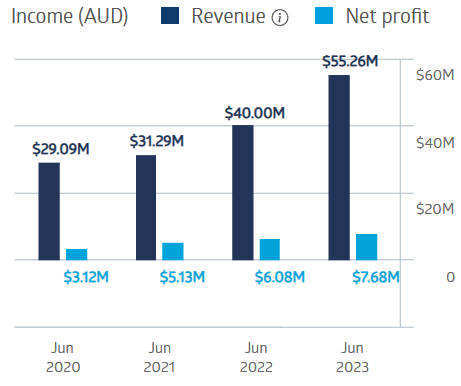

- XRF Scientific has grown both revenue and profit in each of the last four fiscal years.

- The company reported record revenue and profit in FY 2023 but remains under the radar of investors.

- XRF Scientific has multiple revenue sources, some recurring.

XRF Scientific is a high-tech manufacturer of equipment and chemicals used for preparing samples for analysis in producing mines, construction materials companies and chemical analysis labs.

The company has three operating divisions – Capital Equipment, Precious Metals, and Consumables – reaching customers in Australia, Europe and Canada. The consumables division provides chemicals and other supplies needed by analytical laboratories, a major source of recurring revenue.

In the last decade, the share price has risen from $0.24 to $1.17 as of market open on 11th September, an increase of 387.5%.

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The company’s dividend performance over the last four fiscal years has been exemplary, paying out 1.4 cents per share in FY 2020, 2 cents per share in FY 2021, 2.5 cents per share in FY 2022, and 3.3 cents per share in FY 2023.

Full Year 2023 financial results saw revenues rise 38% and net profit after tax up 26%.

XRF Scientific Financial Performance

Source: ASX

XRF Scientific has been in business since 1972, listing on the ASX in 2006, trading at $0.19 per share. The company’s 90-day average trading volume of 218,469 shares per day suggests that this profitable company in the promising mining and industrial sectors is well below the radar of most Australian investors.

An analyst at Medallion Financial has a BUY recommendation on XRF shares, citing the company’s dividend potential and growth in the XRF capital equipment division.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy