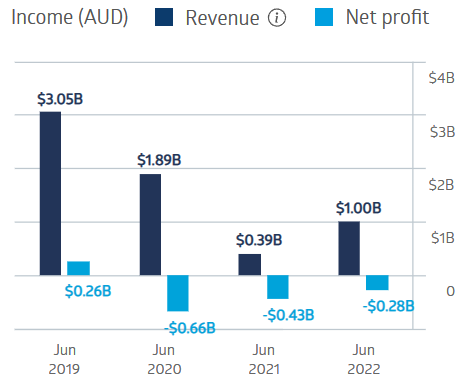

Year to date, in 2023, the stock price is up 48.79%. In FY 2019, Flight Centre had revenues of $3.0bn AUD and an income of $260m AUD. In FY 2020, revenues fell to $1.89bn AUD while profit evaporated, replaced by a $660m AUD loss. The rout continued in FY 2021, with revenues dropping to $390m AUD and the loss improving slightly to $430m AUD.

Flight Centre Travel Group Financial Performance

For the Half Year 2023, the company tripled revenue from $315.6m AUD to $1.0bn AUD and cut its loss from $188m AUD to $2.4m AUD, but the shorts are not giving up.

Flight Centre is one of the world’s largest diversified travel groups, with brick-and-mortar outlets and an online presence in four regions across the globe.

The company had been a continuous dividend payer from 2013 until the onset of COVID.

Source: ASX 01/05/2023

The share price hit a 52-week high on 11th May, and three major analysts posted bullish updates on the stock.

Core Lithium (ASX: CXO)

When a stock travels too far too fast, analysts and short sellers warn of “excessive valuation.” Over five years, the Core Lithium share price is up a staggering 2.025%.

Source: ASX 15/05/2023

In 2016 Core uncovered an ore body at its wholly owned Finniss Lithium Project in the Northern Territory.

In December 2021, Core announced to the market positive drilling results at Finnis, and the share price continued to rise through early 2023 when global inflation and a declining lithium price took their toll.

On 5th January 2023, the company announced the first product shipment from the Port of Darwin. On 11th May, the NT government approved a second mine at Finnis.

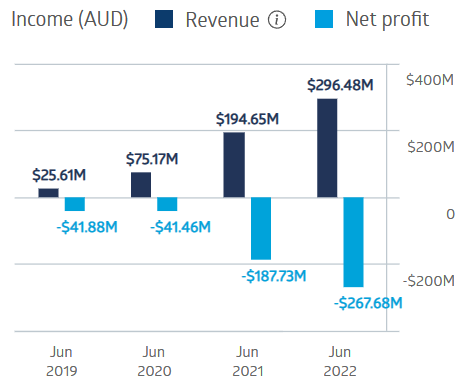

Core Lithium Financial Performance

Core is now generating some revenue and has offtake agreements in place. It has two additional wholly owned lithium projects in the Northern Territory and a zinc asset in South Australia.

Points Bet Holdings (ASX: PBH)

Points Bet is sixth on the most shorted stocks on the ASX list. Some market commentators speculate that short sellers are looking at the amount of cash the company is going through (cash burn) and the highly competitive nature of the sports betting industry.

Points Bet listed on 30th June 2016, hitting an all-time high on 15th February 2021 before slowly falling back to earth, trading today for $1.47 AUD per share.

Source: ASX 08/05/2023

Points Bet opened to great fanfare, touting itself as the best newcomer to Australia’s sports and racing betting scene, with “the most exciting” format for sports betting on the planet. Sports betting is not new to Australia, but what attracted investors to Points Bet was the opening of the sports betting market in select states in the US in 2018.

Points Bet gained entry to state after state, reaching 15 states before its deteriorating financial position forced the company to sell its US assets to US company Fanatics for $225m AUD. The Australian Financial Review had reported Points Bet sought a US buyer following a failed attempt to sell its Australian business.

The shorts may be right on this one, as the company’s revenue generation paled in comparison to its massive losses.

Points Bet Holdings Financial Performance

Source: ASX 15/05/2023

Lake Resources (ASX: LKE)

Lithium miner Lake Resources joined Core on the most shorted ASX share list at the seventh spot following the May 2022 pronouncement from global investment bank Goldman Sachs that the bull market for battery metals had peaked.

Lake’s flagship Kachi lithium asset, along with three other projects, is located in the lithium triangle in South America, dominated by lithium from brine production. Lake claims the direct extraction technology Lilac Solutions of California developed will produce higher-purity lithium.

Lilac and Lake have a pilot plant in operation for providing lithium samples to potential customers.

The share price has taken a beating year over year – down 55% – spurred on by the short sellers hopping on declining lithium prices and concerns over the capabilities of Lake and Lilac’s direct extraction technology.

Source: ASX: 15/05/2023

On 16th April, the company’s joint venture direct extraction pilot plan produced the first significant amount of lithium carbonate – 2,500kg. The Lake Lilac partnership is ready to move to full-scale operations, making Kachi the only brine operation to eliminate the need for evaporation ponds.

Lake Resources Financial Performance

Bell Potter expects Lake to reach profitability in FY 2025, following a slight loss in FY 2024.

Temple & Webster (ASX: TPW)

This online-only e-tailer of furniture and homewares is on the shorted list, presumably because of the housing downturn and the continued expectation that more and more Aussies are returning to shopping at brick-and-mortar outlets.

With its direct shipping model, Temple’s business model reduces the risk posed by downturns. The company maintains no inventory, thereby eliminating significant costs.

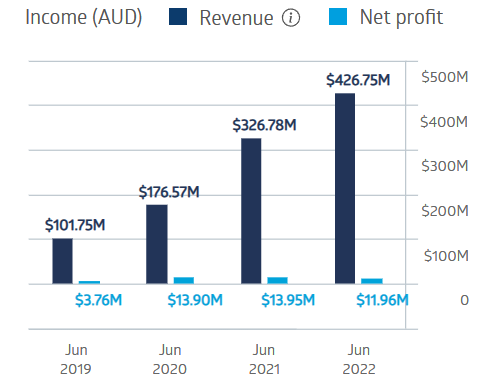

The company’s financial results during the pandemic were phenomenal – increasing revenue yearly while remaining profitable.

Temple & Webster Financial Performance

Source: ASX 19/05/2023

The highly volatile share price is up 15.88% year on year, rescued by a 27% boost over the past five days. In February, the share price was crushed when the company’s Half Year 2023 Financial Results showed a 12% drop in revenue over the same period in 2022 and a 47% decline in profit.

Source: ASX 19/05/2023

Goldman Sachs had already placed Temple on its conviction buy list, releasing a note to its investors following the release reiterating its confidence in Temple.

Short selling is a strategy that allows investors to make a profit when a shorted stock goes down in price, allowing the investor to keep the difference between the price at shorting and the price at the sale to cover shares borrowed for the shorting.

Shorting has unlimited risk, as the cost of coverage increases as the stock rises above the shorted price. Short sellers can be wrong, leading to buying opportunities for investors from a short squeeze.

FAQs

What is Short Selling?

Short selling is a trading strategy that profits from the price of a stock decreasing. It can be used either as a speculative trade, or to hedge against any downside risk from a long position on the same stock. It is a very risky strategy as the potential losses can be very large if the market moves against you. With a long position the price of the stock can only drop to zero. However with a short position there is no limit to how high the price of a stock can go so the risk is theoretically unlimited.

How do you Short ASX Stocks?

True short selling is normally only available to institutional investors. To short a stock you borrow shares of a company and sell it at the current price. The position is then closed by buying back the shares and returning them. A more common method among retail traders is to instead use CFDs or options contracts and take a sell position.

What is a Short Squeeze?

A short squeeze is a rare phenomenon where a heavily shorted stock unexpectedly increases in price. This causes the short sellers to close their positions by buying the stock, driving the price up further. This famously happened to Gamestop (GME) in 2021 when the stock price jumped from $5 to over $300 in less than a month, forcing the hedge fund Melvin Capital to lose billions.