- Santos is expanding its LNG (liquefied natural gas) capabilities.

- The company has a JV with Beech Energy (ASX: BPT) to construct a major CCS (carbon capture storage) facility.

- Santo Energy Solutions is working on the development of cleaner fuels for the future.

Like many of the world’s oil and gas producers, Santos is preparing for a future with zero, or near zero, carbon emissions.

Since 2018, Santos has been issuing annual climate change reports, following the guidelines of the G20’s Task Force on Climate-related Financial Disclosures (TCFD).

Included in the company’s Climate Transition Action Plan is the target of net zero emissions from Santos operational facilities by 2040.

The Moomba CCS (carbon capture storage) facility, a joint venture with Beach Energy (ASX: BPT), is expected to begin operation in 2024. Moomba will have the capacity to store 1.7 million tonnes of carbon dioxide in depleted gas reservoirs in the Cooper Basin during its first year of operation.

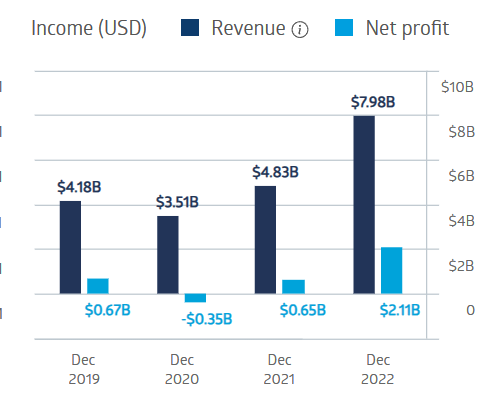

COVID 19 plunged the company into the red, but, despite fluctuating oil prices the company has more than doubled its pre-COVID profit, with revenues close to doubling.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Santos Financial Performance

Source: ASX

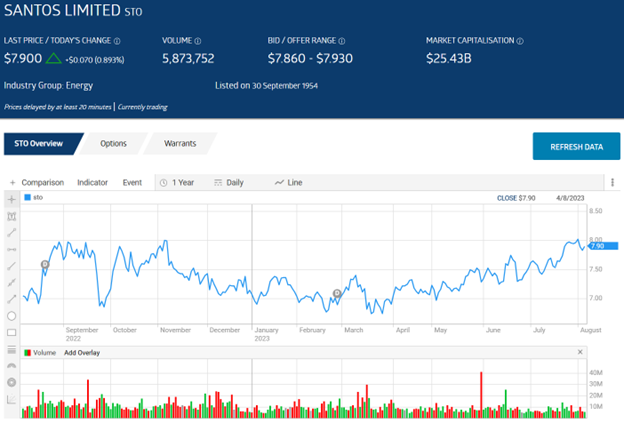

Year-over-year, the share price is up 11.42%. With the share price bouncing back and forth, there is ample opportunity for buying on the dip.

Source: ASX

The acquisition of rival Oil Search Limited added the Papua New Guinea LNG project to Santos’s existing Darwin LNG operation. In 2020, Santos acquired the Barossa Gas Field under the Timor Sea to expand its LNG capabilities.

An analyst at Marcus Today has a BUY recommendation on Santos shares, citing the Barossa project as an important catalyst for growth.