- A Royal Commission into the Financial sector uncovered damning practices by AMP Capital.

- The company responded with a plan to restructure its operations into two entities.

- A class action suit filed against AMP Capital has now been settled.

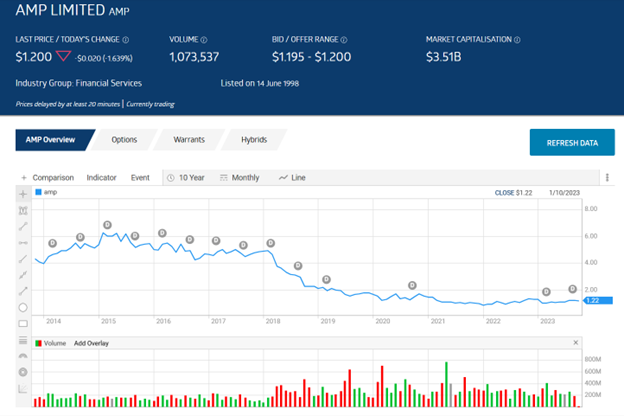

Diversified financial services provider AMP Limited (ASX: AMP) saw its share price embark on a steady decline as investors reacted to the negative findings of the Royal Commission inquiry into the banking and financial services sector led by Kenneth Hayne.

Source: ASX

AMP has operated for over a century as a provider of traditional banking services such as mortgages, loans and deposits. It also offered financial advice and investment services for clients. The company had a massive network of independent financial advisors.

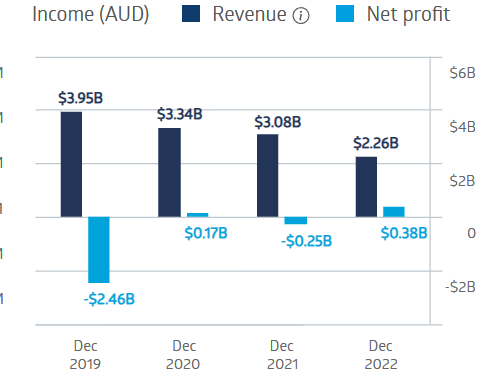

AMP’s profitability suffered a massive decline following the damaging revelations, with no firm evidence yet that the restructuring is bearing fruit.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

AMP Limited Financial Performance

Source: ASX

The listed entity emerging from the company’s 2021 strategic business restructuring is AMP Limited (ASX: AMP). On 9th August, the Half Year 2023 results were released with mixed results. Overall revenues were up 31%, but statutory net profit dropped 44%. Underlying net profit – which reflects core business results without one-offs was up 23.9%, and the company will continue its share buyback program.

A Stockopedia analyst has a HOLD recommendation on AMP shares based on improvements seen from the company’s business transformation in recent financial releases and market reaction. The share price is up, and there has been “an uptick in analyst earnings expectations.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy