In 1950, Alan Turing, famed British codebreaker and creator of one of the world’s first computing machines pondered the question “Can machines think?” His paper entitled Computing Machinery and Intelligence introduced the Turing Test as a measure of machine intelligence. When humans ask the same questions of a machine and another human without being able to distinguish the two, the machine can be considered intelligent.

Skeptical investors growing impatient waiting for the Internet of Me and the Internet of Things to achieve “next big thing status” have only to look at the intense interest in AI everywhere, propelled to a fever pitch on 30 November of 2022 with the launch of an early demo of ChatGPT.

ChatGPT is capable of communicating in a human-like way, beginning with human-provided databases of sample conversations, fine-tuned through reinforcement leaning.

Artificial intelligence technology is complex, but for the layperson, here is a serviceable definition:

The theory and development of computer systems able to perform tasks that normally require human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages.

That definition opens the door for applications of AI in virtually every form of human endeavors. Early entries of AI companies traded publicly include companies manufacturing critical components like computer chips, companies researching and developing AI applications, companies offering support for other companies to power their own operations with AI, and companies actively adopting AI into their own business models.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

While the biggest names in AI stocks can be found in the US, Australia has a selection of companies in the sector along with two exchange traded funds (ETFs) offering exposure to global AI players.

Here are what many analysts consider the top three ASX AI stocks right now.

Appen Limited (ASX: APX)

Appen got its start in what is now acknowledged as an early example of AI – speech recognition, language translation, and text classification.

AI applications are powered by “Big Data,” now exploding with increasing computing power speed and storage capabilities. Appen is partnering with some of the world’s biggest tech companies in managing their data as well as providing a broad array of services for companies looking to infuse AI in their own operations.

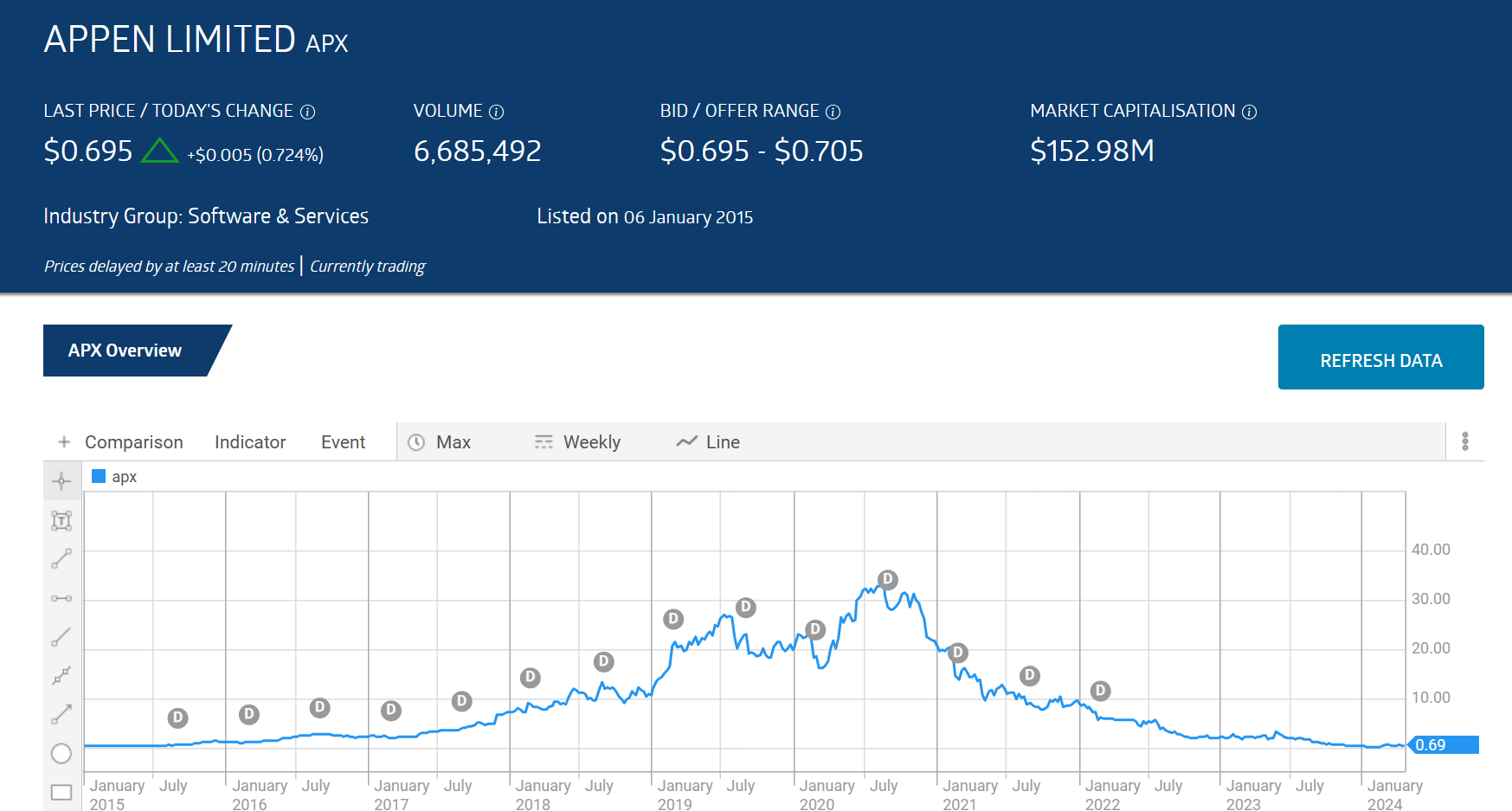

The company was listed on the ASX in 2013. Following a brief dip at the onset of the COVID 19 Pandemic, the share price hit an all-time high in mid-2020 before the full brunt of lockdowns bit into the share price, igniting a downward trend from which the stock has not recovered.

Source: ASX

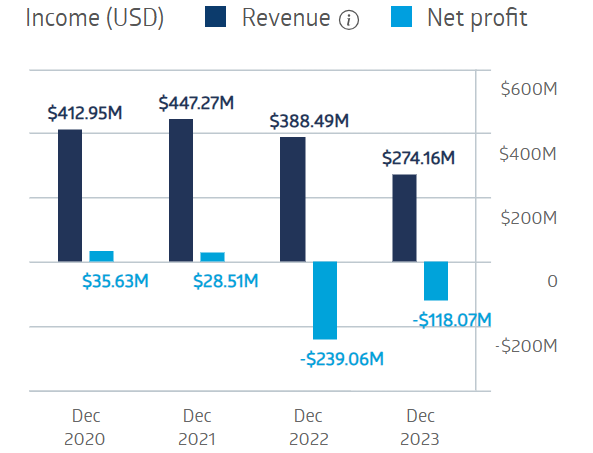

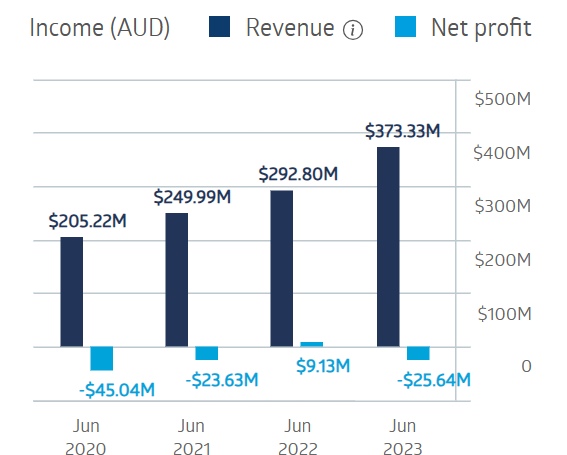

Year over year the stock price is down 72.6% as of 24 April of 2024, but year to date the price is up 10.3%. Appen managed to remain profitable in the first two years of the COVID 19 pandemic but succumbed in 2022 and 2023.

Appen Financial Performance

Source: ASX

ChatGPT is a form of generative artificial intelligence, where machines are trained to recognise patterns and make decisions base on huge inputs of data. According to the Appen Full Year 2023 results release, generative AI is forecasted to grow from $40 billion dollars in 2022 to $1.3 trillion in 2032. Appen estimates that new opportunities in generative AI will expand the company’s total addressable market by $4 to $8 billion dollars.

Bigtincan Holdings (ASX: BTH)

Bigtincan is an award-winning provider of a SaaS (sales as a service) multiple AI based platform for use by field employees that interact directly with customers. The mobile platform is categorized as a “personal sales assistant” that can be tailored to meet the needs of the business sector in which it operates.

The Bigtincan Search AI and Genie Assistant provide users with generative AI derived from secure data sets of more than 100,000 customer interactions.

The platform automates sales processes like prospecting clients, creating presentations, planning and summarising meetings, and more. Not limited to private sector organizations, the Bigtincan platform is customisable to the work of government agencies, non-profit organizations, and healthcare organizations. The company partners with Microsoft, Samsung, Apple, IBM, Adobe, and more.

Listing in 2017, the share price hit an all-time high in July of 2021 before the COVID pandemic intervened followed by the challenging macroeconomic conditions besetting business of all types in all places intervened.

Source: ASX

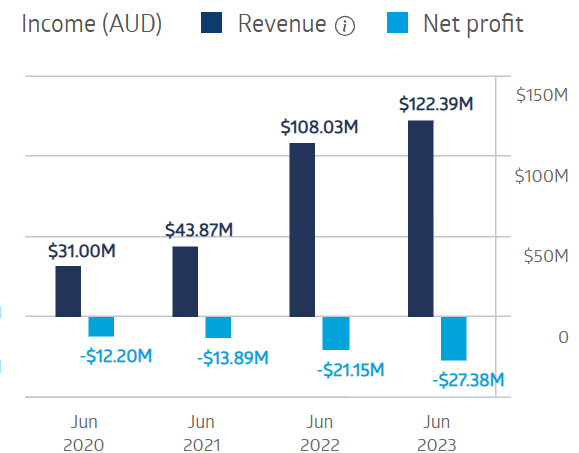

While the company continues to grow revenue, the losses are accelerating,

Bigtincan Holdings Financial Performance

Source: ASX

Half Year 2024 financial results saw a modest 1.5% decline in revenues and a substantial 41% improvement in posted loss, from $18,822 million dollars in the Half Year 2023 to $10,713 this year.

BrainChip (ASX: BRN)

BrainChip is another example of a high-tech company hitting all-time highs at the onset of the COVID 19 Pandemic. Since listing in 2011 the share price has managed to rise 47.1%, but over five years the share price is up 528.8%. Year over year the price dropped 23.1% but the volatile share price rose again, up 85.2% year to date.

Source: ASX

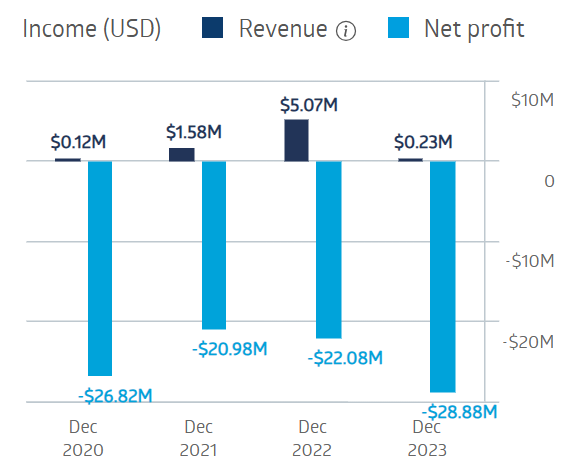

Investors fascinated by the potential of the company’s neuromorphic computing AI technology appear to have grown weary of the dearth of financial performance, with minimal revenues and maximum, ever-increasing losses.

BrainChip Holdings Financial Performance

Source: ASX

The company touts the advantage of its line of Akida AI chips operating on the “edge” of the network in which they are embedded. This means instead of data collected at the source and transmitted to cloud storage for analysis, computations are performed where they are collected. This makes the company’s product line ideal for applications using sensor technology.

In its early days, the idea of a technology that simulates neuron processing in the human brain seemed more than revolutionary, but the financial performance to date suggests the addressable market has yet to be impressed. BrainChip has an impressive list of partnering organizations but the company is facing competition from the likes of Nvidia (NASDAQ: NVDA), a mammoth goliath fueling investor fervor for AI chip manufacturers.

To add to investor’s woes, the company does not rely on capital raises or debt facilities to raise the cash needed for the company to maintain operations and growth expenditures. On 19 March, the company announced a capital call notice whereby BrainChip has a put options agreement with LDA Capital allowing the company to exchange shares for cash.

NEXTDC (ASX: NXT)

Data Centre designer, developer, and operator NEXTDC has formed a research partnership with LaTrobe University’s Research Centre for Data Analytics and Cognition (CDAC) to explore AI applications to improve data centre operations. In the words of NEXTDC’s Head of Operations Sean Rimas, the vision is to create an ecosystem where predictive maintenance through machine learning – that is, using past data to recognise patterns – would identify anomalies and predict incidents likely to happen in the future – and … stop them before they happen.

Despite expenses eating into profits, NEXTDC has analyst consensus BUY recommendations at yahoo finance Australia, marketscreener.com, and the Wall Street Journal.

NEXTDC Financial Performance

Source: ASX

Full Year revenue growth of 25% and EBITDA (earnings before interest taxes depreciation and amortisation) growth rose 15% were weighted down by 14% increase in capital expenditures.

AI Exchange Traded Funds on the ASX

Investors looking for broader exposure to AI activities have two ETFs to choose from. Both began as automated robotics holdings and expanded their portfolios to include global AI leaders.

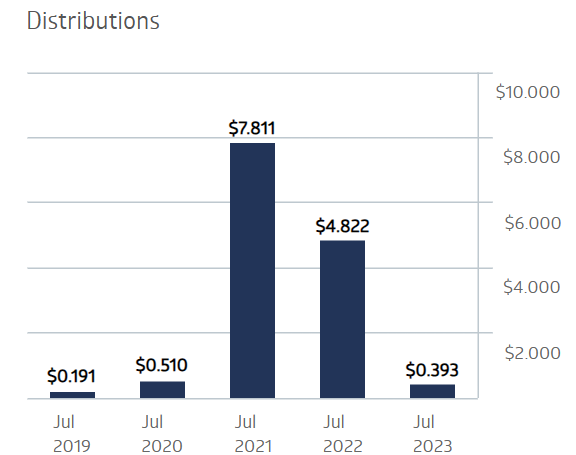

Robo (ASX: ROBO) Global Robotics and Automation from Global X leans heavily towards robotics and automation companies. The share price is up 41% since listing in 2017. Year over year the share price is up 5%. Distributions going into the tech sell-off that started in 2022 dropped dramatically.

Global Robotics and Automation Distributions

Source: ASX

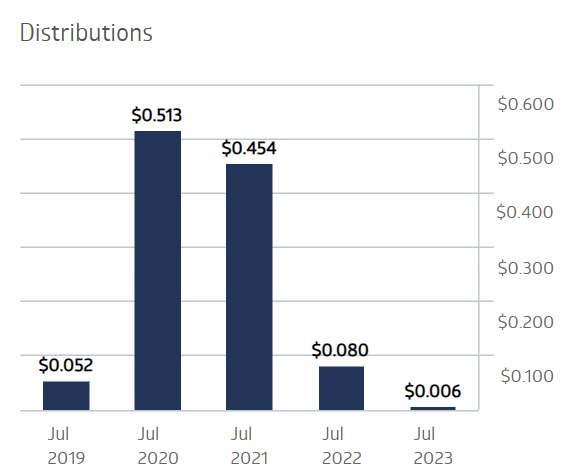

Global Robotics and Artificial Intelligence (ASX: RBTZ) from BetaShares lists NVIDIA as its top holding, with a portfolio weight of 9.02%. Since listing in 2018 the share price is up 36%. Year over year the share price is up 23.6%. Distributions for RBTZ began to fall in the second year of the COVID pandemic and continued in the tech sell-off and beyond.

Global Robotics and Artificial Intelligence Distributions

Source: ASX

ASX Blue Chips Using AI

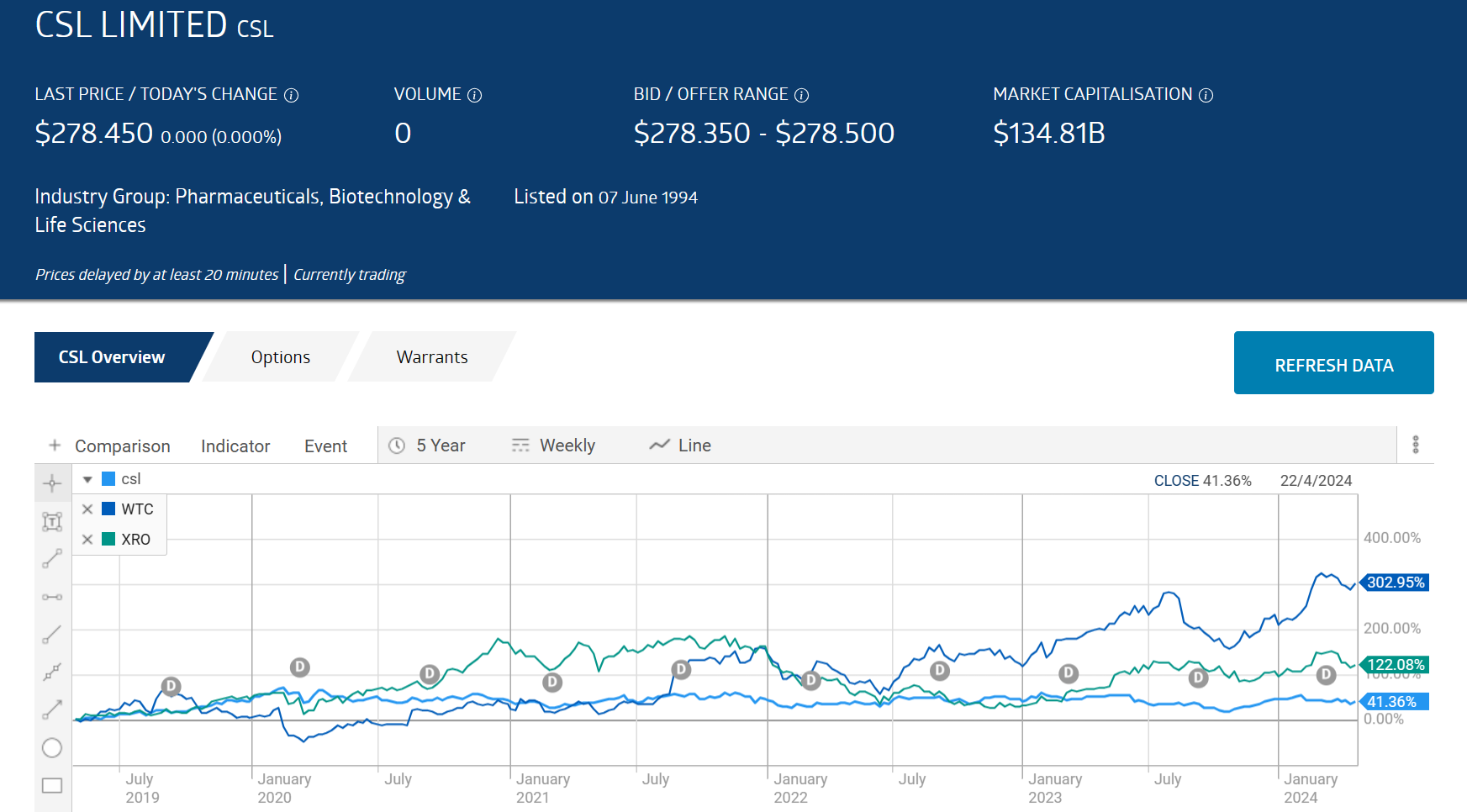

A “backdoor” entry into AI stocks comes from investing in solid ASX companies incorporating AI into their business operations. These include:

- Blood plasma and vaccine provider CSL Limited (ASX: CSL)

- Global logistics solutions providers WiseTech Global (ASX: WTC)

- Accounting software provider Xero (ASX: XRO)

The following graph shows the year-over-year share price performance of the three companies.

Source: ASX

The daily bombardment of stories of the upside and downside of artificial intelligence in the financial and legacy news outlets coupled with social media posts suggests AI truly is the “next big thing.” Simply put, machines that can “learn” to recognize patterns in massive amounts of data and then provide information and make decisions as a human would are considered intelligent.

Although the majority of news making publicly traded AI companies trade on US exchanges, Aussie investors have options.

First there are companies whose primary focus is on developing and marketing AI technology, either through component manufacturing or AI related services for companies interested in incorporating AI into their business operations.

Next there are exchange traded funds providing access to a mix of companies engaged in robotics and automation along with artificial intelligence.

The final source is companies with aggressive use of AI technology in their businesses.