Since 6 February the ASX investment community has watched the back and forth movements in the saga of what could have become the largest acquisition in Australian History – the takeover of the largest gold miner in Australia – Newcrest Mining (NCM) – by the largest miner in the world – US based Newmont Corporation (NYSE: NEM).

Following the rebuff of the initial offer, speculation arose for little more than a momentary flash that the second largest gold miner in the world – US based Barrick Gold ( NYSE: GOLD) would jump in and ignite a bidding war.

The Barrick CEO was quick to splash ice water on that possibility, commenting in a Bloomberg interview that “there is a difference between value merger acquisitions and getting bigger for the sake of getting bigger.”

In the absence of competitive bidders, the proposed acquisition appears to have withered on the vine, possibly awaiting changes in interest rates to combat inflation, the value of the US dollar, and the price of gold itself.

The Barrick comment raises the question why Newmont was interested in acquiring Newcrest.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

It appears investors in gold sector investments remain unimpressed with the prospect of a giant elevating to gigantic. In many cases, significant merger and acquisition is seen as a sign of overall economic health, with other stocks in the sector becoming sources of takeover speculation.

Although the share price of Newcrest rallied, the share price of Newmont fell, which is not out of the ordinary. However, other major ASX listed gold mining stocks fell while Newcrest was rising. In other times, that kind of major acquisition would send bargain hunting investors off to search “under the radar” stocks in the sector.

Cynics may cast a wary eye of the skepticism coming from Barrick as industry experts acknowledge that both Newmont and Barrick need to find new producing sources just to maintain current production capability over the next five years.

With dwindling exploration sites and rising costs for new producing mines, bolting on a company like Newcrest, with superior ore reserve and mine life estimates does make sense. This suggests other gold miners, especially promising juniors, might be attractive takeover targets.

Calendar year 2022 was wracked by rapidly rising inflation coupled with rising interest rates to combat inflationary pressures, along with a major return of the COVID Pandemic in China. Add to that, the rise of bonds as a more attractive alternative to stocks. Despite this, the price of gold did increase, but by a paltry 1.35%.

US investing website forbes.com makes two critical points for investors straddling the fence over adding gold and/or gold miners to their portfolio’s.

First Forbes claims ‘”many analysts” see a “sharp rise” in the price of gold in 2023 despite the lack of certainty about restored demand for gold in China, nor the direction of interest rate hikes.

The second point is the most relevant for investors and the one most often ignored. While gold is hailed as a safe haven, Forbes correctly points to its stability over the long term as its greatest strength, so why should investors wait for a rising gold price to add gold investments , most notably gold miners.?

There are roughly 185 gold miners listed on the ASX according to listcorp.com/ASX /sectors/materials/metals-mining/gold, with market caps ranging from Redcastle Resources (RC1) at $3.14 million dollars to Newcrest Mining at $22.5 billion dollars.

Investors with an eye towards lower priced stocks bordering bargain territory or better should consider first looking for miners in later stages of exploration and development with low market caps.

On the ASX a market cap under $100 million dollars tells investors their brethren have expressed little interest in the stock, since market cap is a measure of market perception inflating share prices. Investors buy shares in companies they believe to be solid investments, with the exception of short selling. The stock price is determined not by the value of the company but by the demand for the company’s stock. Selling drives down both market cap and the stock price.

Companies with lower market caps are not necessarily bad investments. Rather, they have yet to excite the masses of investors.

Potential excites investors, with earlier prospects for significant gold production ranking high on investors’ radar. However, given the abundance of small cap junior miners from which to choose, there are stocks that remain largely under the radar.

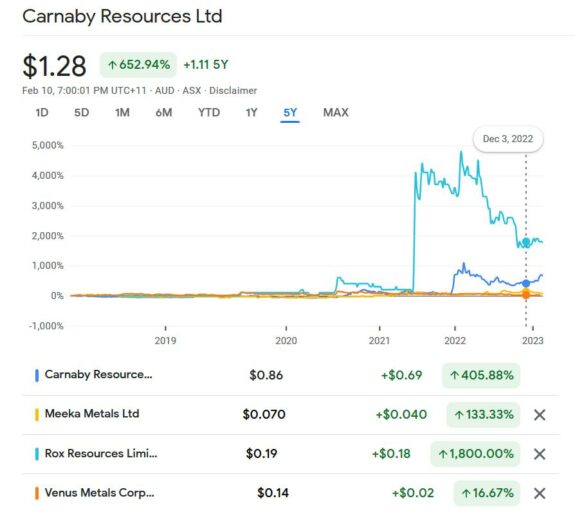

The following table includes four such junior gold miner prospects, all of them with depreciating stock prices year over year yet showing substantial positive price appreciation over five years.

| Company

(CODE) |

Market Cap | Share Price

Current |

Share Price

52 Week High 52 Week Low

|

Average Trading Volume

90 Day 30 Day

|

Total Cash (MRQ)

Total Debt (MRQ |

|

Carnaby Resources CNB

|

$184.3M | $1.28 | $2.04

$0.69 |

403k

515K |

$17.9M

$63.8K |

|

Meeka Metals (MEK)

|

56.5M | $0.05 | $0.092

$0.039 |

1.6M

1.4M |

$2.47M

$54.06K |

|

Rox Resources (RXL)

|

$40.1M` | $0.185 | $0.46

$0.14 |

303k 1.23M

|

$4.44M

$491K |

|

Venus Metals (VMC)

|

$24M | $0.13 | $0.215

$0.12 |

117K

92.6k |

$6.48M

$4.57M |

With the exception of Venus Metals, the companies are in a relatively solid cash versus debt position. All have trading volumes that put them in or near “under investor radar” status. The higher trading volume from Meeka Metals can be interpreted as coming from the company’s near penny stock status.

Year over year, all have seen share price declines, with Meeka Metals showing flat movement.

Depending on the status of their mining projects, all could be considered attractive investments considering their share price appreciation over five years, going back to the pre-pandemic years.

In June of 2020 Rox Resources delighted investors with the announcements of increasing its stake in the Youanmi Gold Project to 70% followed by a highly positive announcement on the drilling program at Youanmi – impressive gold grades at deepest drilling points along with the discovery that the initial mineralisation uncovered extends to other potential exploration sites in the project. Youanmi is a Joint Venture between Rox and Venus Metals, with Venus holding 30%.

In October of 2022, a scoping study was completed, showing a low capital, high return future for the project, with a capital injection of around AUD$100 million dollars prior to production, with yearly output estimated at 71,000 ounces of gold concentrate and all in sustaining costs (AISC) averaging $1538 per ounce.

With a mine life in excess of eight years, the project could produce as much as 569,000 ounces, of gold with cumulative EBITDA (earnings before interest taxes depreciation and amortisation) of AUD$577 million dollars.

On 16 January of 2023, the JV announced a multi-drilling campaign to further define and upgrade the project resource base. The project is well capitalised following recent capital raises and asset sales. The Youanmi Gold Mine is located in Western Australia.

Rox Resources also is exploring the Mt Fisher / Mt Eureka Project Gold Project with drilling and high resolution airborne aeromagnetic surveying underway.

Venus Metals has additional lithium, rare earth, zinc/copper, vanadium, and lithium/gold/nickel assets in development. Drilling is underway at the Henderson Lithium/Gold/Nickel project and the Youanmi Vanadium Project.

Meeka Metals has two gold and two rare earth projects in development. The Murchison Gold Project in Western Australia borders several multi-million ounce gold mines. A scoping study was released in December of 2021 with positive early indicators. A pre-feasibility study is expected to be released in June of 2023, followed by a definitive feasibility study and an investment decision.

The Circle Valley Gold and Circle Valley Rare Earth Projects are located in an underexplored region of the Western Australia mining belt. Preliminary drilling is underway at both, with drilling yet to begin at Meeka’s Cascade Rare Earth Project. The drilling at Circle Valley Rare Earth is expected to produce a mineral resource estimate for the project by June of 2023. The drilling program at Circle Valley Gold will be expanded in early 2023

Carnaby has three exploration projects underway in Australia – a copper/gold project in Queensland and a gold/lithium project and a gold/nickel/platinum project. In Western Australia.

The Mount Isla Project in Queensland contains both the Tick Hill Gold Project and the Greater Duchess Gold Project. Orebodies were discovered at Tick Hill in 2019 and Carnaby is assessing the extent of those orebodies, with an eye toward proving a link to Greater Duchess. Other prospective sites exist within Greater Duchess and the company is now focusing its efforts on three, with drilling at the Nil Desperandum Discovery and Mount Hope underway. Tick Hill has a pre-feasibility (PFS) in place and the company announced a series of positive drilling results at Mount Hope and Greater Duchess.

There are multiple targets within Carnaby’s Pilbara Gold/lithium tenements – Strelley; Mount Grant; Pardoo ; and Goldsworthy Gold Projects as well as the Big Hill Lithium.

There are six targets within the Strelley Gold Project -the Bastion, Stockade, Alcazar, Palisade, Gibraltar, and Conwy Prospects., with drilling at four of the six.

Soil sampling at the Big Hill Lithium Project has taken place with results positive enough to plan a drilling campaign. Finally, initial soil sampling at the company’s Malmac Project in the Yilgarn Margin region of Western Australia indicating a band of copper/nickel/gold.

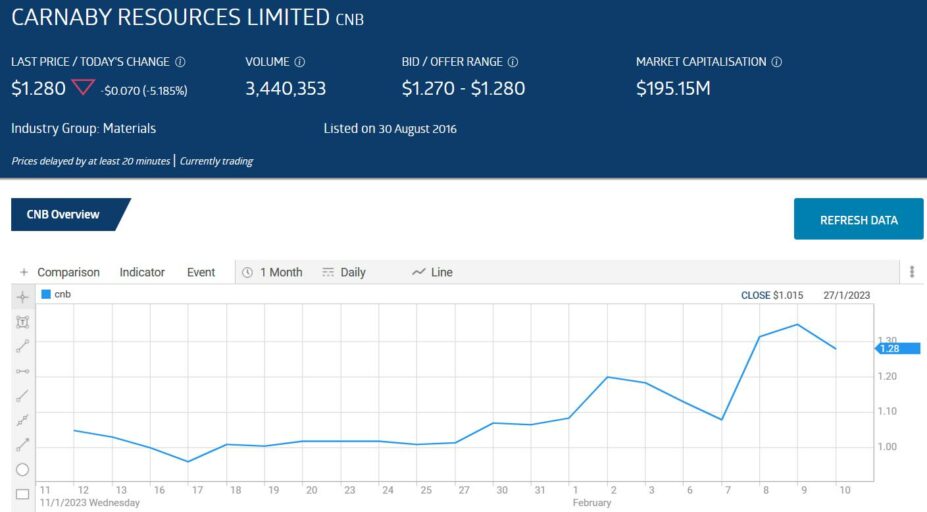

The following one month price movement chart from the ASX website suggests recent positive developments may be pushing Carnaby stock out from under the radar.