Searching for the Best Vanadium Miners on the ASX

Vanadium is not only used in steel but also in aerospace titanium alloys but is its promise for large scale energy storage systems that is attracting multiple exploration companies and investor interest. With a confusing array of acronyms for a battery that could revolutionise large scale energy storage, vanadium is taking center stage, under these monikers – the Vanadium Redux Battery (VRD); the Vanadium Flow Battery (VFP) or the Vanadium Redux Flow Battery (VRFB).

At the present time the VRFB battery presents no competition for the omni-present variations of the lithium-ion batteries powering electronic devices and electric vehicles (EVs). But its scalability and long life make them ideal for replacing lithium in commercial scale energy storage, such as the 2019 installation of lithium powered Tesla Megapacks in South Australia.

The use of VRFB batteries liquid electrolytes as opposed to solid cell construction enables the commercial scale size needed to stabilize energy grids by storing energy generated from wind and solar, eliminating the downside coming from days without wind and sun.

In addition VRFB batteries have a lifespan in excess of twenty years and are free from overheating and other thermal issues associated with lithium-based batteries. Some experts are convinced VRFB batteries will supplant lithium-based batteries for large scale energy storage.

Since vanadium is found in other minerals such as magnetite iron ore and bauxite, ASX giant miners like BHP Group (ASX: BHP) and Rio Tinto (ASX: RIO) could pursue vanadium production, but the mineral’s presence is dwarfed by their predominant revenue generating resources.

Top Australian Brokers

- eToro - Social and copy trading platform - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- Pepperstone - Trading education - Read our review

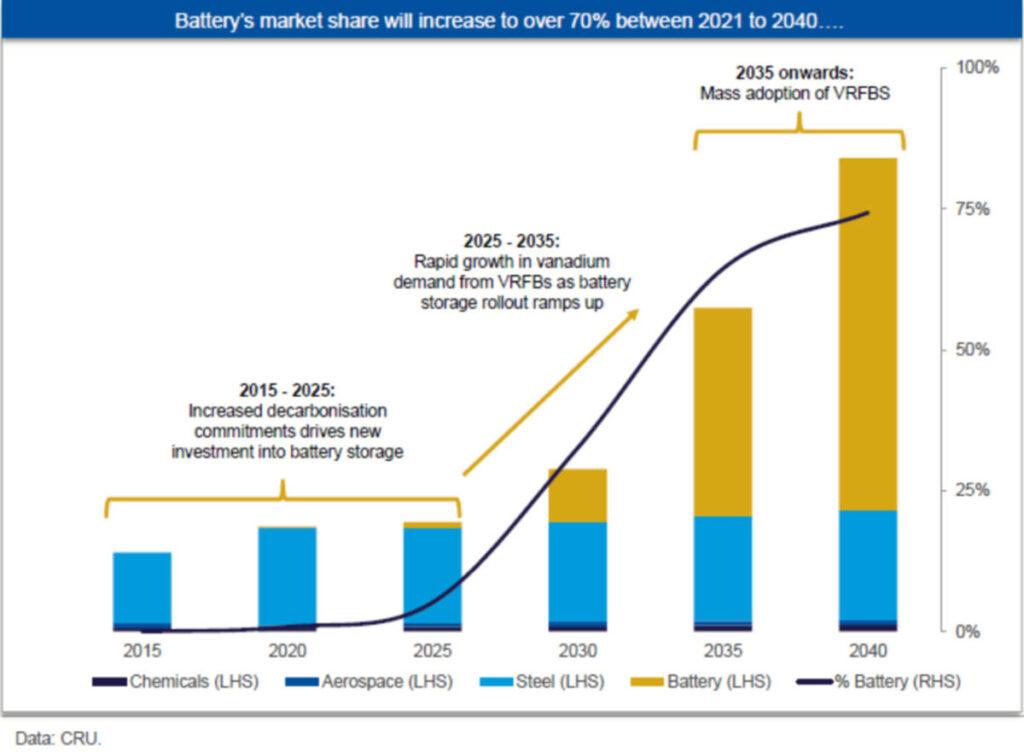

That leaves the most attractive ASX listed companies as those focusing on development of vanadium, with expected demand and the rising price of the mineral driving the stock price of successful vanadium producers. The demand for vanadium for use in steel and aerospace alloys is expected to remain constant to 2040 with dramatic growth in VFRBs. The following graph is from vanadium developer Technology Metals, now merged with Australian Vanadium (AVL) based on data from market intelligence firm CRU Group.

Graphite miner Syrah Resources (ASX: SYR) is an example of a company with the potential to enter vanadium production. As far back as 2014 the company’s flagship asset in Mozambique was referred to as the Balama Graphite and Vanadium Deposit, with positive scoping study results for vanadium from mined graphite tailings. The company made the decision in 2015 to store vanadium bearing graphite concentrate in tailings until the Balama graphite mining was fully operational. Syrah is reportedly considering updating its vanadium resource estimates in 2024.

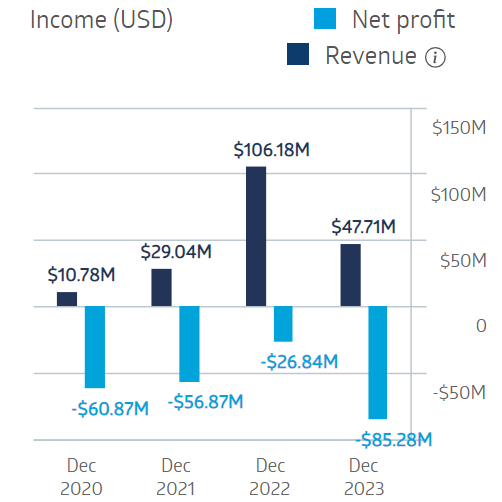

The company has been hemorrhaging money to develop its Vidalia active anode materials (AAM) operation in the US state of Louisiana, with plans for expanding operations which began in the first quarter of 2024. Syrah has an offtake agreement in place for initial production from Vidalia.

The company’s dismal financial performance and position as the third most shorted stock on the ASX has driven down the stock price, year over year by 46.4% and 50.5% as of 21 May of 2024.

Source: ASX

Syrah Resources Financial Performance

Source: ASX

The short sellers are on the opposite side of analyst opinion on Syrah Resources, with marketscreener.com reporting an analyst consensus rating of BUY and the Wall Street Journal reporting an OVERWEIGHT consensus.

Australian Vanadium (ASX: AVL) appears to have vaulted into the pole position as arguably the best vanadium development stock on the ASX. The company has now completed its merger with former rival vanadium developer Technology Metals, adding Technology Metals’ Murchison vanadium asset, directly adjacent to AVL’s asset in Western Australia.

Included with the merger agreement was an institutional placement to fund project integration and future development, creating what management called “the leading ASX listed vanadium developer and a world-class asset of scale located in a Tier-1 mining jurisdiction.”

In 2021 the Australian Federal Government awarded Australian Vanadium a $23.69 million dollar grant for the development of a vanadium electrolyte processing facility, now officially opened. In 2022 the company received another government grant of $49 million dollars for the development of the Australian Vanadium Project, spiking the share price.

Led by lithium, pricing for battery metals commodities has slipped, dragging down the share price of ASX listed vanadium developers. Year over year AVL’s share price is down 54.5% and 10.5% over five years.

Source: ASX

VSUN Energy, a wholly owned subsidiary of Australian Vanadium, was formed in 2016 to begin creating a market for VRFBs as AVL moved closer to production. VSUN now has an agreement with Horizon Power, Western Australia’s regional energy provider, to purchase a third party sourced VRFB for a long-term energy storage pilot. VSUN is also working on a residential version of the VRFB.

Australian Vanadium also is proposing to build the Tenindewa processing facility in Western Australia for vanadium processing.

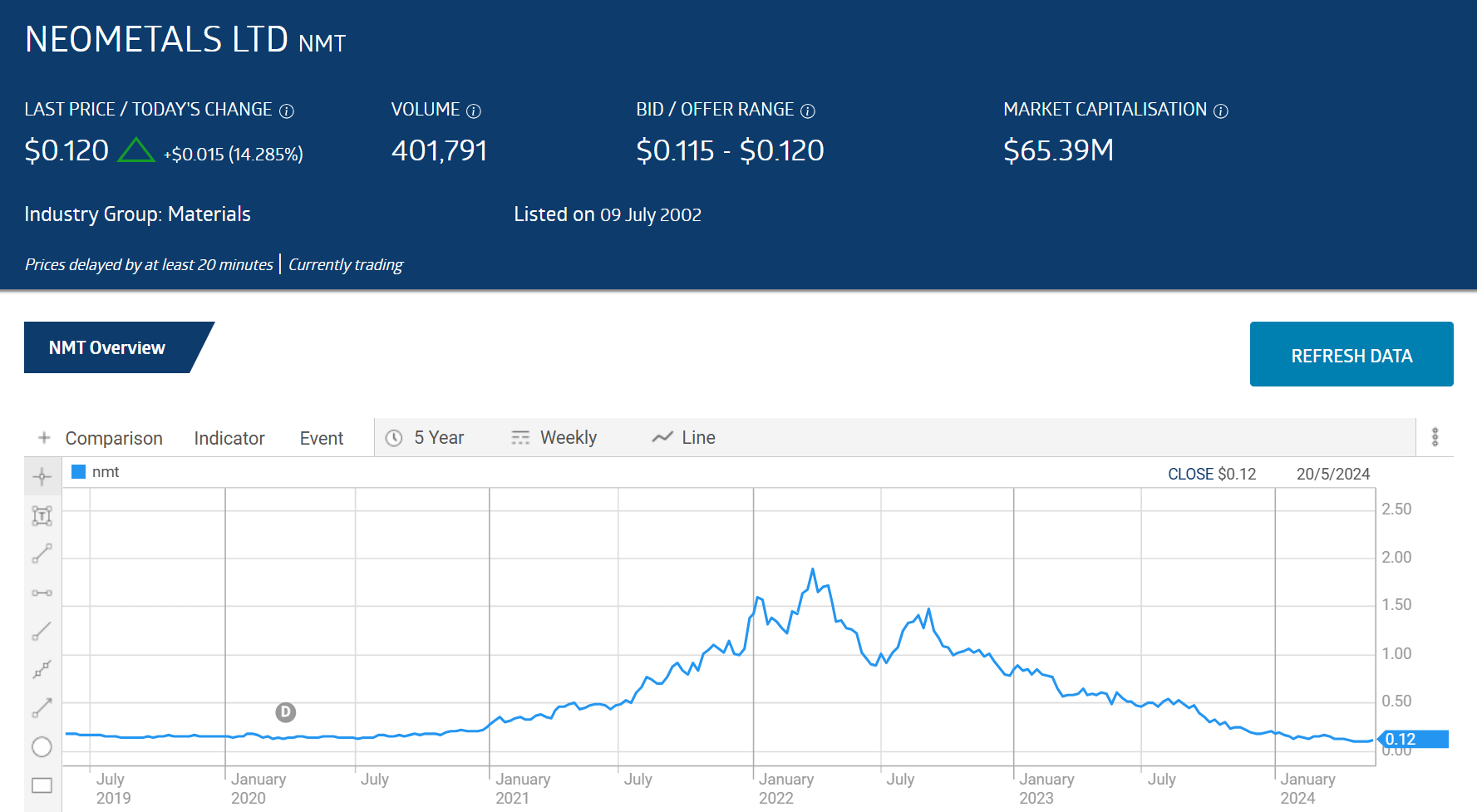

Neometals (ASX: NMT) targets lithium and vanadium with its processing technologies for converting above ground feedstock into usable battery minerals. The Neometals technology for recycling spent lithium-ion batteries is in commercial development, while vanadium recovery is in pre-commercial development, along with the company’s electrolysis processing technology for converting lithium chloride and hard rock feedstock into useable battery chemicals. The company also is the sole owner of the Barrambie Titanium/Vanadium project in Western Australia. Barrambie is large and “mine ready” with Neometals actively seeking partners for further development.

In January of 2023 Australian mining related websites were reporting a potential partnership between Neometals and Australian Vanadium. The companies signed a non-binding term sheet to look for opportunities for Australian Vanadium to buy and process vanadium and iron ore concentrate co-product from Neometals Barrambie project. The two companies are also considering jointly located, shared non-processing infrastructure near the proposed Tenindewa processing facility.

Neometals has a binding offtake agreement with global mining behemoth Glencore for vanadium produced by the Neometals Vanadium Recovery Project.

Investors remain unimpressed as the share price is down 79.9% year over year and 43.9%over five years.

Source: ASX

Listing in December of 2022, Richmond Vanadium Technology (ASX: RVT)’s stock price is up 6.38% since listing but down 34.2% year over year.

Source: ASX

The Queensland site of the company’s Richmond- Julia Creek Project has seen thirty years of prior exploration, mostly for oil. In 1998 exploration showed the presence of oxide vanadium mineralisation. Richmond entered the picture in 2018, with a drilling program at the Lilyvale deposit within the project producing results warranting the company listing on the ASX following a positive pre-feasibility study. A bankable feasibility study is underway with expected completion in the June quarter of 2025 with a final investment decision and regulatory approvals following in the September quarter of 2025.

While early in the development cycle, the Richmond-Julia Creek project has garnered the attention of the Australian government. In early February the Australian Trade and Investment Commission released its Critical Minerals Prospectus, part of the federal Critical Minerals Strategy.

Critical minerals are those deemed essential for the economic future of the country, and/or minerals with vulnerable supply chains. According to the prospectus, Australia boasts 22 commodities ranked in the top five for global economic resources, including cobalt, lithium, manganese, tungsten, and vanadium. The prospectus singles out investment-ready projects for the minerals on the critical minerals list, with fifty-two projects making the list.

Under Vanadium the government highlighted the Australian Vanadium Project along with the Technology Metals Murchison Project and the Richmond-Julia Creek Project.

Vanadium is getting a “new lease on life” moving from its historical use in steel making and aerospace into battery technology. Vanadium is the source of the liquid electrolyte in the vanadium redox flow battery (VFRB), giving the battery the ease of commercial scalability compared to the cellular electrolyte construction in a lithium-ion battery. While the VFRB poses no threat to li-ion batteries in electronics and electric vehicles, its use for large scale energy storage is attracting the attention of analysts and investors alike.