Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

Latrobe Magnesium (LMG)

LMG is one of the few ASX listed stocks with exposure to the burgeoning magnesium market. The Latrobe Valley magnesium project is advanced and the demonstration plant is expected to produce by the end of 2022. The company plans to sell magnesium to Australian, US and Japanese customers. We like the company’s outlook, as we expect stronger demand for magnesium as its increasingly used in car parts, computers and power tools.

Castle Minerals (CDT)

The company has interests in projects in Western Australia and Ghana that are prospective for gold, lithium and other minerals. The company is positioned to accelerate towards drilling several of its projects. Some include the Beasley Creek gold project, the Earaheedy zinc-lead project and Ghana’s graphite deposit known as Kambale. Growth potential exists and suits investors with an appetite for risk. We acted as lead manager to a recent placement.

HOLD RECOMMENDATIONS

Beam Communications Holdings (BCC)

BCC specialises in designing, making and distributing satellite, cellular and dual mode equipment applications and services. Its products and services are adopted by several of the world’s largest satellite and telecommunications companies. The company posted $18.5 million in revenue from ordinary activities in fiscal year 2021, a 24 per cent increase on the prior corresponding period. We expect revenue growth to continue in fiscal year 2022.

Lion Energy (LIO)

In the June quarter, the company announced it had raised $2.8 million to back its green hydrogen strategy, which targets first mover production status in Australia. LIO has appointed the Queensland University of Technology to assist in locating green hydrogen infrastructure in Queensland. Momentum in the sector received another boost after the New South Wales Government recently launched a hydrogen strategy to cut emmissions.

SELL RECOMMENDATIONS

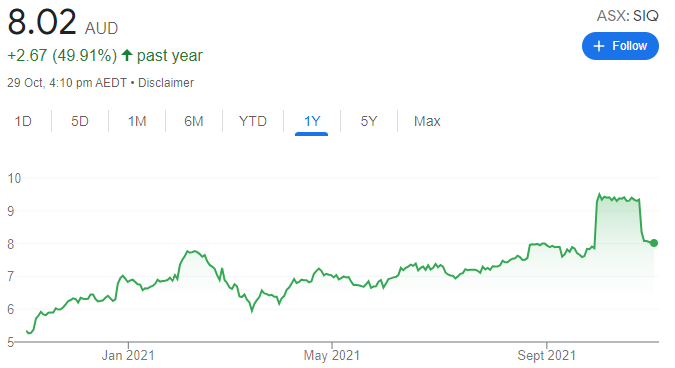

Smartgroup Corporation (SIQ)

A potential takeover of SIQ was recently shelved. A consortium comprising TPG Global, LLC and Potentia Capital initially proposed $10.35 a share for SIQ, a salary packaging company. The consortium revised its proposal to $9.25 a share following due diligence. The SIQ board rejected the $9.25 proposal. The share price plunged on the news. In our view, downside risks remain in the absence of another offer.

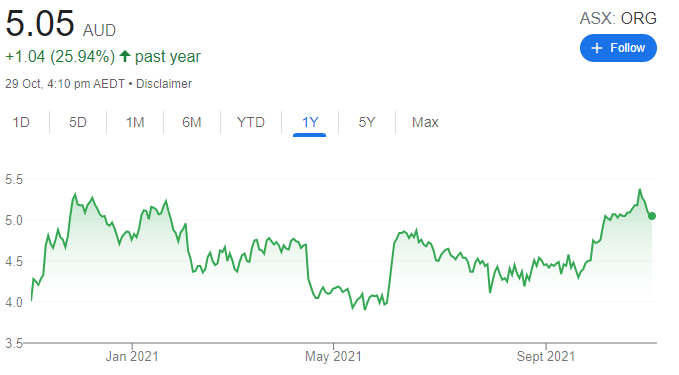

Origin Energy (ORG)

The power and gas giant was hit with $5 million in penalties for allegedly charging more than 20,000 small business customers with prohibited exit fees. The Essential Services Commission in Victoria issued Origin with 250 penalty notices after discovering contracts wrongly included exit fees totalling $489,774 between 2016 and 2020. In our view, the negative news may have an impact on the share price over the medium term.

Peter Moran, Wilsons

BUY RECOMMENDATIONS

ReadyTech Holdings (RDY)

This software-as-a-service business is attractive for its high levels of recurring revenue and strong margins. Both are driven by the quality of its software. As an example, ReadyTech recently highlighted a potential opportunity to move existing payroll customers to a new superior product that’s more profitable. We expect continuing growth across its business. We hold an overweight rating.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

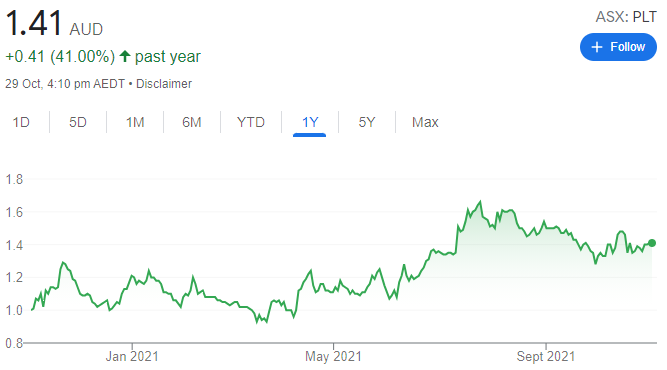

Plenti Group (PLT)

The second quarter update confirmed continuing strong loan origination across all three of its lending segments. Loan origination increased from $3.3 million a day in the first quarter to $3.9 million a day in the second quarter. As a result, we expect Plenti to reach a $1 billion loan book and become cash flow positive by the end of December this year. Our rating is overweight.

HOLD RECOMMENDATIONS

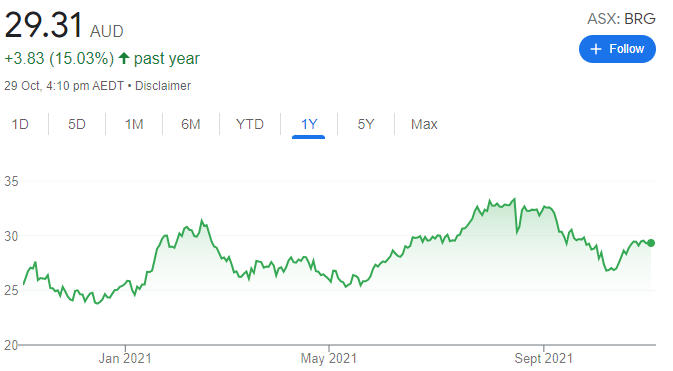

Breville Group (BRG)

This kitchenware company has a solid track record of product development over many years. In the near term, BRG may experience increasing cost pressures, but the company should benefit from a continuing consumer trend towards higher quality appliances. Earnings should continue to grow over the medium term. BRG was recently trading on a price/earnings multiple of about 40 times, so we consider it fairly valued. We retain a market weight rating.

Nanosonics (NAN)

NAN specialises in preventing infection. In our view, the company outlook is more positive following its better than expected full year result. Importantly, the company has announced a new flexible endoscope cleaning device that will be launched next year. We upgrade to a market weight rating.

SELL RECOMMENDATIONS

Elders (ELD)

This provider of agricultural products and services is likely to report a good result on November 15, as it benefits from buoyant conditions in much of rural Australia. However, in our view, the share price appears to assume existing favourable conditions will persist long into the future. This appears overly optimistic in a cyclical industry and we see downside risk. We retain an underweight rating.

ELMO Software (ELO)

ELMO offers cloud-based solutions for small businesses and mid-market organisations. The company continues to grow revenue. But cash burn is an issue, in our view. According to our analysis at this point, further cash may be required to fund earn-out payments from past acquisitions. Consequently, we expect ELO may need to raise more capital in the future. Our rating is underweight.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Nick Scali (NCK)

This furniture retailer reported underlying net profit tax of $84.2 million in fiscal year 2021, a 100 per cent increase on the prior year. September quarter revenue in fiscal year 2022 was in line with last year, which we commend given lockdowns and shipping delays. October trading was buoyant after New South Wales opened. We expect the same to occur in Victoria when it fully opens.

ARB Corporation (ARB)

This 4-wheel drive accessories company is continuing to perform despite lockdown restrictions. It posted good sales and profit growth in the September quarter, and we expect this to continue in the first half of financial year 2022. The order book remains strong, both domestically and internationally, and the company is continuing with its product and store development work program in Australia amid expanding its manufacturing capability.

HOLD RECOMMENDATIONS

Camplify Holdings (CHL)

The company’s digital market platforms connect recreational vehicle owners to hirers in Australia, the UK, New Zealand and Spain. CHL continues to generate growth despite widespread lockdowns in the September quarter. The company posted revenue of $3.07 million in the 2022 first quarter, an increase of 106 per cent on the prior corresponding period. We expect 2022 bookings to exceed 2021 as state border restrictions ease. The company should benefit from pent-up demand.

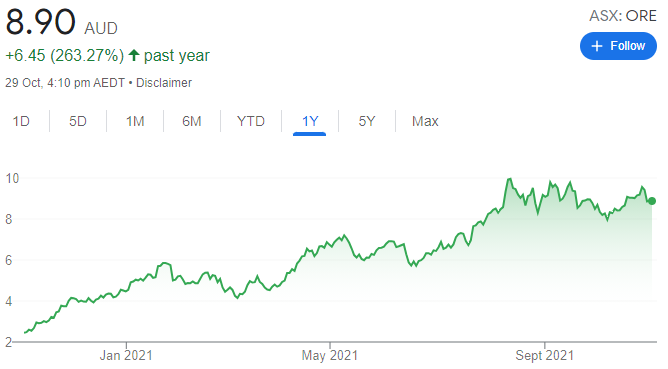

Orocobre (ORE)

This lithium miner posted another record production result at its Mt Cattlin mine in the September quarter. The result led to an upgrade of its calendar year 2021 production forecasts. Global average lithium chemical and spodumene concentrate prices continued to rise during the quarter in response to soaring electric vehicle sales during 2021. We expect favourable trading conditions to continue into the second half of financial year 2022 and beyond.

SELL RECOMMENDATIONS

Redbubble (RBL)

RBL operates a global online market for artwork prints. Gross profit in the September quarter fell 34 per cent to $42 million. Marketplace revenue was down 28 per cent to $106 million. We expect easing of COVID-19 restrictions to weigh further on RBL’s trading performance. Better options exist elsewhere, in our view.

Ansell (ANN)

The share price of this protective gloves manufacturer has fallen from $40.50 on August 23, 2021 to trade at $31.99 on October 28. Management has warned about supply pressures due to COVID-19 outbreaks in South East Asia causing short term factory closures or reduced operations. Higher freight costs and shipping delays are expected to persist in fiscal year 2022.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.