- Wisetech Global’s Price to Earnings Ratio on 22 June was 110.79, while the average P/E for the ASX 200 was 15.47 in March 2023.

- Excessive valuation leads analysts to suggest that investors take profits.

- Wisetech customers include the top 25 global freight forwarders and 42 of the top 50 third-party global logistics providers.

Wisetech Global is a top ASX growth stock, where higher valuation measures like the P/E are expected and accepted by investors. Many analysts cite “stretched” valuations as justification for slapping a HOLD or SELL recommendation on a stock.

Taking profits now for some investors may be necessary, but doing so creates the possibility of missing out on higher gains in the future.

Wisetech provides logistical software solutions to the supply chain industry, with its flagship product – CargoWise – leading the way. While the COVID-19 Pandemic created havoc with the global supply chain, later accentuated by the war in Ukraine, demand for logistical software solutions remains robust.

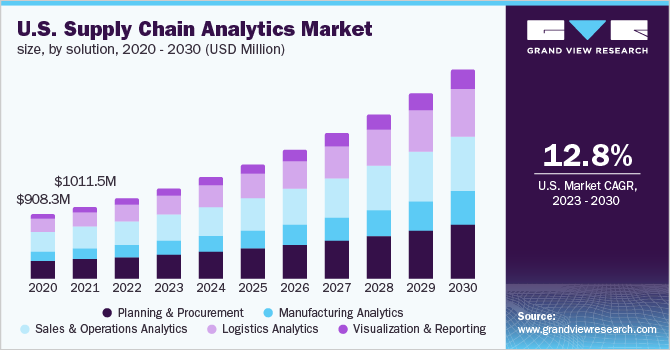

The supply chain encompasses the entire process of producing and distributing products to the market. In the US alone, the CAGR (compound annual growth rate) for the sector is forecast to be 12.8% annually, according to Grandview Research.

Source: Grand View Research

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

MarketWatch cites a report from Reliable Business Insights – The Supply Chain and Logistics Software Market – expects global CAGR to reach 13.6% annually between 2023 and 2030.

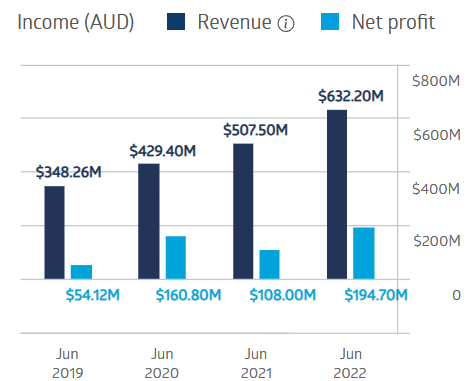

The pandemic hurt the company, but it continued revenue growth and maintained profitability throughout before returning to form in FR 2022.

WiseTech Global Financial Performance

Source: ASX

Half Year 2023 Results had revenues up 35% and profit up 40%. Year over year, the share price is up 119.99%.