- Telstra is the dominant player in the Australian telecommunications sector.

- The company’s Full Year 2023 results saw increases in both revenue and profit, but guidance, although positive, was disappointing.

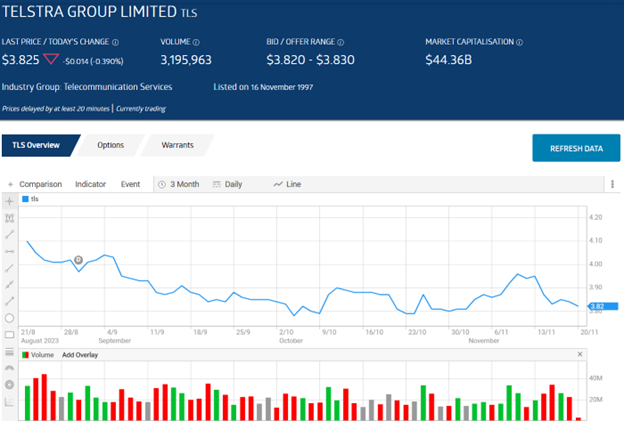

- The share price has been trending downward over the last three months.

As Australia’s second most valuable brand, even the newest newcomers to share market investing must be familiar with our largest telecommunications provider – Telstra.

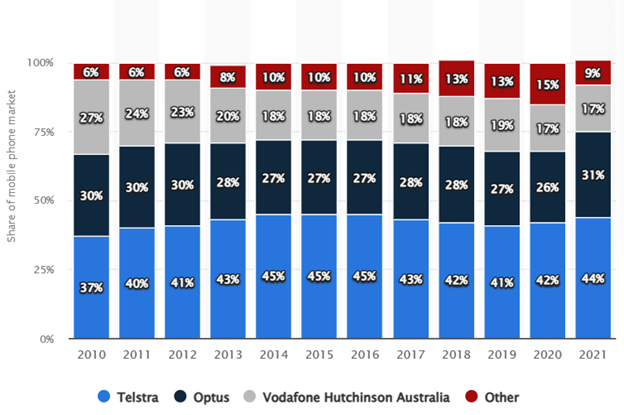

In terms of market share, the company dominates its competitors.

Source: statista.com

The company’s full-year 2023 Financial Results showed a 6.7% increase in revenues and a 13.1% profit increase, yet the share price began falling. The culprit may be guidance below market expectations, according to Goldman Sachs.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

Intraday on 20 November, the stock price is down 4.5%.

The recent outage at Optus, the second-largest Australian telco, may provide some tailwinds for Telstra.

Social media posts point to long lines in front of Telstra and the number three provider, Vodafone, with little activity at Optus stores. Telstra management confirmed the claim that Optus customers were switching to Telstra but could not estimate how many but did recall a similar incident in the past, which did not result in a significant shift.

An analyst at Marcus Today has a BUY recommendation on Telstra shares, stating: “Despite recent gains following the Optus crash, the share price is still below its long-term trading range average and remains our choice in the telecommunications sector.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy