- The big three iron ore producers – BHP, RIO, and Fortescue – are transitioning into more greener metals.

- The outlook for iron ore in 2024 is improving with China’s pledge for more infrastructure spending.

- RIO is opening a new major iron ore operation in Guinea.

In early December 2023, RIO made two announcements to the market showing the company was still growing.

First, RIO reported iron ore reserves for the company’s joint venture Simandou iron ore project in the Republic of Guinea of 1.5 million tonnes of high-grade ore (65.3%) at a mine life of 26 years.

Second, the company expanded its US recycled aluminium business with a joint venture with Matalco, an aluminium recycling company with six operational facilities in the US and Canada.

RIO is spending $800 million dollars to expand its operations at the Kennecott Copper mine in the US state of Utah.

Although the company’s plans for the Jadar Lithium mine in Serbia were halted, RIO is not giving up and has continued to purchase land around the project site. RIO acquired the undeveloped Rincon Lithium brine project in Argentina in March 2022.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

RIO is a dividend champion, with a five-year average dividend payment of $6.88 per share and a five-year average dividend yield of 6.58%. FY 2023’s dividend payment of $5.87 per share was fully franked.

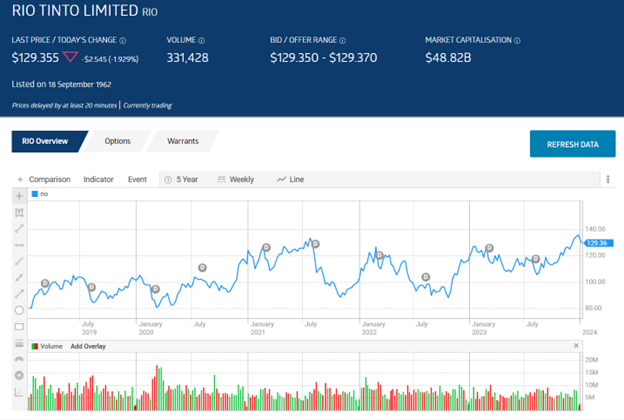

Over five years the share price is up 64.85%.

Source: ASX

Marketscreener.com has RIO at OUTPERFORM, with seven analysts at BUY, five at OUTPERFORM, and seven at HOLD.

Analysts are bullish on RIO, with the Wall Street Journal reporting an OVERWEIGHT rating with seven analysts at BUY, three at OVERWEIGHT, and four at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy