- Amcor’s packaging products are essential requirements for global commerce.

- The bustling packaging sector, and Amcor’s leading role in the sector, make the company’s stock a valid long-term hold.

- As long as the world makes products, the demand for packaging will remain.

Warren Buffet once said that his favorite holding period for a stock was “forever.” Not many stocks meet this high standard, but global packaging giant, Amcor (ASX: AMC), may be one of them.

Virtually all products will require some sort of packaging. Amcor has innovated this field and makes both flexible and rigid packaging; the flexible packaging is often made from plastic, aluminum, and fiber-based materials, whilst the rigid packaging is formed of hot and cold tolerant polyethylene and glass.

In challenging economic environments, the demand for packaging will suffer almost in parallel with the declining demand for products. However, since the time of the industrial revolution, there have been repeated cycles of hard times followed by good times; the need for packaging may drop at times, but it will never disappear.

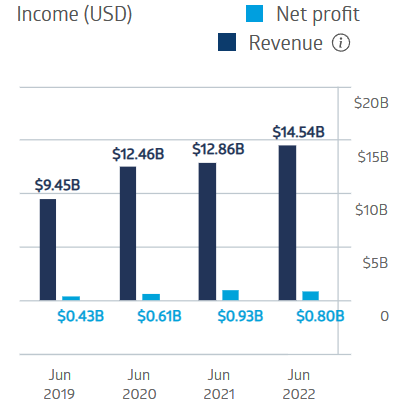

Despite the Covid pandemic and the subsequent lockdowns and supply chain disruptions, Amcor managed to increase revenue in each of the last four fiscal years, with profit declining only between FY 2021 and FY 2022. The company reaches forty-three countries around the world.

Amcor Financial Performance

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

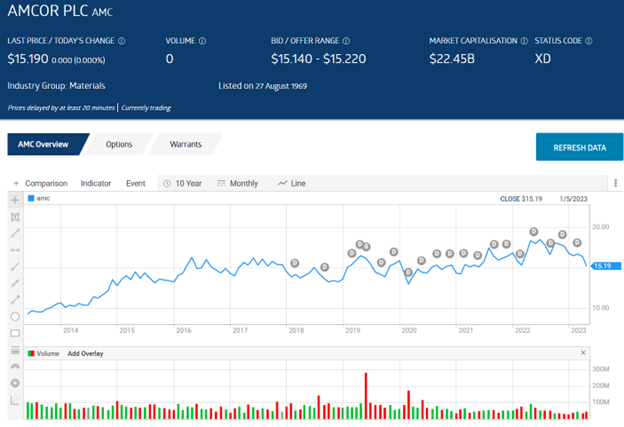

Amcor (ASX: AMC)

The global market for packaging is valued at USD $1,015bn, which is over one trillion. As of 2020, Amcor ranks as the fourth largest packaging company in the world. Between 2019 and 2027, the packaging industry has an expected compound annual growth rate (CAGR) of 7%.

Year over year, Amcor’s share price has dropped 16.35%, driving the price to earnings ratio (P/E) to a ten year low of 15.36, which is well below the average P/E for the index of 21.96.

Analysts at JP Morgan and Jeffries have recently upgraded Amcor stock. Analysts at Baker Young has a hold on the shares but commented that the price decline puts the stock below its fair value.

Over ten years, the company’s share price has risen from $9.29 per share to $15.19, with dividend payments commencing in 2018. They have a five-year average dividend yield of 4.32%.

Source: ASX