- CSL is benefitting from an ageing global population that needs more medical treatments

- CSL is a leader in research and development in the healthcare sector

One of the greatest investing gurus of all time – Warren Buffet – once remarked his favoured holding period for a stock is “forever.” Aussie investors have a stock worthy of holding forever – CSL Limited (ASX: CSL).

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

CSL is the third largest company listed on the ASX and is a global leader in the production of the kind of healthcare products it offers – blood plasma treatments and influenza vaccines. CSL Behring is the operating division that produces blood plasma treatments, with the company ranked among the top players in its field.

Between 2022 and 2029, the market for blood plasma is expected to reach USD $ 46.88 billion dollars, a compound annual growth rate (CAGR) of 7.1%. In 2022 the market was valued at USD $33.2 billion dollars.

Seqirus is the operating arm that produces influenza vaccines. While the COVID-19 pandemic hurt CSL’s blood plasma segment, the virus heightened awareness of the need for vaccines, with the world governments focusing on flu season vaccinations across the population. In 2022, the global vaccine market stood at USD $7.02 billion. By 2029 it is expected to reach USD $13.58 billion, a CAGR of 8.8%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Since 2018 CSL has had revenue growth each year, from USD $7.5 billion to USD $10.4 billion in 2022, while profit saw slight declines in 2021 and 2022.

CSL makes the grade as a “forever” stock for three reasons. The population in countries worldwide is growing, expanding the customer base for the company. The ageing population in some developed countries suffers from epidemic levels of obesity, adding to the likelihood of health conditions arising.

Finally, CSL invests heavily in research and development (R&D), ensuring a growing pipeline of plasma treatments and vaccines. The company also pursues an acquisition strategy, most recently acquiring Vifor Pharma, a kidney disease treatment provider.

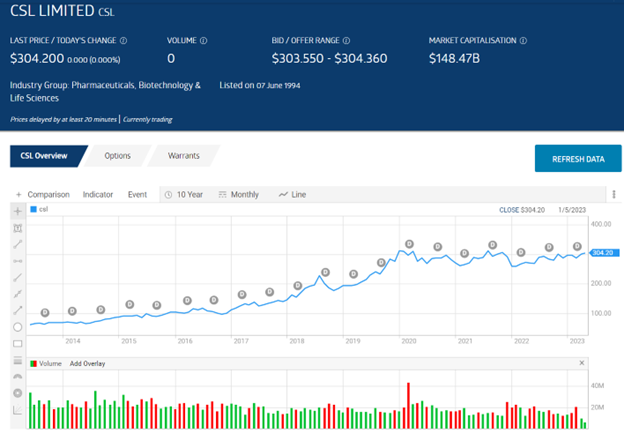

The CSL stock price has risen from $61.58 per share to $304.20 in ten years.

Source: ASX 1/5 2023