Conventional wisdom suggests in the face of crippling inflation and rising interest rates consumers will curtail their spending.

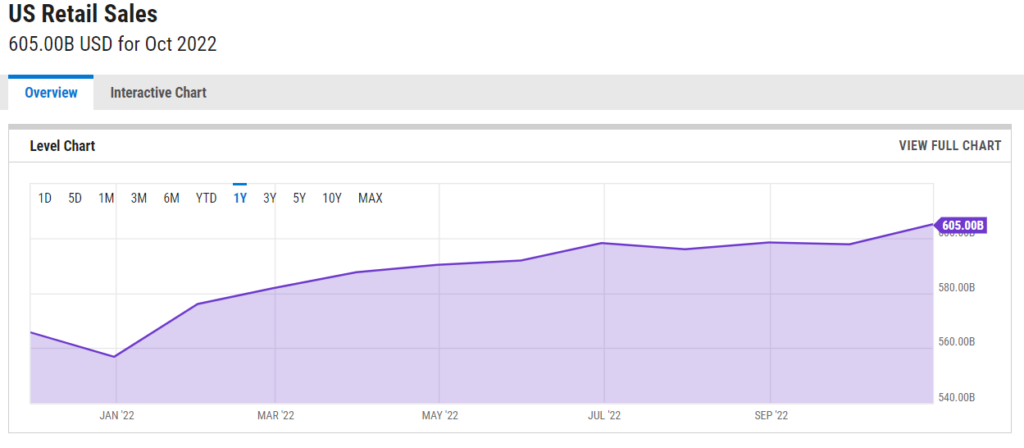

In the all-important US markets, conventional wisdom appears to be dead wrong. From the US website ycharts.com:

July and September were the only months year to date where US consumers decreased their spending slightly. By October consumer spending posted its strongest increase in eight months, up 1.3% from September spending.

Retail sales in the US should be of concern to all Aussie investors since the US economy impacts our stock markets and global markets as well.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Investors who check what is in store for the ASX on a daily basis are familiar with the “lead” from the previous day’s close of trading in the US.

Unlike the Australian economy, which depends heavily on resource exports, the US economy is driven by consumer spending. The US Federal Reserve Bank estimates consumer spending accounts for 67.6% of that country’s economy.

In 2020 US exports of goods and services accounted for 10.13% of the US economy. In 2021 here in Australia trade exports represented 40.2% of Australian gross domestic product (GDP).

Consumer spending here is a factor in our economy and is credited with the economic burst as the COVID 19 Pandemic began to fade and lockdowns began to dwindle. From 1959 to June of 2022 the average quarterly contribution of private spending to Australia’s GDP averaged 56.6%.

In October consumer spending here took a surprise dip of 0.2% month over month, the first decline in 2022. Analysts had forecasted an increase of 0.5%. From the Australian Bureau of Statistics (ABS) website:

The troika of the Australian Retailers Association (ARA), Roy Morgan, and Salesforce estimates Australians will spend $63.9 billion dollars between 14 November and 24 December, an increase of 3% over the holiday period in 2021.

It is not surprising retail stocks have yet to fully recover from the COVID 19 Pandemic woes with the additional bricks of inflation, rising interest rates, and a potential recession contributing to the “wall of worry.”

In time, solid retailers should recover. Right now there are at least four retailers of interest on the ASX. All have bargain basement price to earnings (P/E) and price to sales (P/S) ratios, healthy trailing and forward dividend payments, and beaten down share prices.

Leading the list are ASX 200 electronics retailers Harvey Norman (HVN) and JB Hi-Fi (JBH). The remaining two are homewares and home furnishings retailer Adairs Limited (ADH) and home fragrance products retailer Dusk Group Limited (DSK).

The following table includes share price performance, valuation, and dividend yield metrics for the four retailers.

|

Company (CODE) Market Cap |

Share Price |

52 Week High Low |

Price to Earnings (P/E) Price to Sales (P/S) |

%Change Year over Year Year to Date |

Dividend Yield Trailing Forward |

|

Harvey Norman (HVN) $5.38B |

$4.32 |

$5.74 $3.53 |

6.64 1.30 |

-13.7% -12.5% |

8.68% 8.10% |

|

JB HiFi (JBH) $4.9B |

$44.97 |

$56.85 $36.39 |

9.41 0.56 |

-5.27% -6.93% |

7.03% 7.03% |

|

Adairs (ADH) $390.4M |

$2.28 |

$4.11 1.65 |

8.88 0.71 |

-35.2% -43.1% |

7.89% 8.77% |

|

Dusk Limited (DSK) 117M |

$1.88 |

$3.29 $1.55 |

6.58 0.88 |

-32.6% -41% |

10.64% 10.64% |

Trailing Dividend yield represents dividend history over the prior twelve months while forward dividend yield represents predictable, expected dividends over the next twelve months.

While the P/E ratio is the metric of choice for many bargain hunting investors, the P/S ratio is preferred by others, since growth companies and companies experiencing temporary setbacks will not have a P/E.

Harvey Norman is an omni-channel retailer, with wholly owned company stores, stores with majority Harvey Norman ownership, franchise stores, and online sales.

The company sells computers and electrical goods, furniture, bedding, flooring, bathroom products and major and small kitchen appliances.

In Australia the company has 195 franchise stores under the Harvey Norman, Domayne, and Joyce mane brands. The company owns and operates 109 stores in Australia, New Zealand, Croatia, Slovenia Ireland, Northern Ireland, and Malaysia.

The Malaysian stores were a top performer for the company in the first quarter of FY 2023, with sales there up 38.4%. Total sales revenue for franchise operations as a whole were up 9%. Harvey Norman hopes to expand its store count in Malaysia from the current twenty eight stores to eighty stores by 2028. Global sales revenue for the quarter was up 6.9%.

The company’s FY 2022 Full Year Financial Results slipped from a solid year in FY 2021, attributed to COVID 19 related lockdowns.

Investors who favor insider buying as a metric for investing should know over the last twelve months Harvey Norman insiders bought AUD$6.7 million dollars worth of stock. There are many reasons insiders choose to sell their holdings, but only one for buying more – they are bullish on the company’s future.

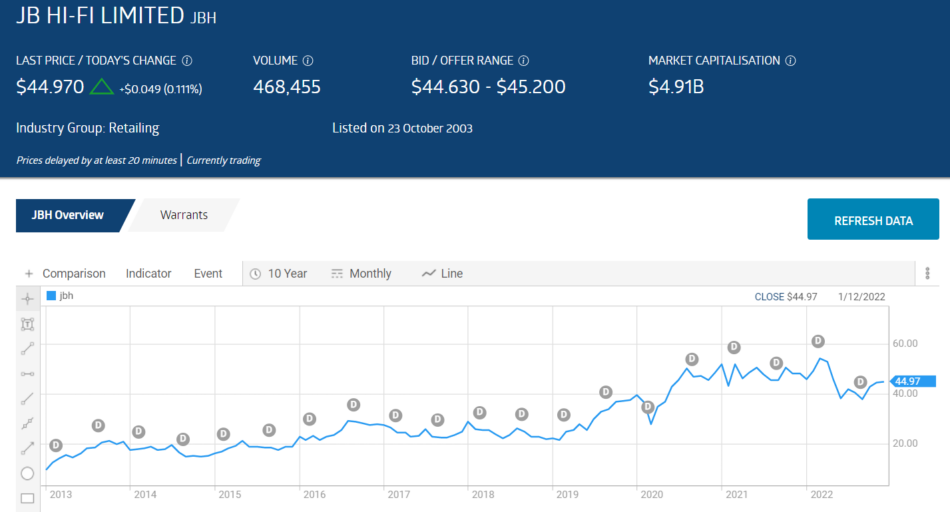

Over the last decade JB Hi-Fi has bounced back and forth on the ASX Top Ten Short List as short sellers questioned the company’s business model. It began when the JB Hi-Fi’s low price business model faced intense competition from offshore online retailers who could offer cheaper goods. The short sellers smelled blood from price wars and dramatically lower margins. JB figured out how to remain competitive and shocked the shorts by expanding its business from home entertainment electronics to include white goods and appliances. Once again, the short sellers anticipated trouble ahead, and once again, they were wrong.

In the last decade, the company’s stock price is up 340% paying dividends consistently over that period. Over the same period Harvey Norman is up 154%, also with consistent dividend payments.

JB Hi Fi now has 319 electronics retail outlets across Australia and New Zealand with a robust online presence. In 2016 the company added The Good Guys, a complementary business. JB also counts commercial, insurance, and education sector organisations among its customers, offering consulting and information technology services under is JB Hi-Fi Solutions business operation.

Some analysts see JB as one of Australia’s best run retailers, with the company anticipating instead of following consumer trends over the more than two decades the company has been in business.

As a measure of how pessimistic investors are towards the retail sector, JB reported record Full Year 2022 Financial Results on 15 August. The company cited strong consumer demand driving total sales to a record high of $9.23 billion dollars, up 3.5%. Online sales of $1.63 billion dollars were up 52.8% and NPAT (net profit after tax) rose 7.7% to a record $545 million dollars – and the share price dropped, not recovering until the beginning of October.

On 26 October JB released sales figures for the first quarter of 2023, and they were up across the board. Total sales growth for JB Hi-Fi Australia was up 14.6% while New Zealand Sales were up 27.7% and the total sales growth for The Good Guys were up 12.3%. All three operations posted negative sales growth for the first quarter of FY2022.

Adairs sells homewares and home furnishings here in Australia and in New Zealand., through more than 170 stores across Australia and New Zealand and a growing online presence. The product lines the company offers is massive – over 4,000 on the company’s website – with everything from bedding to beds to towels to furniture and laundry and a variety of home care products. The company sells through three brands – Adairs, Mocka, and Focus Furniture, a recent acquisition.

On 24 January the company issued a trading update on the unaudited Half Year 2022 Financial Results – warning that group sales declined one million dollars and earnings before interest (EBIT) reduced by half, mostly as a result of store closures, coupled with supply chain issues. The stock price fell twenty percent in early trading.

The company is expanding its brick and mortar presence, with online only Mocka set to adopt omni-channel operations and an anticipated expansion of Focus Furniture’s twenty three existing stores to between fifty and sixty.

Investors who put faith in analyst recommendations should be heartened by Goldman Sach’s BUY rating and $2.65 price target on Adairs.

The company’s Full Year 2022 Financial Results both encouraged and disappointed investors. Revenues of $564.5 million dollars set a company record but profit dropped 29% and EBIT fell 30%. Online sales also established a record.

Management remains bullish, looking to achieve $1 billion dollars in sales within 5 years, with the Adairs Linen Lovers Loyalty program leading the way. Linen Lovers account for close to 80% of the company’s current sales.

Dusk Group is a relative newcomer to the ASX, listing on 2 November of 2020 and remaining well under the radar screen of most investors, with a thirty day average trading volume of only 134.7k shares per day.

The share price got a boost when the company issued a trading update on 29 December with upward guidance for the first half of FY2021, with sales expected to rise from $58.7 million dollars for the first half of FY2020 to between $90 and 90.5 million dollars, and EBIT to increase from FY2020’s $9.7 million to between $26 and $27 million.

Full Year 2021 Financial Results delivered, with a 47.4% revenue increase and a 130.2% profit increase.

The company issued a trading update for less than stellar Full Year 2022 Financial Results and once again the company delivered. Store closures drove sales down 6.9% and NPAT fell 31%, but investors appear to have focused on the online sales growth of 2.9%, improvements in the online platform, and the addition of 10 new stores, bringing the total to 132 stores. The share price went up.

The company is an omni-channel operator, selling a broad array of home fragrance products from candles to diffusers to home fragrances to essential oils. Dusk also offers homewares and holiday gifts. Some fund managers like he company’s high quality product line and competitive pricing.

Risk tolerant investors have to gauge whether the possibility of a recession could have any worse impact on these beaten down retailers than did the lockdowns and store closures.