For decades, investors worldwide have had a love affair with technology stocks. In the US, the acronym FAANG stocks gained popularity to encapsulate some of that country’s most successful technology companies – Facebook (now Meta), Apple, Amazon, Netflix, and Google (now alphabet).

Not to be outdone, the Australian investing community put out its own acronym to pinpoint some of the best Australian technology stocks listed on the ASX – the WAAAX stocks.

- Wisetech Global (WTC)

- Afterpay Limited (APT)

- Appen Limited (APX)

- Altium Limited (ALU)

- Xero Limited (XRO)

Tech stocks typically are engaged in operations many investors find amazing and even glamorous. Some sectors are staid and boring, but not technology. In addition, tech stocks are seen as drivers of the world of the future, with in many cases seemingly unlimited potential for growth.

The downside of many is the risks, which can be daunting. Established tech stocks may be generating revenue and profit, but there is often a competitor somewhere whose offerings may cut into market share.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Tech stocks in the early stages of the life cycle of a business often have more cash going out the door than coming in the door, leaving debt and capital raises as necessary to generate the cash flow needed to get to revenue and profit generating stages.

Debt leaves tech stocks highly exposed to the challenges of inflation and rising interest rates. As central banks around the world raised interest rates to combat global inflation, the once favored tech sector has gone through some challenging times.

The tech sector experienced a muted recovery into 2024 with lowered recession risk and signs of interest rate cuts in the US and a 42% reduction in layoffs compared to 2023. .

At the end of the first quarter of FY 2024 we looked at some of the best ASX tech stocks to buy for risk tolerant investors.

The key factor to consider in choosing these best ASX tech stocks is financial stability. Startups can get the blood pumping but should inflation and interest rates lead to a global recession, reasons for buying evaporate quickly.

Xero Limited (XRO)

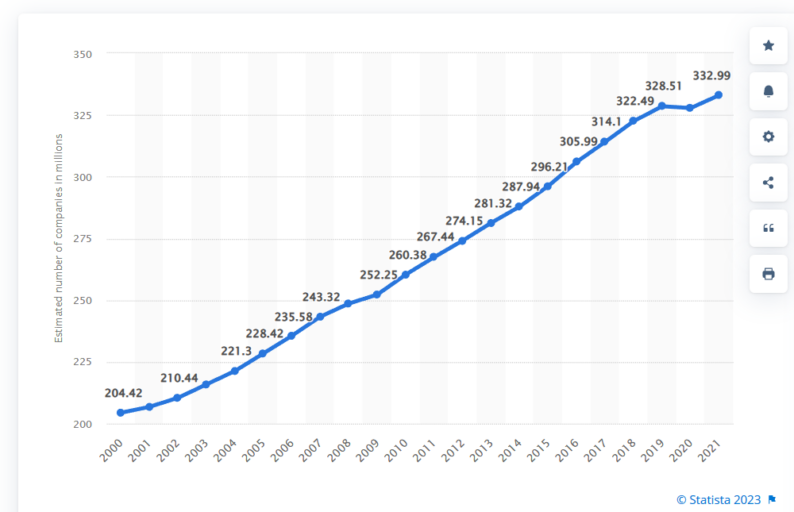

Xero is a SaaS (software as a service) provider with a cloud-based accounting platform targeting the needs of small to medium sized enterprises (SMEs). Although individually small in size, SMEs as a group represent a huge and historically underserved market for technology innovations. Lacking the resources of blue chips and large caps, SME companies are often left out in the cold. In 2021 there were a reported 332.9 million small and medium enterprises in business around the world.

Global Small and medium sized enterprises (SMEs) — 2000 to 2021

Source: Statista.com/statistics

The company has expanded from its home base in New Zealand to become the largest SaaS accounting company in the region, now operating in both the US and the UK as well as in multiple countries.

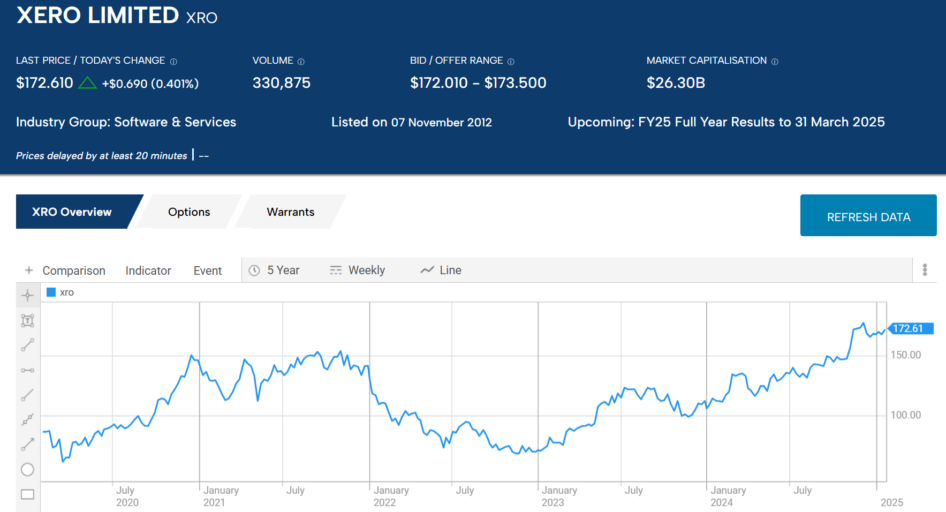

Xero listed on the ASX in early January of 2011 with the share price hitting rock star status until it hit the skids in late 2021, continuing into 2022 in an environment racked by fears of a global recession amid high inflation and interest rates.

As the first month of the 2025 trading year drew to a close, the XRO share price remained up 101.6% over five years, despite cratering in 2022. A recovery for the XRO share price began in 2023 with the price now up 53.8% year over year.

Source: ASX Website

The company’s growth strategy is hyper-aggressive with multiple acquisitions and partnership relationships, but coming at outsized costs, especially in the more expensive acquisition markets in the US and the UK. Xero defends this strategy, citing the global market potential at 45 million customers and its own existing client base of 3.5 million customers. Investors and analysts alike are pinning their hopes on Xero’s solid revenue growth.

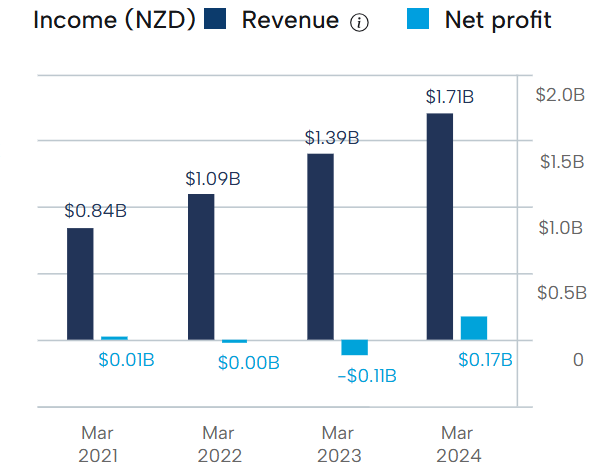

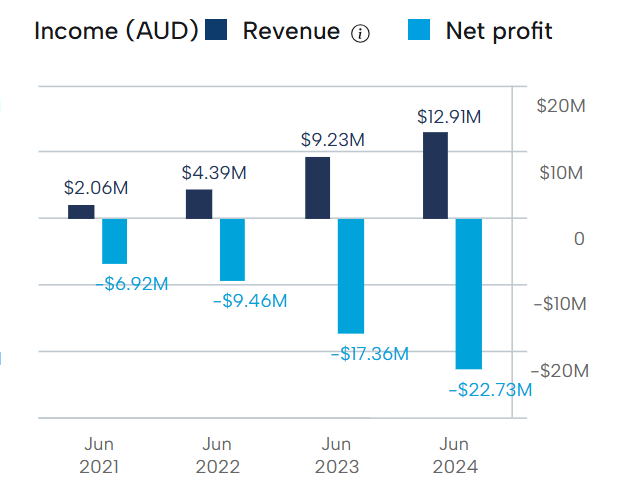

Revenues have increased over the past four fiscal years, but profit has not followed suit, with a significant loss in FY 2023 , reflecting the stormy conditions. The company saw a solid rebound in FY 2024, increasing revenues and reversing a FY 2023 loss to turn its best net profit performance in the last four fiscal years.

Xero Financial Performance

Source: ASX Website

The company’s aggressive growth strategy means increasing operating expenses, which along with one-off charges ate into Xero’s 28% revenue increase, posting a $111 billion dollar loss. Subscribers rose 14% with subscriber loss turnover (churn) low at 0.9%. Management expressed confidence in the continued move to cloud-based accounting driving growth.

Half Year 2025 financial results again showed revenue increases, — up 25% — along with a 76% increase in net profit.

Megaport Limited (ASX: MP1)

Megaport operates as a ‘network-as-a-service’ (NaaS) company, providing a desperately needed single connectivity platform to a world drowning in digital connection needs. Todays’ businesses need to connect their own internal ICT (information and communication technology) networks to multiple cloud providers, managed services providers, and multiple supplier and partner networks.

Megaport operates globally, offering its customers connection to the largest cloud providers on the planet, including Amazon Web Services, Microsoft Azure, Google Cloud, Oracle Cloud, IBM Cloud, Salesforce and others. The company claims to have more than 960 enabled data centres in 26 countries around the world

Megaport has become a “poster child” for the battered and beaten ASX tech stocks considered as growth stocks but continuing to post losses through FY 2023 but returning to profitability in FY 2024.

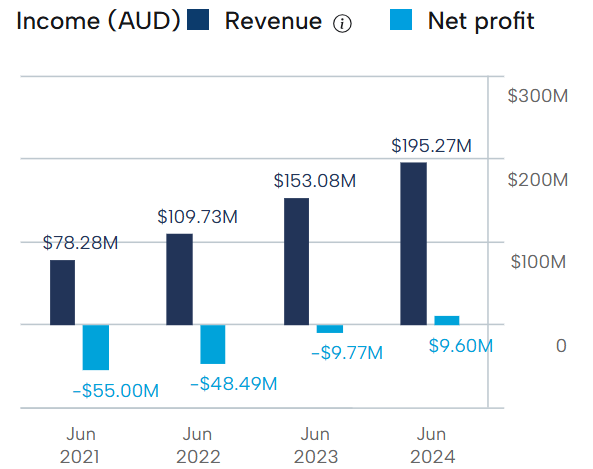

Megaport Financial Performance

Source: ASX Website

Despite a recovery in 2023 – now interrupted – the Megaport share price is down 23% over five years and 9.2% year over year.

Source: ASX Website

Silex Systems Limited (ASX: SLX)

Silex Systems has developed laser technology for enriching uranium. Governments around the world are realizing how difficult it will be to meet their ambitious carbon reduction targets without nuclear energy. The war in Ukraine intensified the push for nuclear energy, ending the Fukushima nuclear disaster tailwind for uranium stocks.

While the vast majority of ASX tech stocks were on the chopping block in 2022, Silex shares were on the rise, with an interruption in 2024 before returning to form at the beginning of 2025. . Over five years the share price has risen 1,726% and is up 32.3% year over year.

Source: ASX Website

The Silex laser uranium enrichment technology is being jointly developed with US based Global Laser Enrichment (GLE) with plans for a full scale demonstration uranium production operation by the end of the decade, a timeline that is under review for earlier completion.

The company is also exploring the use of the technology to enrich silicon for use in quantum computing and in medical radioisotopes. The Silex/GLE joint development operation recently signed its third LOI (letter of intent) with a US utility to explore areas of cooperation.

While Silex is growing revenues, the losses continue to mount.

Silex Financial Performance

Source: ASX Website

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

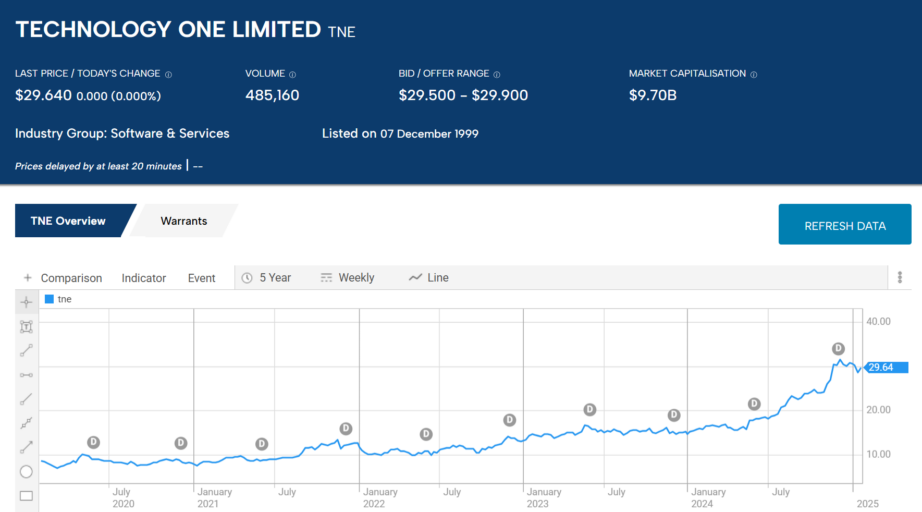

Technology One Limited (ASX: TNE)

Technology One is another ASX tech stock whose share price escaped the tech crash in 2022 and continued its upward momentum through 2023,into 2024, now hitting an all-time high in early 2025.. Over five years the share price is up 247.8% and 87.8% year over year.

Source: ASX Website

The company operates both as a SaaS provider of its own researched, designed, and developed information communications technology solutions for enterprise customers and as an ICT consultant.

Its customer base is extensive – ranging from governments to health care operators to educational institutions to financial services to utilities and other corporate customers. Available software solutions are equally expansive, ranging from human resource management to accounting and billing to asset and project management to payroll.

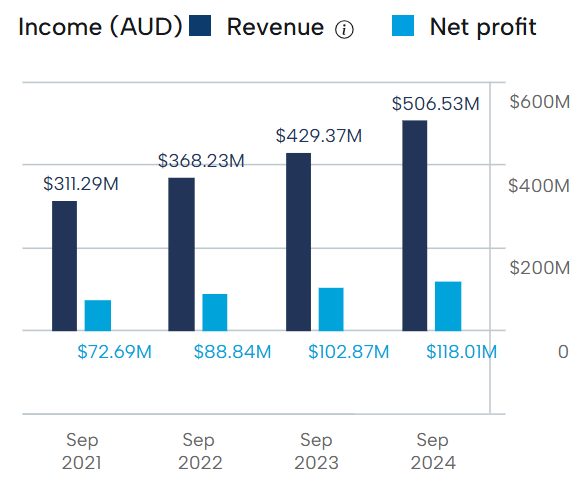

The company has an outstanding track record of financial performance, growing both revenue and profit throughout the pandemic and the collapse of most of the Australian tech stocks, and continuing in the challenging inflationary/high interest rate environment.

Technology One Financial Performance

Source: ASX Website

The company is the rare exception in the technology sector as a dividend payer, with a five-year average dividend yield of 1.12%.

Hansen Technologies Limited ASX: HSN)

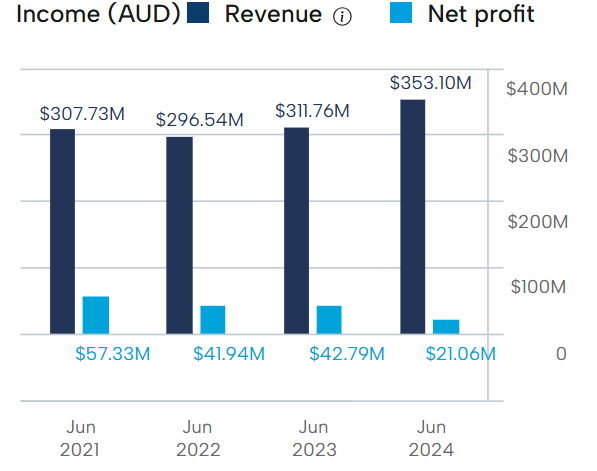

Hansen is another financially stable dividend payer that deserves a place on any watchlist of best ASX tech stocks to buy. The company has a five-year average dividend yield of 2.01%. Hansen is a SaaS provider of billing software and consultancy services for the utilities and communications sectors. In business for 50 years, Hansen now operates in more than eighty countries.

Hansen’s financial performance has shown consistency in revenue but volatile net profits over the last four fiscal years.

Hansen Technologies Financial Performance

Source: ASX Website

On 10 February, the company announced the acquisition of Germany-based billing and customer management software provider Powercloud, expected to add AUD $40 to 46 million dollars by FY 2025.

The greatest innovations of the last century have come from the technology sector. Many investors see virtually unlimited growth potential in the best Australian technology stocks.

Investors need to be mindful that the high growth potential often comes with high risk, even among the best ASX listed tech stocks. The most profitable of the best ASX tech stocks are subject to pressures from competitive technologies.

Tech stocks in the early stages of development frequently rely heavily on borrowings to fund operations and growth initiatives. Inflation carries twin risks for tech stocks in the current economic climate. First, inflation raises the input costs of the majority of tech stocks. Second, to combat inflation central banks around the world have been raising interest rates, impacting both the cost and the availability of debt financing for tech sector stocks.

FAQs

What Are Tech Stocks?

Tech stocks are publicly traded shares of companies involved in the technology sector. This can include a wide range of business activities such as telecommunications, software development and digital products.

What Are FAANG Stocks?

The acronym FAANG is used to refer to a group of major US companies in the technology sector. These companies are Facebook (now Meta), Apple, Amazon, Netflix and Google (now Alphabet).

What Are WAAAX Stocks?

Like the FAANG stocks in the US, the WAAAX acronym groups together some of Australia’s most prominent technology companies. These companies are Wisetech Global, Afterpay Limited, Appen Limited, Altium Limited and Xero Limited.

Why Invest in Tech Stocks?

Technology stocks have grown in popularity in recent years. The tech sector is growing rapidly and many of these companies have very strong fundamentals. Technology represents a key part of the future global economy and so tech stocks are an essential part of any portfolio.

How to Buy Tech Stocks

Technology stocks can be bought via a regulated Australian broker. Many brokers will offer a range of Australian technology stocks. Once you have opened your account you should then research the different stocks available and decide which ones, if any, are the right investment for you.