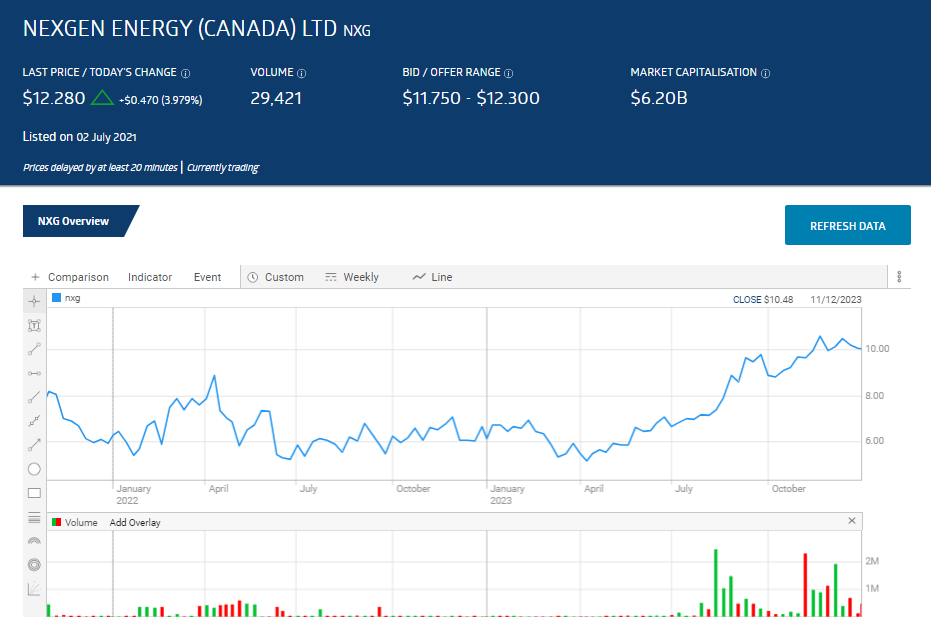

- NextGen listed on the ASX in 2021, with double digit share price appreciation since listing.

- The company is based in western Canada with multiple exploration targets.

- Although focused on the flagship Rook 1 Project, NextGen has exploration drilling and geophysical surveys underway in other targeted projects.

NextGen has a completed Feasibility Study for its wholly owned flagship Rook 1 project in Saskatchewan. The highest uranium price assumption included in the study was $65 per pound. On the third Monday of January 2024 the price of uranium hit $103 per pound, with expectations the price will go higher.

Regulatory approvals moving a mine from concept to o production are a process with a series of approvals linked together. NextGen in November of 2023 passed the first link, getting approval from the Environmental Assessment Act of Saskatchewan to proceed with project development.

An analyst at Medallion Financial Group has a HOLD recommendation on NextGen shares based largely on the low production costs at the company’s flagship asset. Medallion “likes NXG as a higher risk opportunity in the uranium space.”

The larger analyst community is decidedly more bullish, with no analysts reporting on the Wall Street Journal or marketscreener.com with ratings at HOLD or lower.

Marketscreener.com has a BUY consensus rating on NXE, the Canadian and US listing of NextGen Energy, as well as on NXG, the ASX listing for NextGen Energy. Of twelve analysts reporting, seven are at BUY and five are at OUTPERFORM.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The consensus analyst recommendation the Wall Street Journal is reporting is BUY, with ten analysts at BUY, and two at OVERWEIGHT.

The share price is up 97.4% since listing, now trading at an all-time high.

Source: ASX

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy