While the COVID 19 Pandemic ravaged sectors like energy, utilities, and industrials – all down more than 10% for the year 2020 – the Information Technology sector shined. Led by two residents of the ASX WAAAX stocks – Afterpay and Xero – the sector was up a staggering 57% for the year, dwarfing the 18.2% for the Materials sector.

Buy Now Pay Later (BNPL) company Afterpay Limited (APT) led the group with a year over year increase in excess of 270% while accounting software provider Xero Limited (XRO) rose around 60%. The following chart from the ASX website shows the current year over year performance of the two.

The other members of the WAAAX group did not fare so well, with two of the three showing negative share price performance. Wisetech Global (WTC) provides logistics software and services with a current year over year increase of 16%.

Altium Limited (ALU) provides software design products for creating printed circuit boards. Appen Limited (APX) provides advanced Artificial Intelligence (AI) -assisted data annotation platforms. The following graph shows the current year over year performance of the three.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

While the ASX All Ordinaries Index (XAO) is up about 2% since the trading year 2021 began, the price performance charts show all of the WAAAX stocks started the year in a slight downward trend, with only APT reversing course. Aussie investors building their holdings of red-hot Afterpay stock by buying on the dip have already been rewarded with buys prior to 14 January.

The only things the five have in common are software and their inclusion in WAAAX, Australia’s answer to the FANG acronym in the US grouping mega cap tech companies Facebook, Amazon, Netflix, and Google (Alphabet).

All of the WAAAX companies operate in different markets, provide different services, and have different growth prospects.

Market darling Afterpay has shown remarkable growth in one area since listing in 2017 – active customers. Investors are comfortable with the company’s yearly losses in anticipation the growing customer base will eventually lead to profits, similar to the early days of Amazon.

The company offers its retail customers a convenient BNPL software platform that allows the retailers’ customers to “buy now and pay later.” Afterpay generates revenues from the fees charged to retailers for the service. Consumers have options for interest free repayment over time and are charged late fees if they miss a payment date.

Afterpay pays the retailer for the goods purchased immediately and assumes responsibility for bad debts. The major advantage to the consumers is not accruing interest on their purchases while making monthly payments to their credit card provider. Other advantages include “easy credit” with no waiting for credit approval and no reporting to credit bureaus.

Some analysts are cautious about the stock, citing its excessive valuation. Others point to the potential for regulatory intrusions should growing numbers of consumers burden themselves with payments they cannot make. However, the 14 January boost is likely the result of a price target upgrade from Morgan Stanley. In addition, investors might have had their eyes on the 90% jump of US rival Affirm on its first day of trading in the US.

Afterpay’s growth relies on consumer spending habits while the other four companies operate in different niches in the business world.

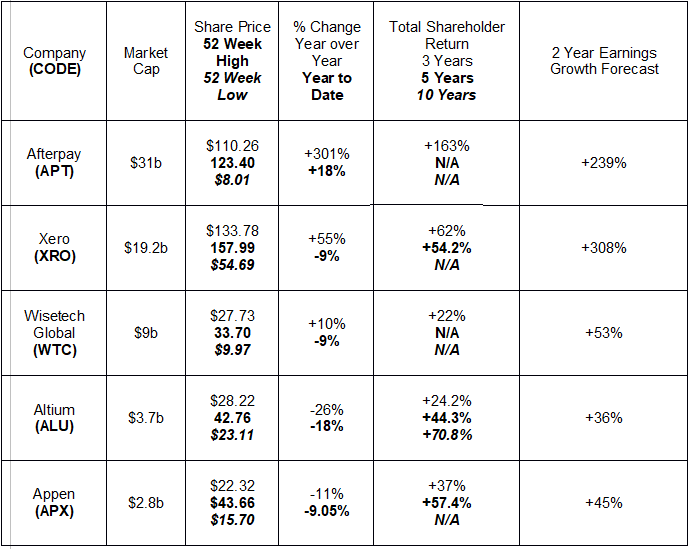

The following table compares share price and shareholder return information for the WAAAX stocks.

Xero started in New Zealand in 2006 as a provider of cloud based accounting software, evolving into today’s status as a full service provider of solutions for the financial operations of SME (small business enterprise) companies. Xero also has software for independent bookkeepers and accountants. The business model is SaaS, or software as a service.

The company’s digital operations thrived during the early days of the pandemic, keeping “at home” employees connected. For the Half Year 2021 operating revenues were up 21% but the real story was the 305% increase in profit from operations. In FY 2020 Xero reported $1.3 million in net profit for the first half and $2.0 million for the entire year. For the Half Year 2021 the company reported a net profit of $34.5 million dollars. The company’s subscriber base grew by 19%.

The company reports in March, so the Half Year 2021 results began in the teeth of the pandemic. Earnings per share for FY 2020 came in at 3.3 cents per share, with forecasted growth to FY 2021 of 39.8 cents per share and 55.1 cents per share in FY 2022.

Logistics was a term first used to describe the complex operations in the military, from procurement and transportation of military material and facilities as well as men, and the continuous maintenance. Today it describes the complex operations involved in getting goods from the manufacturer to the end customer.

The “supply chain” involved includes multiple independent operators, making communication a potential nightmare. Wisetech Global has a cloud based software platform called CargoWise One that integrates the operators.

According to the company website describes, Wisetech’s software platforms are in use at more than 17,000 logistics organisations in more than 160 countries. Of the top 50 third party logistics providers around the world, 42 use the company’s software.

CargoWise manages logistical operations from rates and taxing information to customs issues to transportation and carrier information and global tracking. The company made its first acquisition in 2004 with another 37 coming between 2015 and 2020.

Wisetech’s aggressive acquisition strategy led to a short seller attack claiming the company’s acquisitions “are from distressed sales or bankrupt companies with revenues falling post-acquisition”. Wisetech’s chief financial officer denied the accusations but investors took notice. The company survived another short seller attack in 2019.

The software platform is continuously updated, with more than 3,900 product enhancements in the last five years, according to the Wisetech FY 2020 Full Year Results Presentation.

The company was hurt by the pandemic as companies around the world enacted cost cutting measures, yet Wisetech posted a 23% increase in total revenue in 2020 with a statutory net profit of $160 million, up from FY 2019’s $54 million. Wisetech has increased both revenue and profit in each of the last three fiscal years and recently reaffirmed its FY 2021 guidance, calling for revenue growth in the range of 9% to 19% and EBITDA (earnings before interest, taxes, depreciation, and amortisation) growth between 22% and 42%.

Investors searching futurist reading for megatrends have seen Artificial Intelligence (AI) called a “massive” megatrend. AI, or machine learning, refer to the building of smart computing machines that can perform tasks normally done with human intelligence.

Appen limited is at the forefront of AI development. The company got its start with AI software platforms for speech and language recognition leading to the advent of devices like Amazon’s Alexa that can recognise and interpret human speech.

The company has expanded its expertise to assist client organisations to develop their own AI software platforms. Appen captures and annotates the data the client company needs to build AI platforms and machine learning models.

Investors who need reassurance of the company’s capabilities have only to look at some of the global tech companies that use their services, including Microsoft, Amazon Web Services (AWS), Facebook, and Google.

Appen was one of many companies warning the market of a slowdown in customer spending in an April announcement to the market. The Half Year 2020 Financial Results reported in August (Appen’s fiscal year ends in December) showed what was not yet obvious in April – tech companies fared well during the pandemic.

Appen reported a 25% revenue increase and a 20% increase in statutory net profit of 20%. The exchange rate reduced the revenue increase to 16% and the profit increase to 8%. The company maintained its full year guidance.

Disappointed investors drove down the stock price, with three possible explanations beyond profit taking.

First, the underlying net profit declined 3% and 12% in constant currency. Underlying profit is a more reliable indicator of financial performance as it excludes one off items included in statutory net profit.

Second, Appen has two revenue generating operations – Relevance and Speech & Image – with relevance bringing in $274 million dollars for the period versus $32 million from Speech & Image. While Revenue was up 34%, Speech & Image was down 20%.

Third, the company noted a slowdown in new business and deferred renewals from smaller customers.

On 10 December, with the COVID 19 Pandemic accelerating in the US, Appen issued a trading update lowering its earlier guidance and pointed to the 28% annual growth in AI spending cited by industry experts as a positive indicator for FY 2021.

Altium is another company with strong tailwinds in the long term from the rise of the Internet of Things (IoT) and increasing digitisation on all fronts. Like Appen, some of its customers have reduced spending due to the pandemic. The company’s full year follows the fiscal calendar, ending on 30 June. Altium’s Full Year 2020 Results reported in August showed the COVID impact with a 42% drop in net profit despite a 10% increase in revenue.

Altium makes a variety of software platforms for designing the printed circuit boards (PCBs) found in virtually all of today’s electronic devices as well as in electrical devices like switch boxes. Products are grouped into

- Pro Design Software with 5 platforms including the cloud based Altium 365

- Component Management with 3 software platforms

- Trainings with both live and online courses and an Online Viewer for sharing and viewing electronic designs.

The company has been designing circuit boards for 30 years and now has customers all over the world. While some companies generate most of their revenue from one country or region, Altium has a globally diversified revenue base, with 48% from the Americas; 32% from Europe; 14% from Emerging Markets, and 7% from the Asia Pacific region. Altium’s more than 31,000 global subscribers to Altium software platforms make up 53% of the company’s total revenue.

On 12 January, the company decided to announce a market preview of Half Year 2021 results by releasing the results unaudited. Revenues dropped 3%, with the lion’s share coming from China and the US.

The extreme and ongoing COVID 10 situation in the US led to a 10% decline in sales. Sales in China dropped 15% despite that country being in a post COVID era. Some economic conditions remain uncertain there affecting license compliance activities.

Right now Altium and Appen trail the other WAAX members in both share price appreciation and growth forecasts. For long term investors, any review of future trends points to these two companies as major beneficiaries.