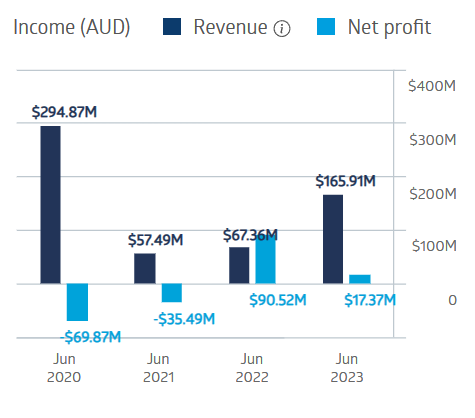

- The COVID-19 pandemic devastated stocks in the travel and leisure sector.

- Helloworld Travel posted three consecutive years of losses before returning to profitability in FY 2023

- The company’s latest financial release points to high demand for leisure and travel in Australia and New Zealand.

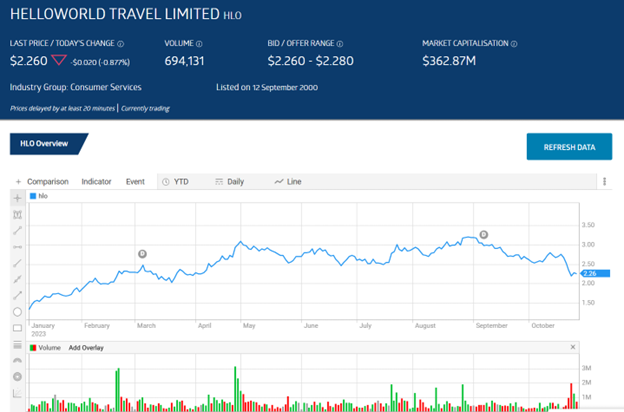

Investors eager to get in on the travel sector recovery’s impact on beaten-down Helloworld Travel have driven the stock price up 68.6% year to date, following a crushing collapse of 61.9% over five years.

Full Year 2023 financials saw the company return to profitability, moving up from a FY 2022 loss from continuing operations of $28.8m to a profit of $19.2m.

The company indicated that it expected to continue growing.

The FY 2022 profit of $90.5m was statutory profit, including discontinued operations – the company sold its corporate travel management services in FY 2022.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Helloworld Travel Financial Performance

A positive trading update on 22nd October was not enough to stop the company’s 21.8% drop over the last three months.

The update highlighted a 67% rise in revenue for the quarter compared to the previous year, and underlying EBITDA (earnings before interest, taxes, depreciation and amortisation) up from $5.5m to $16.8m, which may have fallen short of expectations.

An analyst at Red Leaf Securities has a SELL recommendation on Helloworld shares, advising investors to consider taking some profits as consumers may tighten their travel budgets due to the rising cost of living and interest rates.

An analyst at Elvest points to pent-up demand “as a powerful trend that will likely continue through 2024 and 2025”.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy