Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

BUY – Karoon Energy (KAR)

The oil producer posted a robust 2023 September quarter result. Oil production of 2.85 million barrels was up 69 per cent on the June quarter. A solid cash balance of $US181.5 million, a disciplined acquisitions approach and a steady Bauna operation contribute to KAR’s appeal. We retain an add rating, as we’re confident about KAR’s positive trajectory in the energy sector.

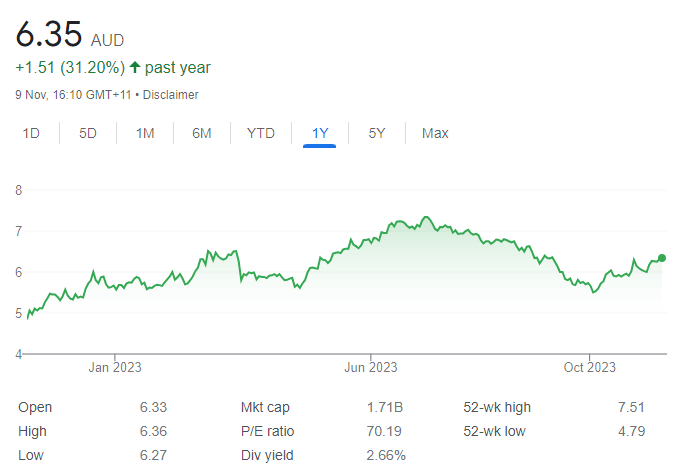

BUY – Allkem (AKE)

Allkem is a specialty lithium chemicals company. We retain an add rating despite the short-term risks of softer lithium prices. Our share price target of $14.10 reflects AKE’s growth potential. The shares were trading at $9.42 on November 9. We believe the company offers long term value despite challenges within the sector.

HOLD RECOMMENDATIONS

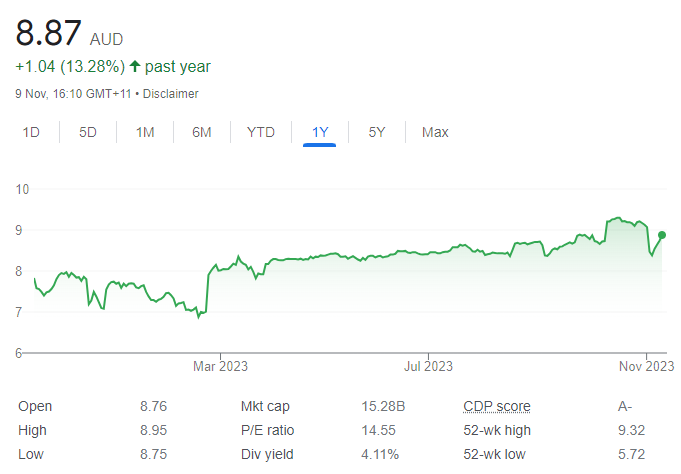

HOLD – Woodside Energy Group (WDS)

Third quarter 2023 production of 47.8 million barrels of oil equivalent was up 8 per cent on the previous quarter. Sales volumes of 53.3 million barrels of oil equivalent was up 10 per cent on the second quarter. Uncertainty over approvals to any offshore activities undertaken in Australia can potentially cause delays and increase costs. The company offers long term potential if it can navigate the current cycle effectively.

HOLD – Origin Energy (ORG)

Electricity sales volumes in the 2023 September quarter fell by 6 per cent on the prior corresponding period. Natural gas sales volumes fell by 21 per cent. However, the outlook, especially with an impending takeover, suggests potential for growth. The Brookfield-led consortium of investors and EIG have increased its takeover bid for ORG to $9.53 a share under the scheme of arrangement as at November 2.

SELL RECOMMENDATIONS

SELL – Fortescue Metals Group (FMG)

First quarter 2024 results show marginally lower iron ore shipments but higher realised prices. Despite positive iron ore revisions, we suggest trimming positions as the stock was recently trading above our $19.40 price target and offers profit taking opportunities. The stock is sensitive to movements in iron ore prices and environmental, social and governance (ESG) concerns. The shares were trading at $23.49 on November 9.

SELL – Commonwealth Bank of Australia (CBA)

The CBA appears relatively expensive on investment metrics compared to the ANZ Bank and Westpac. The company’s capital position remains strong, but the outlook suggests caution in this higher interest rate environment as borrowers struggle to meet rising mortgage repayments. The shares were trading at $102.12 on November 9. It may be prudent to consider trimming positions by cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

John Edwards, Novus Capital

BUY RECOMMENDATIONS

BUY – State Gas (GAS)

This junior gas explorer and developer has assets in Queensland’s southern Bowen Basin. Following a recent $7 million capital raising at 15 cents a share, the company is well funded to complete construction of the Rolleston West CNG (compressed natural gas) Project, with production expected in December. Further drilling should expand the net 2C contingent resource of more than 500 petajoules into reserves. GAS is forecast to re-rate in the next year. A speculative buy, and our price target is 50 cents.

BUY – Allkem (AKE)

This lithium producer operates in Australia, Argentina and Canada. Long term growth plans remain uncertain due to its proposed friendly merger with US brine producer Livent Corporation, which, in our view, is restraining the share price. Production growth is forecast to quadruple during the next five years. AKE had a strong cash balance at its last quarterly update. A speculative buy, and our price target is $17.

HOLD RECOMMENDATIONS

HOLD – James Hardie Industries PLC (JHX)

This building products maker has markets in Australia, the US, Canada, New Zealand, the Philippines and Europe. About 44 million homes in the US need renovating as they are more than 40 years old. But many homeowners are baulking at repairs and maintenance due to higher interest rates impacting consumer confidence. The consumer outlook may be slowing, so we rate JHX a hold or borderline sell.

HOLD – Amcor (AMC)

This global packaging giant appears fully priced as it was recently trading at a 12 per cent price/earnings premium to global peers compared to a long-term average premium of 5 per cent. Challenges include higher labour costs and interest rates, but the company is resilient. Keep up to date with the news flow.

SELL RECOMMENDATIONS

SELL – JB Hi-Fi (JBH)

Shoppers may reduce discretionary spending after another interest rate rise on November 7. JBH is up against an increasing number of households struggling with higher mortgage repayments and soaring cost of living expenses. We expect higher interest rates to impact company sales moving forward. In our view, this consumer electronics giant appears fully priced, so investors may want to consider cashing in some gains.

SELL – Fortescue Metals Group (FMG)

Iron ore shipments of 45.9 million tonnes in the first quarter of fiscal year 2024 were down 3 per cent on the prior corresponding period. Cash costs for the quarter were in the top half of fiscal year 2024 guidance. Demand for iron ore is softer. We need a clearer picture regarding capital allocation and investment metrics in relation to Fortescue Energy projects to support a total earnings and dividend outlook. The recent share price offers an opportunity for investors to consider taking some profits.

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

BUY – Ramelius Resources (RMS)

The gold price has rallied recently in response to the war in the Middle East. In volatile times, buy gold. RMS is one of the cheapest gold names in the sector and should generate more growth as its operations at Mt Magnet ramp up. The company says it remains on track to deliver full year guidance.

BUY – Kelsian Group (KLS)

The company operates public bus and marine transport services in Australia and abroad. The recent acquisition of All Aboard America Holdings gives the company a platform for further growth in the US. We believe the share price is trading at a discount considering the defensive and low risk earnings growth on offer.

HOLD RECOMMENDATIONS

HOLD – Endeavour Group (EDV)

The company operates liquor outlets, hotels and gaming facilities. The board level dispute with major shareholder Bruce Mathieson has soured investor sentiment, but EDV is fundamentally a good business with well-known brands and experienced management. A lot of the downside risk is already priced in.

HOLD – Xero (XRO)

The Australian technology sector has lagged US technology stocks. Xero’s accounting software remains the best in class. As the appetite for Australian software stock improves, we expect XRO’s share price to benefit. The company posted first half fiscal year 2024 operating revenue of $800 million, up 21 per cent on the prior corresponding period. XRO’s share price has performed well since January. But it has retreated from $125.10 on August 31 to trade at $100.61 on November 9.

SELL RECOMMENDATIONS

SELL – BlueScope Steel (BSL)

Management has cut earnings forecasts for the first half of fiscal year 2024 amid softer than expected steel prices. It now expects underlying earnings before interest and tax to range between $620 million and $670 million compared to prior guidance of between $700 million and $770 million. An economic slowdown could result in construction activity stalling across the globe. This could result in lower steel prices.

SELL – Brickworks (BKW)

Full year 2023 results for this building materials manufacturer missed our expectations. Underlying net profit after tax of $508 million was down 32 per cent on full year 2022. Statutory net profit after tax of $395 million, including significant items and discontinued operations, was down 54 per cent. Sustaining demand for building products during the next 12 months will be a challenge, in our view.

Related Articles:

- The Best ASX ETFs to Buy in 2023

- The Best Australian Shares

- The best automated trading platforms

- The Best Crypto Trading Platforms in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.