- Dubber serves major telecommunication companies around the world with high-tech call-recording software.

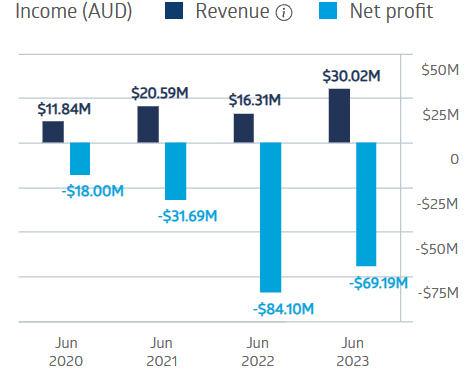

- The company has been burning cash in effecting technological innovation and enhancements.

- The latest launch of an AI-based platform for analysing call data could move Dubber into profitability.

The Dubber share price was bouncing around all-time highs in mid-2021. That was when the company first announced Cisco was incorporating Dubber’s call recording features into some of its customer offerings. This breakthrough was followed by the news that the company had acquired Notiv, an Australian provider of AI-based products.

The company’s communication partners include most of the world’s leading telecommunication providers, including AT&T, Verizon, Cisco, Optus, Vodaphone, Microsoft, Zoom, Salesforce, and Telefonica.

The impressive list and a string of positive announcements were not enough for impatient investors to maintain the buying enthusiasm seen in 2021. The company’s mounting losses would explain that.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Dubber Corporation Financial Performance

Investors were thrown a lifeline in a 4 October investor presentation when Dubber management announced the company expected to turn cash flow around by FY 2025. Reaching the point where cash going out the door does not exceed money coming in is an obvious first step in making the business profitable.

For FY 2024, Dubber is forecasting a more than 50% revenue increase on a “substantially lower cost base.”

An analyst at Red Leaf Securities has a BUY recommendation on the Dubber Corporation, citing the Dubber Moment launch and stating company “sales will exceed investor expectations”.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy