- Gold Road’s Half Year Financial Results reported on 28th August ignited an upward trend in the share price.

- The company also benefits from the Middle East and Ukraine conflicts.

- Gold Road has an impressive list of 100% owned exploration assets.

Gold Road Resources is a 50% joint venture partner in the world-class Gruyere gold mine in Western Australia. The company’s Half Year 2023 Financial Results were impressive, with a 32.5% gain in revenue, a 15.8% increase in net profit, and a rise in its dividend payment to $0.02 per share. Coupled with the company’s latest positive September Quarterly Report, the stock price over the last three months is up 14.51%, intraday on 23rd November.

Source: ASX

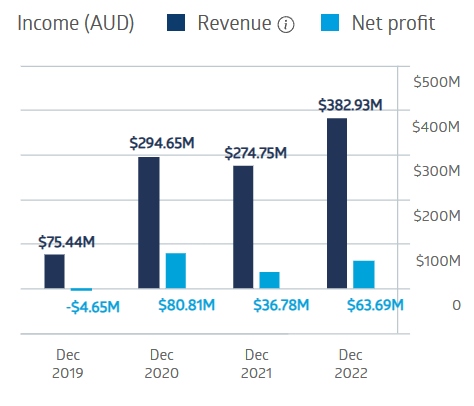

With only its JV operation producing revenue, the company has managed to maintain an admirable financial performance record from FY 2019 to FY 2022.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Gold Road Resources Financial Performance

Source: ASX

Gold Road has an impressive exploration asset portfolio in Western Australia, Queensland, and South Australia, with five development projects 100% owned by Gold Road and another two in JV status.

An analyst at Fat Prophets has a BUY recommendation on Gold Road Resources, calling the company’s September Quarterly Report “impressive.”

Other analysts have a consensus OUTPERFORM rating on the stock, with seven analysts at BUY, one at OUTPERFORM, two at UNDERPERFORM, and one at SELL.

The Wall Street Journal has an OVERWEIGHT rating, with eight analysts at BUY, three at HOLD, one at UNDERWEIGHT, and two at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy