- BHP mines multiple minerals, but iron ore is the company’s prime revenue source.

- On 1 January, the price of iron ore hit an eighteen-month high.

- On 3 January, the price of iron ore rose again, but the BHP share price spiralled downward.

BHP is diversified across an array of commodities, with iron ore being its most important, followed by coal, copper, nickel, and potash.

On 1 January, Bloomberg reported a pledge from Chinese President Xi Jinping to strengthen the country’s economy with infrastructure spending and other measures. His statement sent the price of iron ore up to $142.50 per tonne midday before hitting $144.50.

Source: Wall Street Journal

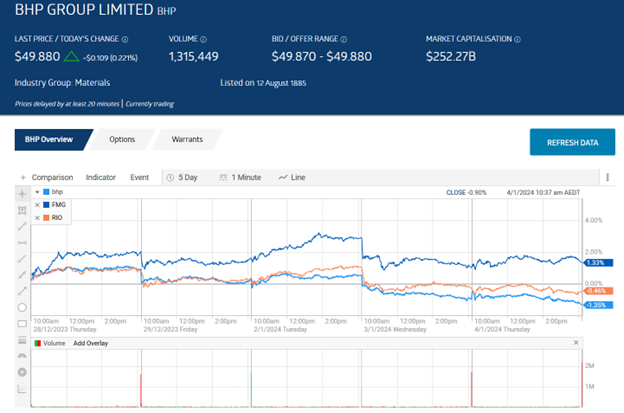

The share price of all three major ASX iron ore producers fell, with some analysts attributing the decline to falling prices for the companies in US markets.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

An analyst at Shaw and Partners is bullish on BHP, predicting growth in Chinese steel production will continue to defy the faltering Chinese economy. The analyst believes a tight iron ore market will keep iron ore prices high and BHP’s outlook bright.

While financial analysis sites like the Wall Street Journal and Marketscreener.com have OVERWEIGHT and OUTPERPERFORM ratings, analysts’ ratings are decidedly mixed.

At the WSJ, ten analysts have BUY ratings, eleven are at HOLD, and three are at UNDERWEIGHT.

Marketscreener.com has four analysts at BUY, two at OUTPERFORM, seven at HOLD, and two at UNDERPERFORM.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy