On 17 October of 2018 Canada became the largest country in the world to legalise the recreational use of marijuana (cannabis.) Uruguay holds the title of world’s first, legalising marijuana for recreational use in 2013.

Canada and Australia are two of roughly thirty two countries have adopted some form of legalised medical marijuana use. In stark contrast, only nine countries have approved the use of recreational marijuana. In Australia, user grown recreational marijuana is legal only in the Australian Capital Territory.

The investing world was quick to respond to the reported massive size of the recreational marijuana market once regulations began disappearing around the world, with hopes the US would follow Canada’s lead. It did not happen, although marijuana is fully legal in twenty-four states in the US.

Source: CNBC.com 30 January 2025

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

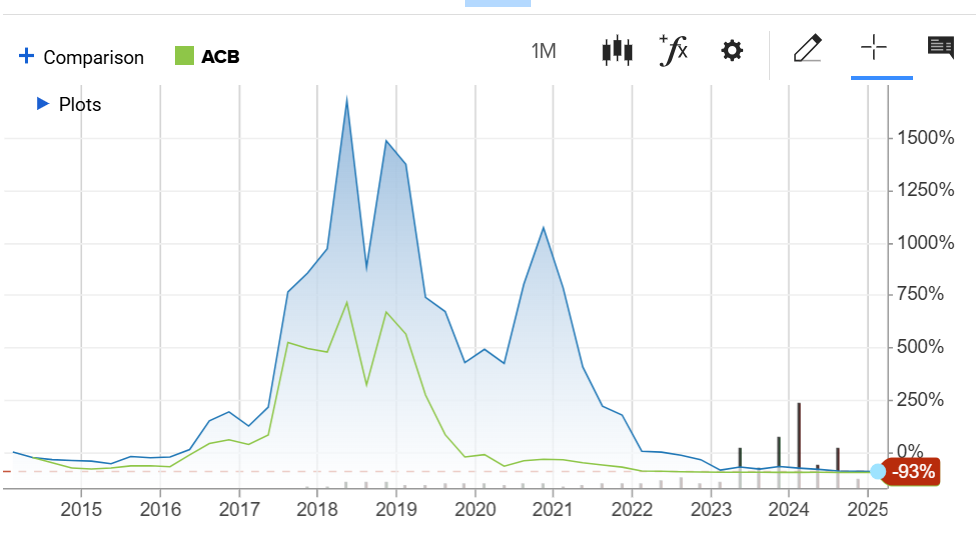

Two of the top contenders for the title of best marijuana stock to buy at that time both had supply arrangements with Australian cannabis growers – Canada based Canopy Growth (NASDAQ: CGC) and Aurora Cannabis (NASDAQ: ACB). Along with other marijuana producers too numerous to mention, the cannabis bubble burst for both of these companies. A ten-year price movement chart from US financial website CNBC shows the meteoric rise when Canada legalised recreational marijuana and the subsequent complete collapse.

There are a variety of factors that contributed to the early collapse, not the least of which was the failure of federal marijuana approval in the US. Investor enthusiasm for any company remotely collected with the marijuana sector failed to consider issues that in hindsight seemed obvious.

Canadian cannabis producers ramped up production in anticipation of federal approval to levels that proved to be unsustainable. Investors and analysts alike exaggerating the profit potential of the recreational marijuana market failed to consider three factors that started the debacle.

First, was distribution. The distribution system to the public had some provinces distributing through provincially controlled stores and others through privately owned stores. The end result was not enough distribution centres for the cannabis loving Canadians.

Second, was the oversupply in anticipation of the new law, with some growers shutting down production sites within a year.

Third was taxation. Taxes slapped onto legal marijuana sales almost doubled the price from illegal marijuana dispensaries.

Since 2016 the Australian Office of Drug Control has granted licenses for the cultivation, growth, and export of marijuana for medical or scientific purposes here in Australia. Marijuana export licenses were granted starting in 2018. The approval levels for medical marijuana here in Australia and around the world suggests that the best ASX cannabis stocks to buy are the companies involved in medical marijuana.

Although marijuana stocks are struggling in the face of investor skepticism, the long term outlook remains robust, Grandview Research estimates the global legal marijuana market will grow at a `compound annual growth rate (CAGR) of 25.7% from 2024 to 2030.”

Global demand for medical marijuana is estimated to have a CAGR of 24% from 2024 to 2032 according to Expert Market Research.

There may be as many as thirty- five or more cannabis stocks on the ASX, but some lists on financial websites may not have caught up with those who have left the sector. In addition, some stocks have branched out to chase a new “hot” idea – psychedelic medicine. Investors should be aware that cannabis stocks remain highly speculative and high risk.

The few low risk plays seem to remain revenue producing cannabis ASX stocks offering some form of medical use, or stocks with medical marijuana treatments in late-stage clinical trials.

As the first quarter of FY 2024 drew to a close, we looked at five “best-of-breed” cannabis stocks on the ASX. Now we will see how these five finished in 2024 and moved into the trading year 2025. Here are the five stocks:

Vitura Health Limited (ASX: VIT)

In February of 2023 Cronos Australia changed its name to Vitura Health, to highlight its independence from its former partnering company, Canada’s Cronos Group.

Vitura considers the company not strictly as a provider of medical marijuana products, but as a digital health operator linking the medical cannabis ecosystem – patients, doctors, pharmacists, and suppliers. Medical marijuana products are channeled through the company’s digital health eco-system.

The company has five distinct brands:

- Canview is an online platform enabling doctors and pharmacists to prescribe and distribute treatments and patients to browse available offerings.

- CDA Clinics is a network of clinics with teams of doctors, nurses, and support staff to offer Australians consultation on medical marijuana and other plant based medications.

- Cannadoc was created as a telehealth option for services offered at CDA clinics.

- Burleigh Heads Cannabis (BHC) distributes medical cannabis products via the Canview platform.

- Adaya produces a range of cannabis and plant-based medications.

Vitura listed on the ASX in 2019, with the share price now down 78>8% over that period. Year over year, the share price is down 68.9%.

Source: ASX 30 January 2025

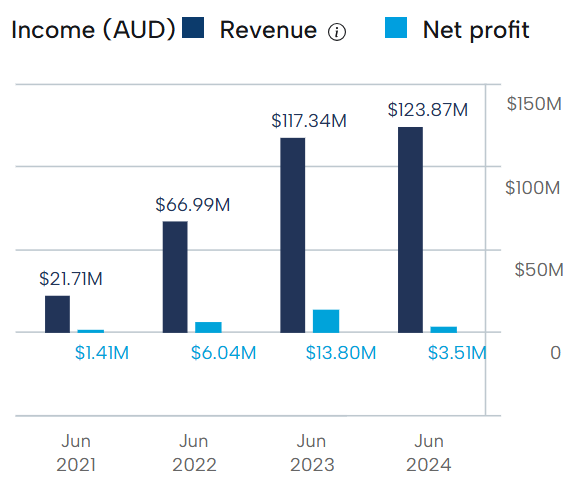

The Vitura Full Year 2022 Financial Results launched an upward movement in the share price. The financial performance was stunning, with revenues up 208% and net profit up 304%. Of particular delight to most investors was the move by Vitura management to declare a fully franked one penny per share dividend payment, indicating management’s confidence in the company’s financial stability. Vitura was the first ASX cannabis stock to turn profitable and declare a dividend.

The upward movement in revenues continued in FY 2023 and FY 2024, but net profit fell in FY 2024.

Vitura Financial Performance

Source: ASX 30 January 2025

Source: ASX 13 March 2024

In May of 2024, the company announced a “Strategy Reset.” Results of the first quarter of FY 2025 showed the strategy reset appears to be working, as the results showed company financials at or ahead of expectations.

Neurotech International (ASX: NTI)

Like many of the remaining ASX cannabis stocks, Neurotech’s scope extends beyond the traditional use of cannabis-based health and medical treatments under the designation “medical marijuana.”

The company’s principal focus in 2023 is its novel compound – NTI164 – for the treatment of paediatric Autism Spectrum Disorder (ASD). THC (tetrahydrocannabinol) in cannabis plants is the source of the “high” induced with its use in recreational marijuana. Medical marijuana compounds typically use low levels of THC. What makes NTI164 unique is its inclusion of multiple cannabis combinations with the low levels of THC.

Working in conjunction with Monash Children’s Hospital in Melbourne, Neurotech has completed early clinical trials (Phase I/II) with 93% of study participants showing symptom improvement with no safety or tolerability issues.

The company continues to report on multiple clinical trials, with the latest positive news coming from the US FDA (food and drug administration) granting ODD (orphan drug designation ) status for children with Rett’s syndrome, one of several conditions targeted by NTI164..

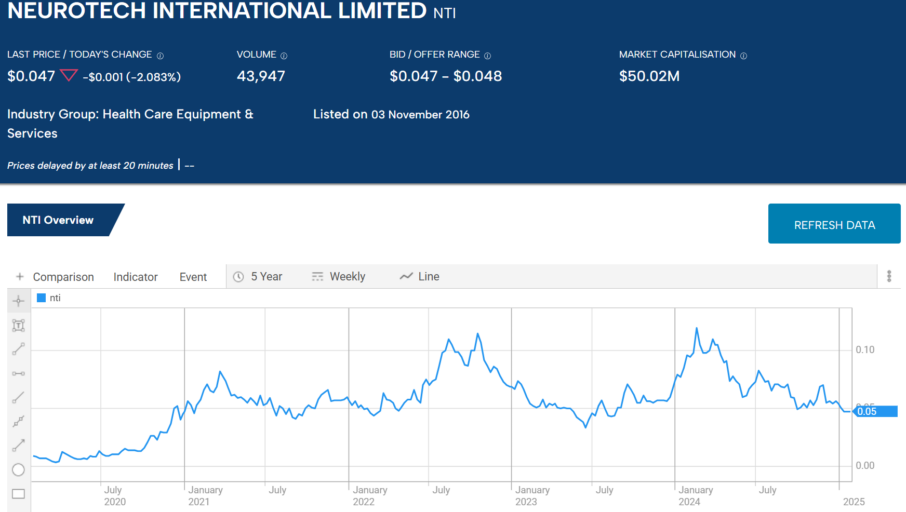

Over the five years since Neurotech embarked on its aggressive clinical trials and patent applications for NTI164, the share price is up 422%.

Source: ASX 30 January 2025

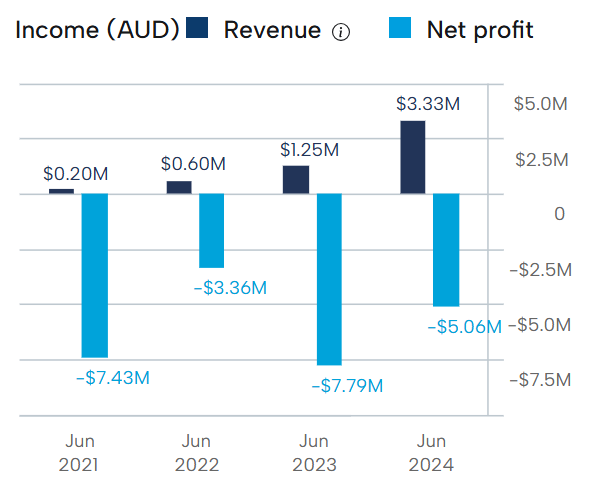

Between FY 2021 and FY 2022 the company tripled its revenue and cut its net loss by more than fifty percent, but FY 2023 results saw the posted loss exceed the prior FY 2021 low. FY 2024 results showed improvements in both revenue and reported losses.

Neurotech Financial Performance

Source: ASX 30 January 2025

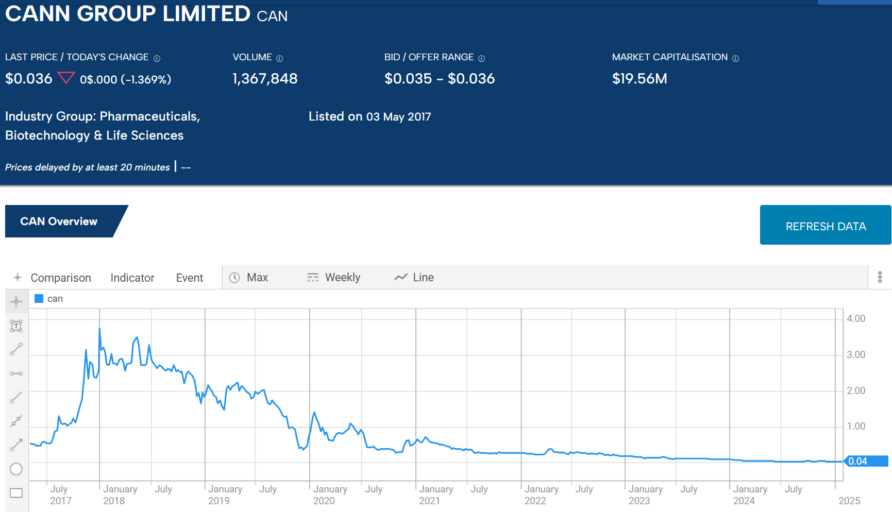

Cann Group (ASX: CAN)

Cann Group has been around since 2014 and was the first cannabis stock on the ASX to get licenses for both the cultivation and growing of cannabis for research purposes and for medical marijuana use.

Cann Group is an agricultural technology company serving the business community with an interest in better breeding through genetic research and improvement. The company has built a “world class” end to end cannabis breeding, cultivation, and production facility at Mildura with its Satipharm CBD sleep capsules in production and in clinical trials.

Satipharm is a technology platform capable of multiple medical marijuana products for multiple markets, in addition to sleep capsules.

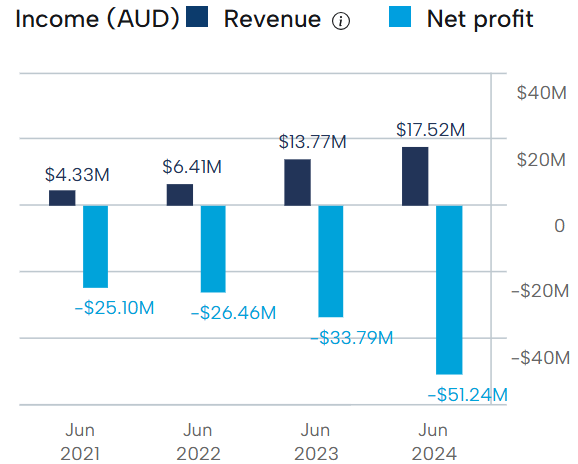

While Cann has revenues moving in the right direction – increasing – profits are going in the opposite direction, with losses also increasing in each of the last four fiscal years.

Cann Group Financials

Source: ASX 30 January 2025

The company listed on the ASX in May of 2017, falling 94.2% since listing.

Source: ASX 30 January 2025

Zelira Therapeutics (ASX: ZLD)

Zelira calls itself a “global biopharmaceutical company” targeting multiple fast growing medical marijuana markets. The company offers clinically validated treatments for insomnia, autism spectrum disorder, and chronic non-cancer related pain by prescription. Over the counter dermatology products are currently available only in the US and oral care products are available in the US and the UK.

Zelira has additional treatments in pre-clinical stages. The company has plans to enter its insomnia treatments into the German, UK, and US markets, along with the autism treatment into Germany and the UK.

On 31 May of 2023, the share price exploded from a previous close of $0.94 to a close of $3.05 on the news results of a head-to-head clinical trial between Zelira”s cannabis-based diabetic nerve treatment drug outperformed Lyrica®, originally developed by Pfizer.

Source: ASX 30 January 2025

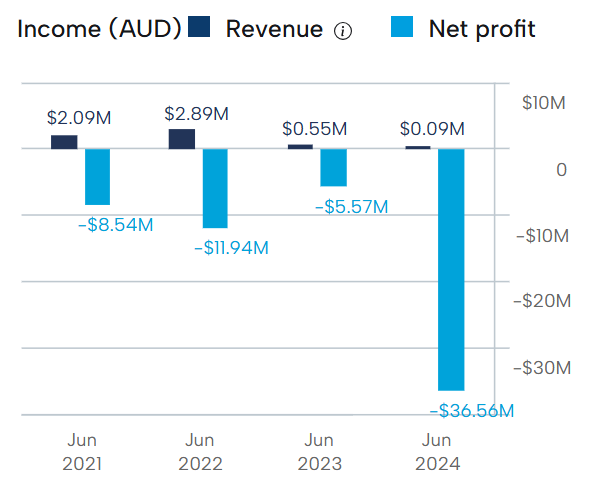

The burst was transitory as the stock fell and fell again in August following disappointing Full Year 2023 Financial Results showing an 88% decline in revenues, but the posted loss improved by 53%. Half Year 2024 results continued the trend with revenues declining 29% and the posted loss reaching a 941% decline. Full Year 2024 results deepened investor gloom as revenues fell and losses increased dramatically.

Zelira Therapeutics Financials

Source: ASX 30 January 2025

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

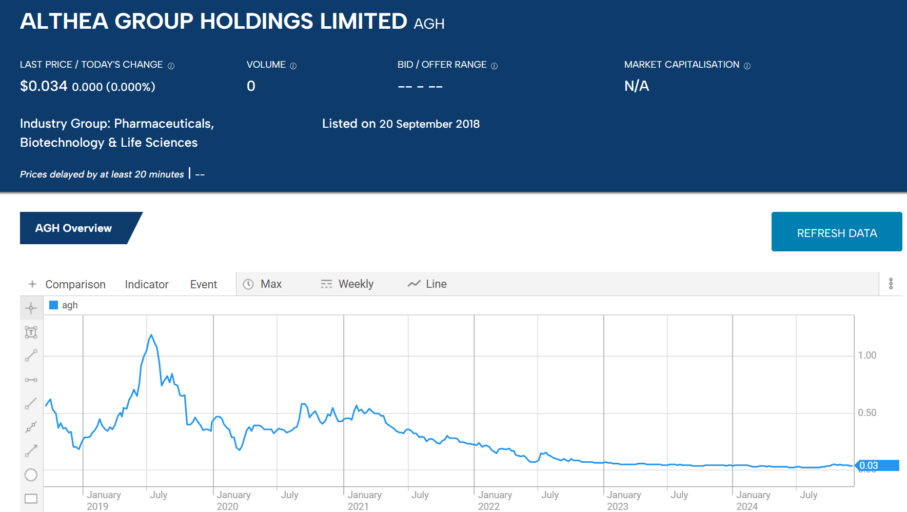

Althea Group Holdings (ASX: AGH)

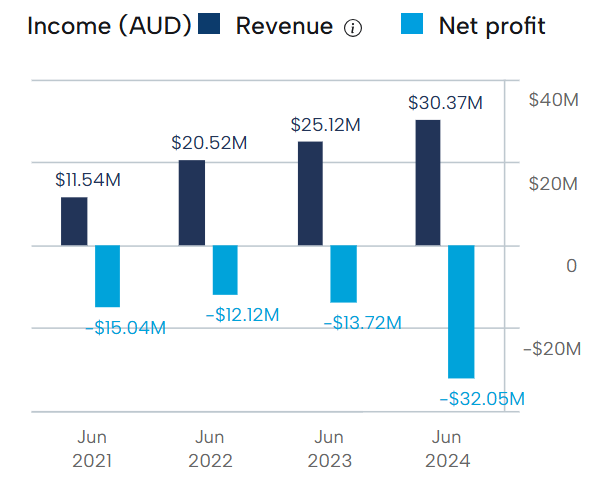

Althea is a marijuana producer and distributor operating internationally. The company produces cannabis both for medical use and for recreational use where legal.

Althea’s full year financial results for FY 2019 through FY 2022 saw substantial increases in revenue while losses remained relatively constant. On 11 April Althea released its quarterly operating activities and cash flow report for the March quarter of 2023. Mixed in with record cash receipts, lowered operating expenses, increased positive cash flow, record results from the company’s medical and recreational operating units, was this – Althea made a profit, referring to the event as its “maiden monthly profit.” The dollar figure was not announced, but Full Year 2023 and 2024 financial results returned to the pattern of rising revenues and increasing losses, with the FY 2023 losses more than doubling in FY 2024.

Althea Group Holdings Financials

Source: ASX 30 January 2025

Althea listed on the ASX in 2018 with the share price declining 93.3% since its first day of trading.

Source: ASX 30 January 2025

Towards the end of the second decade of the twenty first century, investors worldwide eagerly awaited the coming legalisation of recreational marijuana in Canada. Perhaps certain the regulatory change would spread, some analysts and experts began to speculate on the potential size of the market not only for the newcomer in recreational marijuana, but for the existing and spreading use of cannabis for medicinal purposes.

It did not happen overnight, but the shocking truth became evident in a few short years – if cannabis stocks were going to be the “next big thing” investors would have to wait awhile.

There are still solid reasons for optimism in the long term and there are candidates for the best cannabis stocks to buy right here on the ASX The best of breed in speculative, high-risk investments are generally those companies whose cannabis operations include medical marijuana who are increasing revenues and gradually lowering expenses to keep the inevitable losses to a minimum.

FAQs

Where is Cannabis Legal?

More than 40 countries across the world have legalised cannabis fully or partially for medical and /or adult use. Canada is the largest country to fully legalize cannabis. In Australia cannabis was legalized for medical purposes in 2016.

How Do You Invest in Cannabis?

The primary way of investing in cannabis is to buy shares in companies involved in the growing, distribution and research into cannabis. Alternatively you can buy cannabis ETFs which group together several cannabis companies.

How Do You Buy Cannabis Stocks?

Shares in cannabis companies can be bought and sold through any regulated broker. You should research the different types of companies in the cannabis industry and how they operate and do your own research to find out which companies are worth investing in.