Toby Grimm, Baker Young

BUY RECOMMENDATIONS

Westpac Banking Corporation (WBC)

This bank has underperformed its major peers by an average of 33 per cent during the past five years. Following a better-than-expected 2023 half year result, we see attractive relative value and dividend yield. Cost pressures continue to be a major detractor, but they are a controllable factor.

Ramsay Health Care (RHC)

The share price of Australia’s biggest private hospital operator fell notably after investors were disappointed with a recent third quarter update. Like many other firms, RHC had experienced cost pressures, which had a negative impact. However, we expect cost pressures to ease as operating leverage resumes with a continuing recovery in post pandemic revenues, which was evident in the results.

HOLD RECOMMENDATIONS

Amcor PLC (AMC)

This global company produces packaging products for food, beverages, pharmaceutical items and personal care, among other goods. We expect the packaging giant’s highly defensive product categories to be somewhat cushioned from slowing consumer spending than many other discretionary segments. We’re factoring in possible weakness in the months ahead. But we retain a hold recommendation, as the share price has fallen below fair value.

Block Inc. (SQ2)

The payments company delivered encouraging quarterly numbers, displaying resilient double-digit revenue growth in core divisions amid improved profitability. The stock is highly volatile and doesn’t suit all investors. However, we see considerable long term growth and value, and suggest holding as part of a diversified portfolio.

SELL RECOMMENDATIONS

Lendlease Group (LLC)

LLC is a global integrated real estate group. Concerns exist that US listed giant Alphabet is stalling its enormous San Jose project in California. LLC had partnered with Google in the project. This contributes to near term uncertainty. We see limited potential for a positive catalyst in the short term. In our view, better value exists elsewhere in the sector.

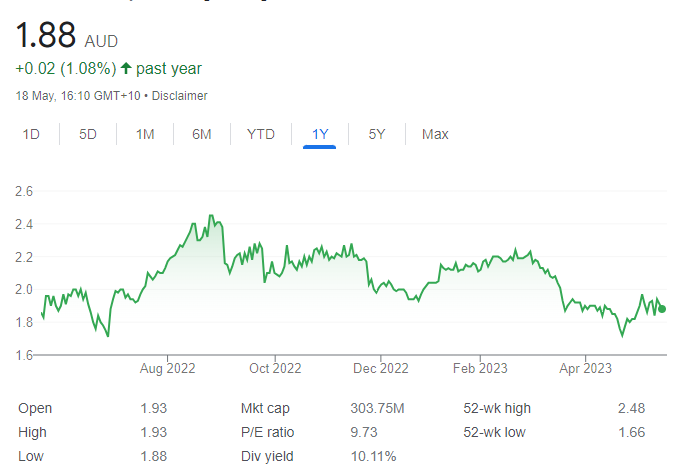

The Star Entertainment Group (SGR)

SGR’s property holdings are potentially undervalued by the current share price. The casino company’s balance sheet is stronger after a recent capital raising. However, in our view, the operating entity is likely to encounter further weakness in response to higher regulatory costs and softening consumer demand.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Pacgold (PGO)

Diamond drilling has resumed at central and southern targets, with two rigs operating as part of an initial 5000-metre program at the Alice River Gold Project in far north Queensland. Drilling is aimed at following up on high grade gold intersected at the central target that included 17 metres at 9.3 grams a tonne gold. This result indicates a favourable environment for possibly further discoveries. We consider PGO a high risk, high reward gold explorer.

Nyrada Inc (NYR)

The company recently issued an update on its cholesterol lowering program. A first-in-human study is expected to start in the early second half of calendar year 2023. Seth Gordon, a former pivotal member of the Lipitor marketing team at Pfizer, has been appointed principal consultant to advise on program strategy and asset development. Pre-clinical in vitro safety and toxicology studies are well advanced in the brain injury program, with in vivo studies to follow. In our view, NYR is a high-risk speculative biotechnology stock.

HOLD RECOMMENDATIONS

PharmAust (PAA)

PAA is a clinical stage biotechnology company. The company’s lead drug candidate is monepantel (MPL) for treating motor neurone disease (MND). A phase 1/2 MND trial is on track to be completed in the third quarter of calendar year 2023. PAA recently noted that five patients had surpassed the six months mark on MPL without any safety issues, and one patient appeared stable. We consider PAA a speculative hold.

BetaShares US Equities Strong Bear Hedge Fund – Currency Hedged (BBUS)

The fund increases in value by 2 per cent to 2.5 per cent for every 1 per cent decline on the S&P 500 index in the US, less management fees and options restructuring. US markets have remained strong despite numerous headwinds, including rising interest rates. Based on elevated global financial risks, BBUS represents a prudent hold, or an opportunity to accumulate for those without exposure.

SELL RECOMMENDATIONS

Liontown Resources (LTR)

This lithium company rejected an indicative takeover proposal at $2.50 a share from Albemarle Corporation in late March. Prior to the bid, the lithium sector was struggling with a falling price and major cost blowouts on new projects. The Albemarle bid and the Allkem and Livent proposed merger have re-invigorated the sector. LTR’s share price has risen from $1.52 on March 27 to trade at $2.82 on May 18. Investors may want to consider cashing in some gains.

Wesfarmers (WES)

This industrial conglomerate has sold its remaining 2.8 per cent interest in Coles Group. The company’s Bunnings hardware chain and its chemicals, energy and fertilisers division have performed well. WES has been a strong performer on the ASX despite delays and issues at the Mount Holland lithium project. The shares have risen from $45.46 on January 3 to trade at $51.18 on May 18. Investors may want to consider locking in a profit.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

GR Engineering Services (GNG)

The engineering services company has entered into a binding term sheet with a subsidiary of Hastings Technology Metals involving the construction of a plant and associated infrastructure for the Yangibana Rare Earths project worth $210 million. The company continues to build a big pipeline of future work. The company’s fully franked dividend yield is also appealing.

Meteoric Resources NL (MEI)

Meteoric recently announced a global mineral resource estimate of 409 million tonnes of rare earths at 2626 parts per million at its Caldeira project. The company has planned a further 100,000 metres of air core and diamond drilling to target high grade areas within the current resource model. The company is in the process of acquiring further licences surrounding the deposit. MEI is well capitalised with $A25 million in the bank.

HOLD RECOMMENDATIONS

Woodside Energy Group (WDS)

Production in the first quarter ending March 31, 2023 fell 9 per cent on the 2022 fourth quarter due to planned turnaround and maintenance activities. The crude oil price is significantly down on 2022 when it traded above $US100 a barrel for most of the year. The final dividend was $2.154. In our view, WDS offers the best exposure to oil and gas on the ASX.

Gold Road Resources (GOR)

The gold producer continues to outperform most ASX peers after delivering $44.2 million in free cash flow from operations in the March quarter. The company is on track to meet calendar year 2023 guidance of between 170,000 ounces and 185,000 ounces at all in sustaining costs of between $A1540 and $A1660 an ounce. GOR also owns almost 20 per cent of De Grey Mining. GOR offers good exposure to a stronger gold spot price.

SELL RECOMMENDATIONS

Myer Holdings (MYR)

The department store giant generated total sales of $1.884 billion in the first half of fiscal year 2023, an increase of 24.2 per cent on the prior corresponding period. The company declared an interim dividend of 8 cents a share, providing an attractive yield to shareholders. But we believe consumer spending is likely to soften in the near term from rising interest rates to fight inflation.

Woolworths Group (WOW)

The supermarket giant reported a strong third quarter, generating group sales of $16.338 billion. It represented an 8 per cent increase on the prior corresponding period. Inflation in Australia appears to have peaked. Moving forward, supermarkets across the board may experience margin pressure on products if inflation falls. It may be an opportune time for investors to consider locking in a profit.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.