Blue Chip stocks are not just for risk averse investors, although most market commentators cite “safety” as one of the principal attractions of Blue Chips. The safety comes from the rock solid financial stability of most blue chip stocks, along with decades long track records of solid performance.

Dividend payments are another major reason for the attraction of blue chip stocks. Although there is no precise definition of a blue chip stock, dividends are acknowledged as one factor that differentiates a blue chip from a large cap stock.

A history of consistent dividend payments reinforces the financial stability of a company that continues to share company earnings with investors.

Many blue chip companies are market leaders in the sectors in which they operate with the products and services they provide instantly recognizable to both the investing and the general public. Putting all those factors together suggests blue chips can withstand downturns in the larger economy or in their respective business sectors.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Here then are five of the best blue chips from the first half of 2024 and their performance through the end of the year.

Rio Tinto Limited (ASX: RIO)

It should come as no surprise that some of the best ASX blue chip stocks in today’s market are mining companies. The UK and Australian joint listed Rio Tinto may be the best of breed, not so much because it is one of several diversified ASX blue chip mining stocks, but because of the range of commodities RIO counts among its operational assets.

On 28 May of 2018 Rio sold its last remaining coal mine, leaving the company as the world’s only global miner having fully exited the coal space. The company has been on a path towards carbon neutrality and has entered the renewable energy space since shedding its coal assets and now counts lithium among its mined commodities. Rio has three lithium projects in development – the Rincon Lithium Project in Argentina, the James Bay project in Quebec, Canada, and the Jadar Project in Serbia, on hold at the moment.

On 12 December of 2024 Rio announced plans to invest $2.5 billion dollars to expand the Rincon project. On 9 October, the company announced plans to acquire Arcadium Lithium (ASX: LTM.)

Rio’s principal asset remains iron ore, but the company is committed to producing “green steel” by reducing carbon emissions at its mine by converting to renewable energy generating sources, primarily wind and solar.

The company also mines copper and aluminum – both commodities of vital importance for a clean energy future – as well as titanium dioxide, a coating that can reduce carbon emissions – and borates for both agricultural and high-tech applications. Rio is the majority shareholder of Energy Resources Australia (ERA). Rio recently announced the company would buy $319 AUD million dollars in ERA shares to help fund the rehabilitation of ERA’s Ranger Uranium Mine site. As of 19 November of 2024 Rio increased its ownership stake in ERA to 98%.

Volatility in commodity prices continued in FY 2023, driving down Rio’s net profit after tax by 19% with revenues declining 2.7%. Higher costs on input materials and energy along with inflationary pressures on operating costs across the board also impacted on the results.

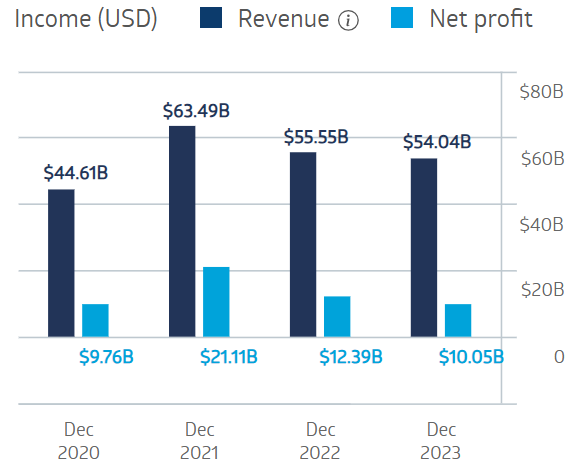

Rio Tinto Financial Performance

Source: ASX Website

Half Year 2024 financial results turned positive, with a modest 1% increase in consolidated revenues with a 14% rise in net profit after tax.

The company has been a prolific dividend payer over time but did cut the FY 2022 dividend payment of AUD$6.86 per share to $3.93 per share. Rio’s five-year average dividend yield is 6.17%.

Analysts are still largely bullish on RIO, led by global investment banking behemoth Goldman Sachs. The Wall Street Journal has an analyst consensus rating of OVERWEIGHT, with five of the thirteen analysts reporting at BUY, three at OVERWEIGHT, and five at HOLD.

It is debatable how much of a household name RIO is, but on every other measure the company goes beyond large cap into blue chip stock status. Over five years the stock price is up 16% % in volatile trading. Year over year the stock price is down 5.66%, as of 15 January of 2025.. The stock price has been in decline in the second half of the 2024 trading year.

Sonic Healthcare Limited (ASX: SHL)

From bruises to bone cancer, the treatment of medical ailments begins with a diagnosis, from sample tests conducted in a pathology laboratory, to medical imaging, to symptomatic diagnosis from a medical practitioner.

Sonic Healthcare may not meet the Australian blue chip stock “household name” qualifying standard, but the company is one of the largest providers of laboratory and diagnostic imaging worldwide and an Australian leader in medical imaging and general and occupational health treatment centres.

The company serves medical practitioners, hospitals, and community health centres with its full line of medical imaging services available in 120 clinics across Australia, from X-rays and Ultrasounds to Magnetic Resonance Imaging (MRI) to Computerised Topography (CT) to mammography and nuclear medicine.

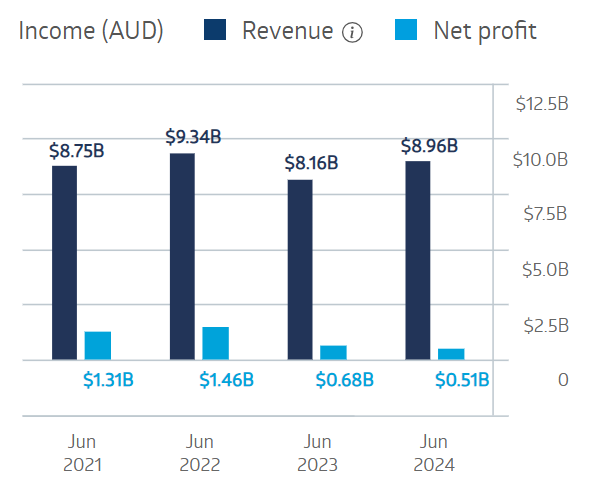

The COVID 19 Pandemic was a “double edged sword” for the company, with some operations benefiting from Covid testing and others suffering from the shutdown of a wide range of non-life threatening medical procedures. The impact was slight, with a drop in net profit between FY 2019 and FY 2020. By 2022 Sonic’s financials fully recovered but took a drop in FY 2023. The company saw declines in both revenue and profit in FY 2023 from declining COVID related revenues but rebounded in FY 2024.

Sonic Healthcare Financials

Source: ASX Website

The company’s five year average dividend yield in 2.88%, with the stock price down 9.88% over five years and 11.7% year over year, as of 15 January of 2025.

The Wall Street Journal has an analyst consensus HOLD rating on Sonic shares, with three of the twelve reporting at OVERWEIGHT, six at HOLD, and three at UNDERWEIGHT.

Transurban Group (ASX: TCL)

Transurban is one of the world’s largest toll road operators. The company designs, builds, and operates toll roads in Sydney, Melbourne and Brisbane in Australia, in the Greater Washington DC area in the United States and in Montreal Canada.

Under normal conditions, toll road operators should function as reliable defensive stocks as travel remains relatively constant even in tough economic times. The stay-at-home work environment and lockdowns were highly abnormal.

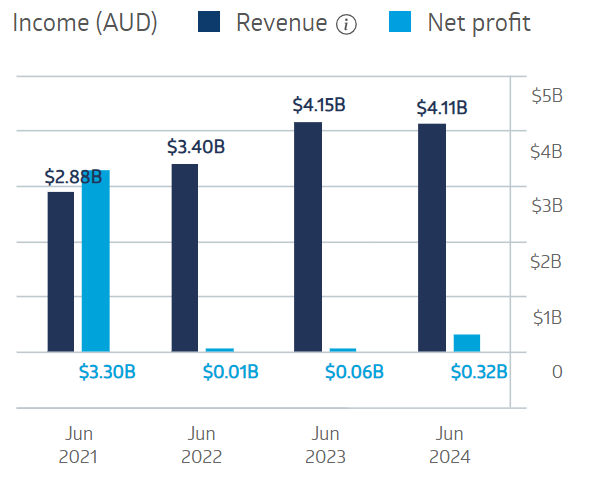

The company’s financial performance over the last three fiscal years reflects the impact of a veritable “black swan” event on Transurban. (A black swan event is an occurrence so rare it is impossible for normal economic models to predict them.)

Transurban Financial Performance

Source: ASX Website

The net profit reported in FY 2021 was attributed to discontinued operations. Half Year 2023 Financial Results showed marked improvements. Revenues rose from $1,056 AUD billion dollars to $1,436 while net profit rebounded from a loss of $106 million dollars to a profit of $55 million dollars. The company reported record traffic volume as well, hitting 2.5 million trips in November of 2022.

Full Year 2023 results showed revenues increasing by 26.2% while net profit rose from $16 million in FY 2022 (excluding one offs) to $92 million. Full Year 2024 results showed a slight decline in revenues with a solid increase in net profit.

Transurban has been a consistent dividend payer over the last decade, maintaining dividends during COVID. TCL’s five-year dividend yield average is 3.36%.The share price is up 1.35% year over year, rebounding in the second half of 2024.

Source: ASX Website

The Wall Street Journal has a consensus HOLD rating on TCL shares, with one analyst at BUY, and thirteen at HOLD.

QBE Insurance Group Limited (ASX: QBE)

QBE Insurance claims it is a “household name” in Australia. The company is among the top 25 insurers and reinsurers on the planet and the largest general insurance company here in Australia.

QBE is international in scope serving consumer and commercial customers in Australia, the Asia Pacific, North America, Asia, Europe, and the UK. QBE has been in business since 1886.

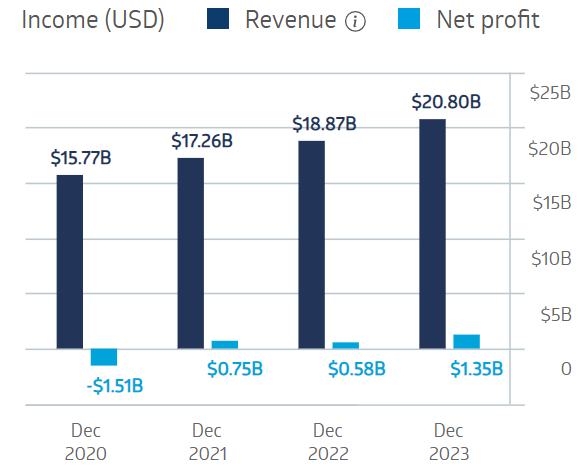

Although QBE’s profit dipped substantially in FY 2020 during the Covid pandemic, revenues rose throughout and net profit in both FY 2021 and FY 2022 exceeded reported net profit in the pre-pandemic year of 2019. The improving trend continued into Full Year 2023.

QBE Financial Performance

Source: ASX Website

Half-Year 2024 results were outstanding, with revenues up 6.7% and net profit up 100%, rising to 4802 million dollars from $400 million dollars.

The company maintained dividend payments during Covid with the exception of the elimination of an interim payment in FY 2021. The current dividend payment of $0.72 per share is a ten-year high. The five-y ear average dividend yield is 1.78%.

Year over year the share price is up 19%, as of 24 May of 2024.29.6%, with a strong finish in the final quarter of the year.

Source: ASX Website

The Wall Street Journal has an analyst consensus rating of OVERWEIGHT on QBE shares with seven of the analysts reporting at BUY, one o at OVERWEIGHT, three at HOLD, and two at UNDERWEIGHT.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Insurance Australia Group (ASX: IAG)

Insurance Australia Group is the largest general insurer serving Australia and New Zealand with multiple brands of insurance products. IAG has six brands in Australia and three in New Zealand. These branded companies offer general insurance products to the consumer and commercial markets as well as investment management services.

The company’s financials have fully recovered from the impact of Covid, with net profit in FY 2023 doubling FY 2022 levels, with the positive results continuing into FY 2024.

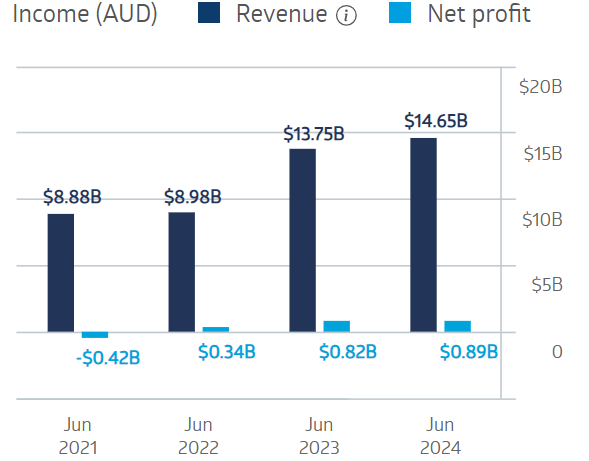

Insurance Australia Group Financial Performance

Source: ASX Website

The company’s five year average dividend yield is 2.77%. The Wall Street Journal has an analyst consensus rating of OVERWEIGHT, with three analysts at BUY, two at OVERWEIGHT, six at HOLD, and one at UNDERWEIGHT.

Year over year the share price is up 55.1%, with a strong second-half performance.

Source: ASX Website

Blue Chips have a gold-plated reputation in the Australian investment community, with the financial resources to withstand challenging economic conditions. Financial stability can be seen in a prospective blue chip’s historical record of financial performance. Share price performance over time shows appreciation. Products and services offered are consistently in demand and may be well-known to the non-investing public. The crown jewel of blue chip investing remains dividend payments.

Over time dividends can significantly increase the total return on investment, earning the best ASX blue chip stocks a place in an investment portfolio.

FAQs

What are Blue Chip Stocks?

A blue chip stock is the stock of a very large company with an excellent reputation and sound financials. Usually these companies have been in business for many years and have dependable earnings. These companies tend to have market caps in the billions of dollars and are one of the leading companies in their sector. Australian blue chip companies include Rio Tinto Limited, Insurance Australia Group and Westpac Bank Corporation

How do you Invest in Blue Chip Stocks?

You can buy blue chip stocks through a regulated broker. Blue chip stocks tend to be a safer investment that other types of stocks as the companies are, by definition, very large and have been operating successfully for many years. You should always do your own research before deciding to invest in blue chip stocks and always have a risk management plan in place.

Where Does the Name Blue Chip Stocks Come From?

The term blue chip stocks was coined in the 1920s by Oliver Gingold who worked for the Dow Jones. It is a reference to poker, where the blue chips had the highest value. It was originally used to describe high value stocks but these days it has more to do with a company’s history and reputation. For example Facebook (now called Meta) has a market cap of over $1 trillion, but is generally not considered a blue chip stock as it was only founded in 2004.