Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

BUY – Rural Funds Group (RFF)

RFF is a listed agricultural real estate investment trust. Its portfolio focuses on almond orchards, vineyards, cattle, cotton and macadamias. RFF was recently trading at a 38 per cent discount to its market net asset value. In our view, a buying opportunity exists for an undervalued stock recently trading on attractive dividend yield above 6 per cent.

BUY – Transurban Group (TCL)

TCL owns and operates toll roads in Melbourne, Sydney and Brisbane. It also owns toll roads in the US and Canada. The company reported record full year traffic across its portfolio in fiscal year 2023, up almost 20 per cent on the prior year. Earnings are defensive with a high portion of toll revenue linked to the consumer price index.

HOLD RECOMMENDATIONS

HOLD – Whitehaven Coal (WHC)

The company produces mostly thermal coal from four core assets located in the New South Wales. In our view, the recent acquisition of two metallurgical coal assets may reduce WHC’s capacity for dividends in the short-term, while maintaining material thermal coal exposure. We expect coal prices to retreat from current high levels. Managed run-of-mine production of 5.3 million tonnes in the September quarter was up 5 per cent on the June quarter.

HOLD – Paladin Energy (PDN)

Paladin Energy’s Langer Heinrich mine is approaching a return to production in the first quarter of calendar year 2024. We view PDN as a preferred way to play the uranium sector. We see uranium prices stabilising in the medium-term, but increasing interest in global nuclear energy is a positive for the long-term.

SELL RECOMMENDATIONS

SELL – Harvey Norman Holdings (HVN)

The first quarter 2024 update from the retail giant revealed a sales slump in Australia and abroad in response to difficult operating conditions. We’re cautious about the discretionary retail sector, with interest rates potentially higher for longer amid continuing cost of living pressures. HVN shares have fallen from $4.06 on October 11 to close at $3.60 on November 23. We expect stringent competition this Christmas period.

SELL – Platinum Asset Management (PTM)

Funds under management performance continues to be disappointing with further outflows. In October 2023, PTM experienced net outflows of $165 million. Included in this figure were net outflows of $124 million from Platinum Trust Funds. The share price has fallen from $2.30 on February 21 to close at $1.16 on November 23. Other stocks appeal more at this time.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – Westpac Banking Corporation (WBC)

The fiscal year 2023 result was largely in line with expectations. The bank posted a net profit of $7.195 billion, up 26 per cent on the prior corresponding period. Credit stress in the home lending book remains low, with 90-day mortgage delinquencies trending back to September 2019 levels. Westpac announced a $1.5 billion buyback. The recent fully franked dividend yield of 6.6 per cent is attractive. We believe the shares are cheap as they were recently trading on a modest forward price/earnings ratio.

BUY – Aristocrat Leisure (ALL)

The gaming company delivered a net profit after tax of $1.245 billion in fiscal year 2023, up 24.4 per cent on the prior corresponding period. We anticipate Aristocrat’s highly popular and profitable electronic gaming machine titles enabled it to capture share in the key North American market. The proposed acquisition of NeoGames is expected to close in the first half of fiscal year 2024, with capabilities offering global scale and new distribution channels for the company’s content in the real money games sector.

HOLD RECOMMENDATIONS

HOLD – National Australia Bank (NAB)

Cash earnings of $7.731 billion in fiscal year 2023 were up 8.8 per cent on the prior corresponding period. Higher cash rates were the key driver of earnings growth. The net interest margin of 1.74 per cent was up by 9 basis points on a 3 per cent larger loan book. The full year dividend of $1.67 was 16 cents higher than in 2022.

HOLD – Commonwealth Bank of Australia (CBA)

The bank reported an unaudited cash net profit after tax of about $2.5 billion in the first quarter of fiscal year 2024, up 1 per cent on the prior corresponding period. Operating expenses increased 3 per cent, reflecting wage inflation and higher staff costs. The company’s capital position is strong. The company is focused on increasing its share of Australian home loan revenue. CBA is a market leader in terms of market share and operating efficiency, in our view.

SELL RECOMMENDATIONS

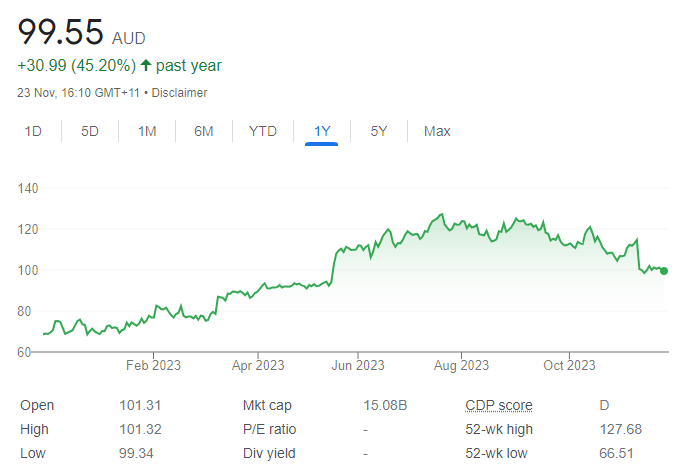

SELL – Xero (XRO)

This accounting software provider posted subscriber growth in line with our expectations in its first half 2024 results. Price increases were the main driver behind average revenue per user growth of 6 per cent year-on-year and 8 per cent in constant currency. However, higher prices aren’t sufficiently compensating for increasing customer acquisition costs in the international segment, with the payback period continuing to lengthen. The shares have fallen from $120.93 on October 12 to trade at $99.63 on November 23.

SELL – Bega Cheese (BGA)

Bega’s branded business should continue to perform well in the first half of fiscal year 2024. However, in our view, challenges are likely to persist for the bulk commodity business throughout fiscal year 2024. While commodity markets appear to have stabilised in recent weeks, weak global demand, particularly from China, continues to weigh on dairy export prices. Further declines in milk production amid strong competition for milk supplies could put upward pressure on farmgate prices, which may need to be offset by price increases.

Tony Langford, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – Santos (STO)

The energy giant produced 23.3 million barrels of oil equivalent in the third quarter of 2023, an increase of 2 per cent on the previous quarter. In September, STO announced it had executed a binding sale agreement with Kumul Petroleum Holdings to sell a 2.6 per cent participating interest in Papua New Guinea LNG (PNG LNG) for $576 million and the assumption of about $160 million of project finance debt. Also, STO agreed to grant Kumul a call option to acquire a further 2.4 per cent participating interest in PNG LNG for $524 million, plus a proportionate share of project finance debt. The sale agreement is conditional only on the approval of the PNG competition regulator on or before December 31, 2023. We believe the stock provides good value at these levels on top of appealing capital returns.

BUY – CSL (CSL)

At its recent annual general meeting, the company forecast 2024 revenue to grow between 9 per cent and 11 per cent at constant currency compared to fiscal year 2023. It expects 2024 net profit after tax and amortisation in a range of about $2.9 billion and $3 billion at constant currency, an increase of between 13 per cent and 17 per cent. We believe this blood products group is undervalued at these levels given its brighter outlook.

HOLD RECOMMENDATIONS

HOLD – Carnaby Resources (CNB)

This exploration and development company focuses on copper and gold projects in Queensland and Western Australia. The flagship is the Greater Duchess Copper Gold project. It has a maiden interim mineral resource of 21.8 million tonnes at 1.3 per cent copper and 0.2 grams a tonne of gold. Recent infill drilling updates have shown positive signs and appear to support a mine life of more than 20 years. Carnaby is more suited to patient, renewable energy investors prepared to back the green transition theme via copper.

HOLD – ResMed (RMD)

The share price has fallen from $33.85 on August 3 to trade at $23.35 on November 23. Investors were concerned that RMD’s sleep apnoea business may be impacted by diabetes and obesity medicines. However, we expect demand for ResMed medical devices to be sustained as the company has a solid track record of treating sleep disordered breathing.

SELL RECOMMENDATIONS

SELL – Deterra Royalties (DRR)

The company manages a portfolio of royalty assets across a range of commodities. Its existing portfolio includes royalties held over Mining Area C in the Pilbara region of Western Australia. Mining Area C royalties fell by 5.8 per cent in the September quarter compared to the June quarter. This was due to lower sales volumes partly offset by stronger iron ore prices. The share price has performed well since August 2023, triggering a trading sell.

SELL – National Australia Bank (NAB)

The NAB has been a strong performing bank in the past three years. Cash earnings of $7.731 billion in fiscal year 2023 were up 8.8 per cent on the prior corresponding period. However, we’re concerned about competitive pressures and cost inflation moving forward in a challenging economy with higher interest rates. We view NAB as a yield stock at this point. Investors may want to consider reducing exposure to chase capital growth in other stocks.

Related Articles:

- Share Trading in Australia

- How to Buy Commodities in Australia

- CFD Trading for Beginners

- CFD Brokers in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.