- Aristocrat Leisure designs and develops electronic gaming equipment and platforms for casino and mobile gaming use.

- At the end of FY 2024, the company had three revenue-generating operating units.

- Aristocrat also offers software for the management of casino operations.

ASX-listed Aristocrat Leisure currently has three revenue generators:

- Aristocrat Gaming – Casino Games

- Pixel United – Mobile Games

- Anaxi – Interactive digital entertainment

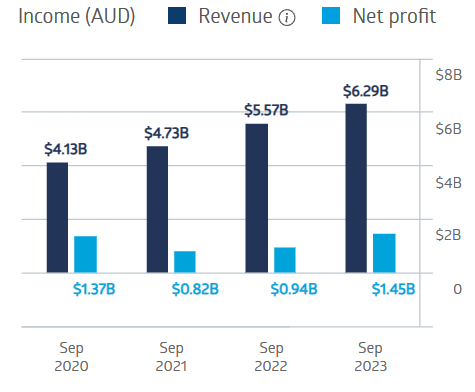

The company’s financial performance over the last four fiscal years is solid but not spectacular. Net profit took a dip in the early COVID years but is now back to pre-pandemic levels, with FY 2023 reported net profit after tax up 53.3% and revenues up 13%.

Aristocrat Leisure Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Aristocrat Leisure is adding a fourth operational unit with the acquisition of NeoGames, a significant player in the growing field of iLottery – online lottery games. NeoGames also offers iGaming and online sports betting. The company was trading on the US NASDAQ exchange with a $927.9 million USD market cap. Aristocrat expects NeoGames to contribute via its net profit in FY 2025.

An analyst at Ord Minnet has a BUY recommendation on Aristocrat Leisure, focusing on the company’s growth trajectory due to the NeoGames acquisition “offering global scale and new distribution channels for the company’s content in the real money games sector.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy