Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – Whitehaven Coal (WHC)

WHC recently announced it had acquired two metallurgical coal mines in Queensland from the BHP Mitsubishi Alliance (BMA). We believe the acquisition is a positive move for WHC. From a charting perspective, we have seen the stock break above a major resistance level near $7.50, so we expect WHC to trend higher from here. The shares were trading at $7.795 on October 26.

BUY – Evolution Mining (EVN)

Despite the war in the Middle East, we expect gold prices to move higher anyway due to falling bond yields and a weaker US dollar. EVN remains our preferred stock in the gold sector to benefit from any rises in the gold price. The company recently sustained fiscal year 2024 guidance of 770,000 ounces at an all-in sustaining cost of $1370 an ounce.

HOLD RECOMMENDATIONS

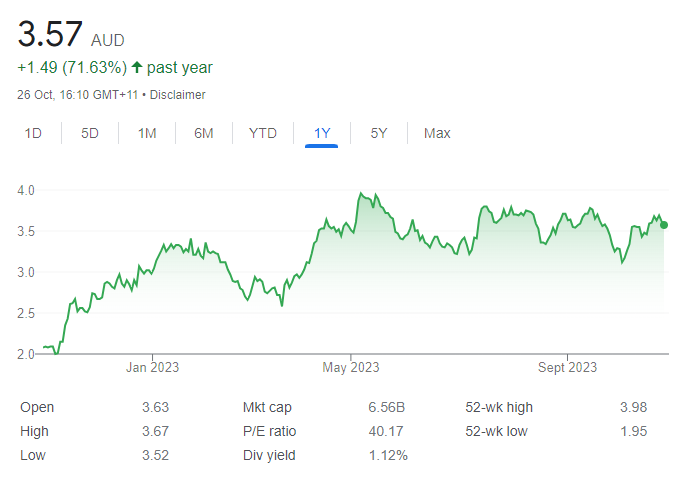

HOLD – Paladin Energy (PDN)

We remain attracted to uranium’s longer-term prospects as a supply shortage is starting to meet increasing demand. From a charting perspective, PDN had spent almost two years forming a large bull flag. It finally broke free several weeks ago, so we expect this uranium stock to trend higher from here.

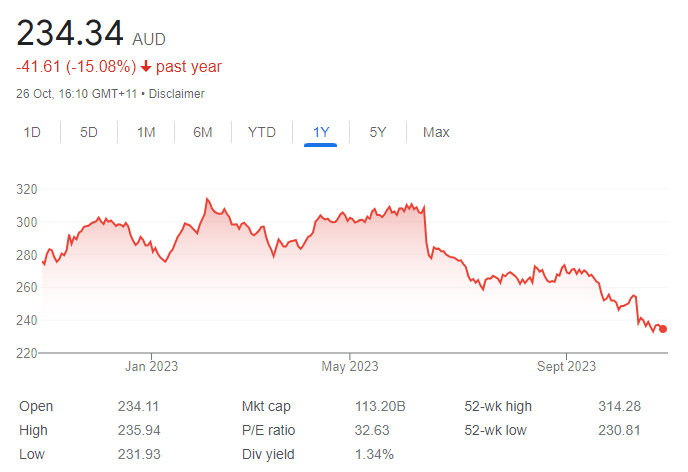

HOLD – ResMed Inc (RMD)

Recent investor concerns that weight loss drugs and diabetes medicines may have a major negative impact on ResMed’s sleep apnoea products business appear overdone, in our opinion. After analysing the recent price action, it appears buyers are taking advantage of a discounted share price as the stock seems to have finally found a low. We expect RMD to recover from here.

SELL RECOMMENDATIONS

SELL – Westpac Banking Corporation (WBC)

WBC is the weakest of the major banks, in our view. In terms of share price action, it recently rallied to below its long-term downtrend line before retreating again. In our view, the stock is vulnerable to maintaining its long-term downtrend, particularly after the company soon declares its final dividend.

SELL – Coles Group (COL)

Shares in the supermarket giant have fallen from $18.42 on July 3 to trade at $15 on October 26. We expect stiffer competition and Australia’s soaring cost of living to pressure earnings. We still believe the stock is expensive as price momentum is skewed to the downside.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Mattew Lattin, Marcus Today

BUY RECOMMENDATIONS

BUY – CSL (CSL)

This blood products group is committed to delivering double-digit earnings growth in the medium term, primarily driven by improving gross margins in CSL Behring and enhancing operational efficiency through a new donation system. CSL’s diverse strategy, including the Vifor acquisition, further reinforces its growth potential and reduces risk. In our view, CSL is an attractive prospect for investors seeking capital growth and income.

BUY – Smart Parking (SPZ)

This car parking manager, with a focus on automatic number plate recognition technology, grew the number of sites under management by 33 per cent in fiscal year 2023 when compared to the prior corresponding period. Its revenue streams are diversified through parking breach notices and technology sales, underpinning a recurring revenue model. The company is expanding, backed by consistent financial growth since 2021. SPZ offers strong leadership and a strategic outlook. SPZ is poised for further growth despite potential regulatory risks.

HOLD RECOMMENDATIONS

HOLD – Rio Tinto (RIO)

Third quarter 2023 results were mixed due to operational issues with the Iron Ore Company of Canada (IOC) joint venture. Pilbara iron ore shipments of 83.9 million tonnes in the third quarter were up 1 per cent on the prior corresponding period. We recommend investors closely monitor iron ore price trends and the progress of the IOC joint venture.

HOLD – Evolution Mining (EVN)

The gold producer has retained fiscal year 2024 guidance of 770,000 ounces at an all-in-sustaining cost of $1370 an ounce. EVN also produced 13,594 tonnes of copper in the September quarter, an increase of 76 per cent on the June quarter. Mine operating cash flow increased 42 per cent to $280 million. A return to normal operations at certain sites has left investors with a sense of optimism.

SELL RECOMMENDATIONS

SELL – Bank of Queensland (BOQ)

The bank’s fiscal year 2023 result disappointed investors. Cash earnings after tax of $450 million in fiscal year 2023 were down 8 per cent on the prior corresponding period. The net interest margin declined 2 basis points, driven by lending competition and higher funding costs across the industry. Operating expenses increased by 8 per cent. Slower credit growth and fierce competition may put more pressure on revenue and margins in fiscal year 2024.

SELL – Fortescue Metals Group (FMG)

The company shipped 45.9 million tonnes of iron ore in the first quarter of fiscal year 2024, a fall of 3 per cent on the prior corresponding period. Concerns exist about over-production in Chinese steel mills. According to FMG, increased maintenance activity and lower stocks at port following strong shipments in the fourth quarter of fiscal year 2023 were behind the fall. The share price has been volatile in calendar year 2023. Investors may want to consider reducing holdings in FMG until a clearer picture emerges about the global commodity outlook.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

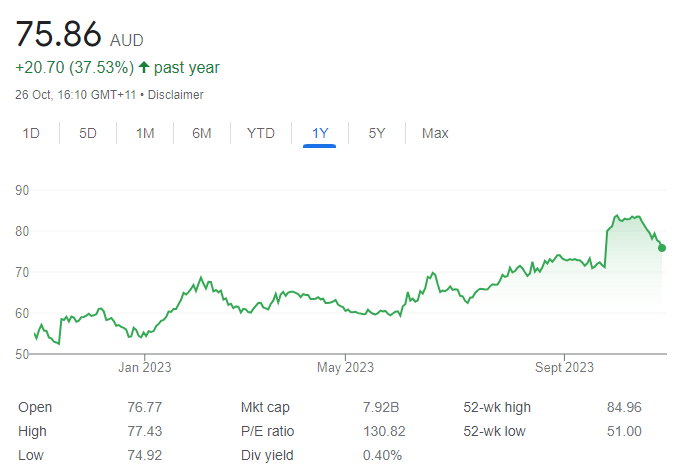

BUY – Pro Medicus (PME)

Shares in this cloud based medical imaging firm recently eased back to attractive levels despite PME announcing a $140 million contract over 10 years with Baylor Scott & White Health – the largest not-for-profit health system in Texas. This contract marks a positive change in contract term, size and client type outside PME’s traditional deals and underpins near-term earnings forecasts and its longer-term market opportunity.

BUY – Santos (STO)

Despite surging global crude oil prices and excellent operational performance at the company’s key LNG projects in Papua New Guinea and Darwin, Santos shares recently remained more than 30 per cent below our valuation. The potential regulatory approval of its Barossa field development offers a catalyst in the short term.

HOLD RECOMMENDATIONS

HOLD – Worley (WOR)

Worley provides project and asset services to the energy, chemicals and resources sectors. The company recently provided an encouraging update. Recent geopolitical tensions had not negatively impacted its business up to October 20, but the company was closely monitoring the situation. Rising energy prices are underpinning hydrocarbon development. The company’s steady progress in growing renewable energy and low carbon industries underpin the longer-term outlook.

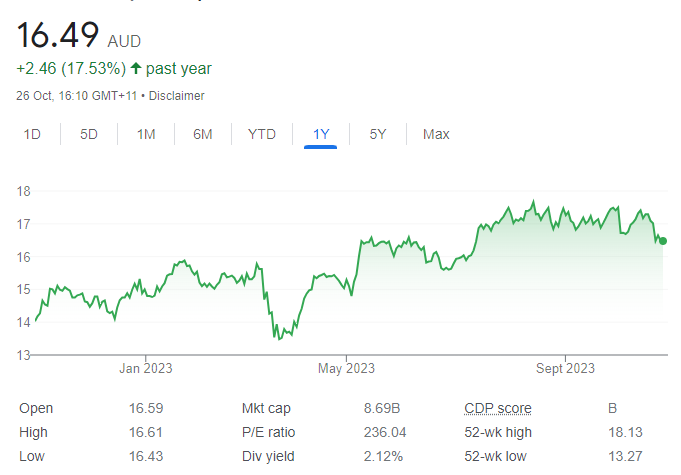

HOLD – ASX Limited (ASX)

While the problematic CHESS replacement program is likely to continue and elevate capital expenditure, we believe the share price has now more than adequately discounted the downside risk and offers reasonable long-term value for holders.

SELL RECOMMENDATIONS

SELL – Origin Energy (ORG)

The Australian Competition and Consumer Commission has granted authorisation for Brookfield Asset Management and MidOcean Energy to acquire ORG. Origin shares were recently trading above the bid, so the Brookfield consortium may have to consider increasing its offer to gain shareholder approval, or potentially face resistance from major ORG investors. We see superior value elsewhere in the sector, so investors may want to consider cashing out now.

SELL – Sims Group (SGM)

The metals recycling business continues to face challenging conditions, with US operations showing signs of weakening in recent months. While understandable, the decision to sell its renewable biofuels assets reduces diversity and removes longer term upside. In our view, short term operating performance is likely to remain soft.

Related Articles:

- ASX Mining Stocks to Buy in 2023

- The Best Australian Apps for Investing

- Share Trading in Australia

- ASX ETFs to Buy Right Now

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.