On 2 June, the Minerals Council of Australia released its Commodity Demand Outlook 2030 report, stating that Australia is in a strong position for future success by meeting growing global demand for commodities to power growth, energy generation and decarbonisation.

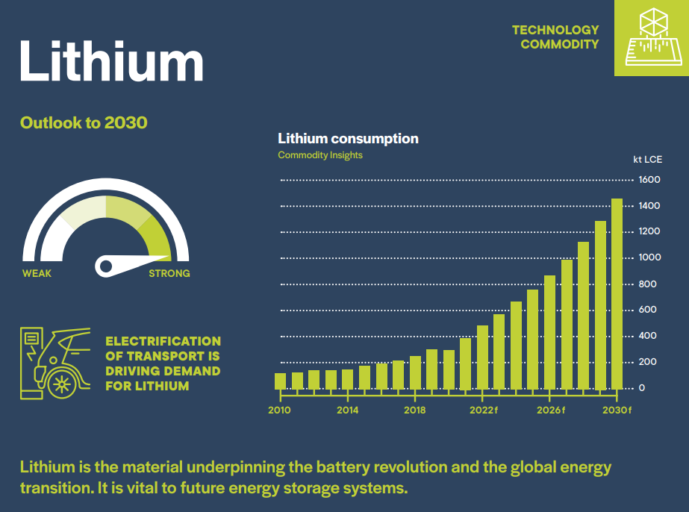

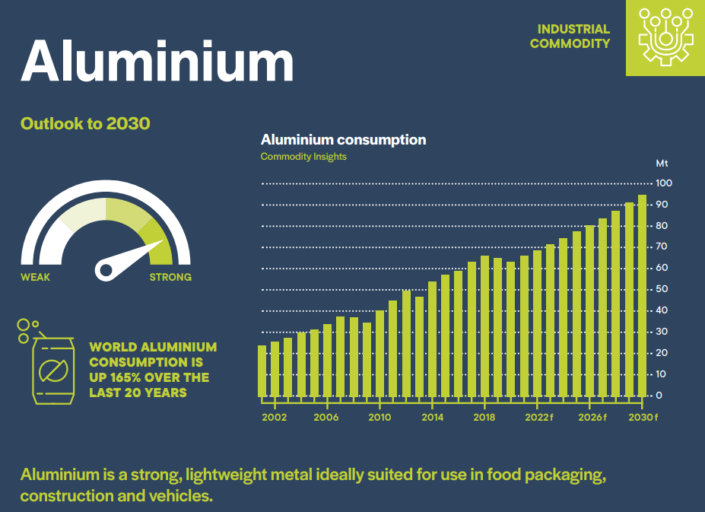

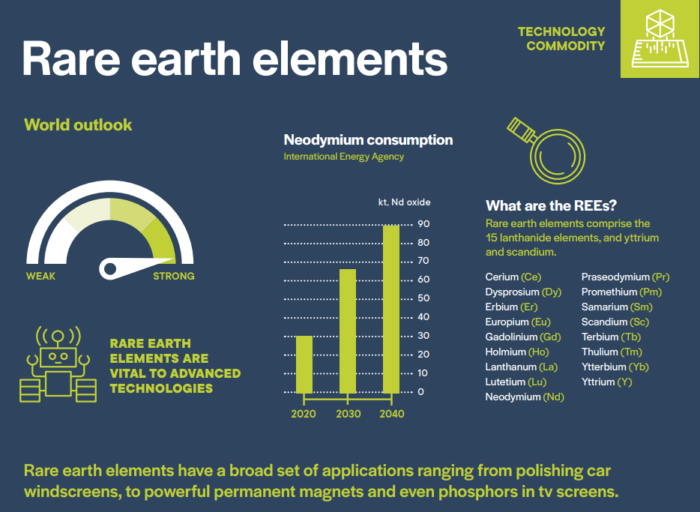

The report predicts moderate to steady growth in the demand for iron ore, metallurgical and thermal coal, copper, nickel, and zinc, with the most explosive growth coming from lithium followed by aluminum and rare earth minerals. The following pictographs are from the report:

Top Australian Brokers

- eToro - Social and copy trading platform - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- Pepperstone - Trading education - Read our review

Long time investors in the resources sector well remember the extreme volatility of commodity prices as the balance between supply and demand bounces up and down. The once red-hot investor demand for lithium miners faded away as the balance tipped in the direction of oversupply.

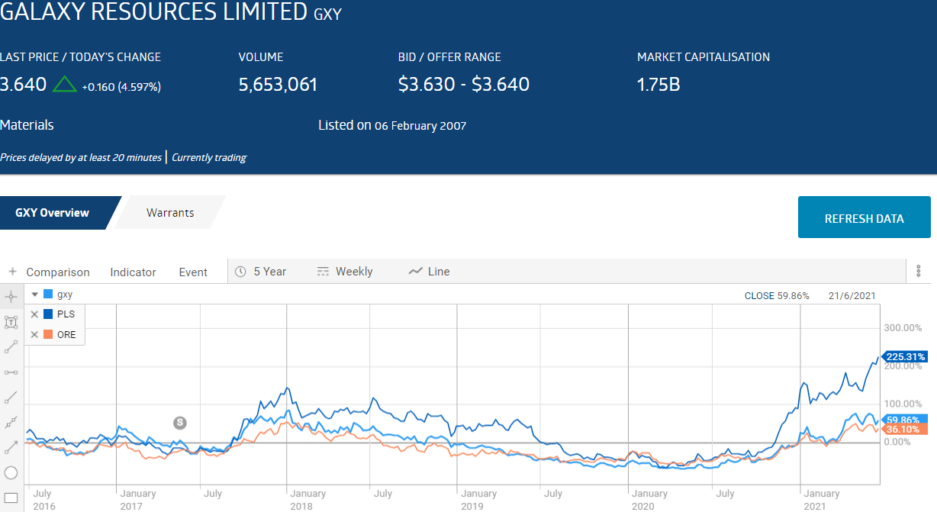

The following price performance charts from the ASX website shows the five year performance of three of the biggest lithium miners on the ASX – Galaxy Resources (GXY), Orocobre Limited (ORE), and Pilbara Minerals (PLS):

Galaxy and Orocobre have a merger in progress.

The next chart tracks the year over year performance of the hottest lithium miners right now. Piedmont Lithium (PLL), Sayona Mining (SYA), and Lake Resources (LKE) all have year over year share price gains of over 800%.

The upside reward in investing in a best of breed miner in a commodity in strong demand is substantial, but so is the downside risk.

For the risk averse, investing in the companies that provide needed services to multiple miners working in multiple commodities is an option.

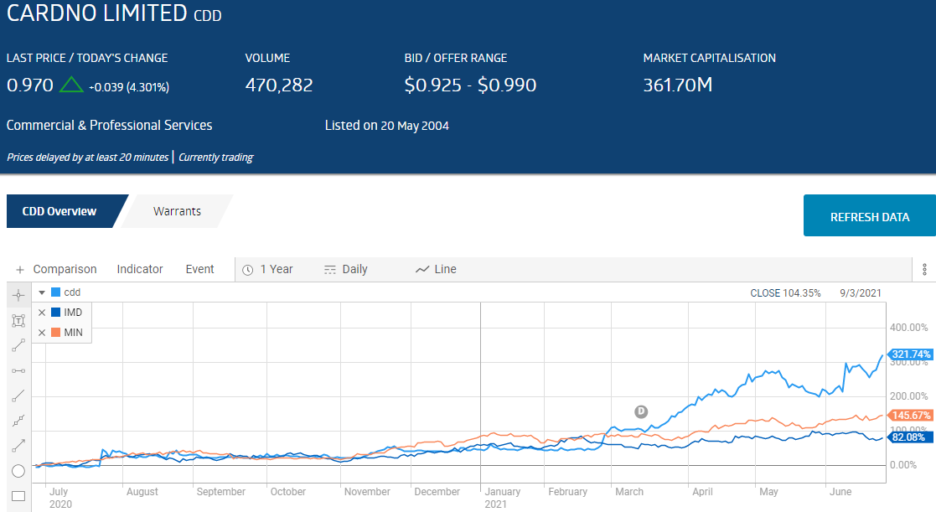

Aussie investors are expressing a clear preference for the miners, as the majority of mining service provider stocks are generating moderate interest at best, with three exceptions. Cardno Limited (CDD), Mineral Resources (MIN), and Imdex Limited (IMD) have all logged significant share price gains year over year.

Portfolio diversification is a time-honored strategy to reduce risk. In some cases, a single stock with a diversified business model provides some protection.

Mineral Resources is a clear choice for the risk averse as not only does the company operate in the mining services sector, but also has mining operations in both iron ore and lithium.

Mineral Resources operates four subsidiary companies that together offer a full range of “pit to port” production, processing, and logistics services. Mineral Resources and its subsidiaries offer the full suite of pit-to-port mining and mining logistics services – including “exploration, planning, mine design and construction, the construction and operation of minerals process facilities, commodity transportation and marketing services.”

Mineral Resources sees its core business as commodities, making a long-term commitment to develop its lithium mining properties. The company claims its hard rock lithium mine at Wodgina is the “largest hard rock lithium mine in the world.” The operation is a Joint Venture with US based provider of lithium for batteries, Albermerle. Wodgina was placed in care and maintenance when the price of lithium faded with a return to production status expected soon.

Mineral Resources also has a 50/50 JV with Jiangxi Ganfeng Lithium Co. Ltd, one of the world’s largest lithium producers, at Mt Marion, reportedly holding the second biggest spodumene (high grade lithium concentrate) reserves in the world.

The company is expanding its production capacity for iron ore from 20 million tonnes per annum (mtpa) to 90 million mtpa over the next three to five years, with demand for iron ore increasing slightly.

Mineral Resources reported solid Half Year 2021 Financial Results on 10 February, posting revenues of $1.5 billion (up 55%) and underlying net profit after tax (NPAT) of $430 million (up 233%). The company’s historical performance record is stellar, with average earnings growth over 5 years of 138% and 24.5% over ten years. Dividend growth averaged 34.8% over 5 years and 10.8% over ten years.

Mineral Resources has a low P/E (price to earnings) ratio of 8.35 while the average P/E for the materials sector is 16.22. Current dividend yield is 3.7%, fully franked. The current share price is $50.73 per share with a 52 week high of $51.50 and a 52 week low of $20.42.

Cardno got a big share price boost from the company announcement it was conducting a “strategic review” of its operations, spurred on by “a number of unsolicited approaches from interested parties.” Here is the full statement released by the company.

- Following receipt of a number of unsolicited approaches from interested parties, the Board of Cardno Limited (ASX:CDD) (Cardno) has decided to commence a strategic review process with the objective of maximising Cardno shareholder value. This process will involve an assessment of Cardno’s strategic options and the alternative strategies available to unlock and enhance value for Cardno shareholders. There are no assurances that the Board will decide to pursue, nor that any transaction or transactions will result from, this review. Crescent Capital Partners, Cardno’s largest shareholder, has advised the Cardno Board that it is supportive of Cardno conducting the strategic review.

Although the company does offer services to the mining sector, it operates more as an international infrastructure and environmental services company

Cardno had already gone through somewhat of a rebirth over the last four years, returning to its roots as a multi-disciplinary, scientific, engineering and development consulting firm. According to the company, its present strategic focus is on assisting its clients with their environmental, social, and governance (ESG) needs.

Services provided by Cardno are grouped into infrastructure and environment, offered to companies in defense, energy, government, industrial, international development, land management, utilities, water, transportation, property and buildings, and mining and resources.

The mining services offered as listed on the Cardno website are:

- automation, coastal, control systems, environmental and social management, geology, geotechnical, impact mitigation, mine engineering, mine governance, mine water management, mine closure planning, mining and resources infrastructure, ocean and ports, power systems, surveying, and waste and sustainability.

The company posted successive losses in FY 2018 and FY 2019 before returning to profitability in FY 2020, with net profit after tax of $56.6 million dollars. However, the profit was the result of operations now discontinued. The NPAT for continuing operations was a loss of $67.1 million.

Cardno’s current share price is $0.97 per share with a 52 week high of $1.02 and a 52 week low of $0.20.

Imdex labels itself as a mining technology company. The company’s specialty is beneath the surface instrumentation that improves both productivity of drilling operations and extraction of minerals.

The company’s business is more exploration than production dependent, which bodes well for the ramp up of mining demand for minerals needed for the future of Electric Vehicles and other new technological developments.

Imdex drilling technology includes cloud-connected sensors to provide the kind of geologic data needed for better mining decision making. The company’s product lines spans the entire mining process, from exploration and production drilling to the processing operations.

Imdex software allows subsurface visualisation and interpretation of geologic data. Testing and analysis can be done onsite. The company also offers IMDEX MOBILE™, an application that allows paperless daily drilling and safety reports, pre starts, and survey information

The company’s footprint extends across the world, working in mining regions in more than 100 countries in the Asia Pacific Region, Europe., Africa, and the Americas. The current share price is $1.93 per share with a 52 week high of $1.02 and a 52 week low of $0.20.

Three newcomers will be listing on the ASX in July and August.

Perth based DRA Global is the largest and the most broadly diversified. In business for more than thirty years. The company offers its clients in the resources sector services ranging from project development to plant optimisation, operations, maintenance, infrastructure, water and energy management, and other industrial services.

The company spans the globe with 20 offices with project engineering and operations management services available. DRA Global’s website lists multiple mining and minerals processing projects underway with miners from gold to diamonds to platinum to rare earth minerals and more.

DRA Global generates about $1 billion dollars annually, making it a rare find amongst ASX IPOs, with many in the pre-revenue stage. The company is profitable, although the pandemic dampened FY 2020 revenues and profit. Revenues for the year fell from $1.03 billion dollars in FY 2019 to $938 million while profit from underlying operations dropped from $48 million dollars to $44 million.

The company is expected to list on 9 July with an issue price of $3.95, raising $20 million dollars in capital.

Aerison is another Perth based multi-disciplinary engineering design, construction, and maintenance services provider. Like DRA Global, Aerison boasts of more than three decades of experience.

The company also has a history of revenue and earnings generation. In FY 2020, Aerison’s revenue came in at $100.5 million dollars, a 26% increase over FY 2019 revenues. Earnings before interest, taxes, depreciation, and amortisation (EBITDA) was $10.5 million and the company’s forecast for FY2021 calls for revenues of $130 million dollars and pro forma EBITDA of $12,5 million and NPAT of $6.4 million.

Aquirian is more of a traditional mining services provider, with two operating divisions serving Australian customers – the Mining Services Division and the People Services Division.

Within the Mining Services division TBS Mining Solutions provides consumable products, blasting products and lease equipment.

Maglok Australia provides innovative storage solutions for explosive materials and dangerous goods to mining, defence and law enforcement customers here in Australia and in New Zealand.

Within the People Services Division, TBS Workforce offers personnel resourcing solutions, including permanent placements, casual workforce, and contracted workers.

Modular Training is a registered training organisation offering drill & blast training in a variety of formats and locations, including inhouse.

The company is relatively new but is already posting impressive revenues and profit numbers. Revenues grew from $7.8 million dollars in FY 2019 to $11 million in FY 2020 while NPAT rose from $474 thousand to $1.07 million.

The company will list on the ASX on 3 August with an issue price of $0.20. The expected capital raise of $8 million dollars will go towards expanding the company’s storage business and further development of Aquirian’s patent-pending Collar Keeper® System, a solution for stabilising blastholes cuttings, collars, and columns.