- COVID Lockdowns crushed Q4 of FY 2020 for parking management software innovator Smart Parking.

- The company has rebounded, posting revenue and profit growth in FY 2022 and 2023.

- Smart Parking operates in Australia, New Zealand, the UK, and Germany.

Smart Parking applies innovative technology to manage a problem that many drivers experience on a regular basis. Unfortunately, the company ranked with travel and leisure stocks being seriously affected by the COVID lockdowns and the stay-at-home conditions imposed by governments.

The company’s principal business – parking management services – uses its software-supported camera design system – ANPR (automatic plate recognition) – for monitoring parking in business and corporate car parks.

Smart Parking offers a range of additional services, including car park monitoring systems and “park and pay” technology for consumers.

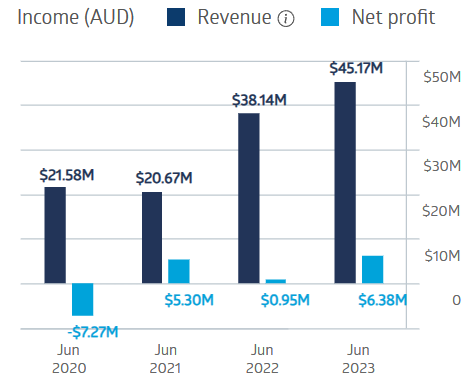

Although revenues dipped slightly between FY 2020 and FY 2021, the loss of more than seven million dollars in FY 2020 was erased in FY 2021 by a net profit of $5.3 million.

Smart Parking Financial Performance

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

FY 2023 results yielded record revenues and a 565% increase in net profit after tax.

Over five years, the share price is up 89.4% and 50% year over year, yet the 90-day average trading volume is 114.96 thousand shares.

In contrast, Webcentral Limited (ASX: ACG), a software company with a one-hundred-million-dollar market cap, has a 90-day shares average trading volume of 688.3 thousand shares.

An analyst at Marcus Today has a BUY recommendation on SPZ, one of the highlights of FY 2023 for the company – a 33% increase in parking sites under management, further stating the “company is poised for further growth despite potential regulatory risk.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy