The 2022 Trading Year mercifully faded into history, but the damage done to a wide array of stocks in exchanges around the world will be slow to erase.

Here in Australia, technology stocks followed the lead from the US with crushing results. High interest rates are not kind to tech stocks so the drastic drops should have come as no surprise to most investors.

Rising interest rates are seen by central banks as the key to taming the second factor impacting the tech sector – inflation.

The third is the uncertainty surrounding the Chinese economy in the light of that country’s deeper plunge into COVID infections.

While inflation in the US has tamed a bit, investors remain unsure of how much further the US Federal Reserve Bank will go with their aggressive rate hiking. The US Department of Labor reported a decline in the annual inflation rate from November’s reading of 7.1% to 6.5%. On a monthly basis that represents a decrease of 0.1%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Economic measures in the US remain robust, despite multiple analysts and economists predicting a recession in 2023. Despite this, it appears the market community is betting on the US rate hike rampage to slow to a 0.25% increase in February with the final increase coming in March.

History suggests to any investor willing to listen that quality companies with products or services remaining in or returning to demand can recover over time. Doubting investors have only to research stocks that collapsed in the GFC (Great Financial Crisis) and in the purported “death of the mining boom” here in Australia.

Investing in tech stocks right now remains the province of risk tolerant investors with the time and temperament to research stocks and avoid the stampeding herd.

On 12 December of 2022, the AFR (Australian Financial Review) reported the results of a survey of eleven of Australia’s top technology company CEOs (Chief Executive Officer).

Most see slowing sales in the EU and the US impacting their operations, but they appear in agreement that business to business (B2B) companies will fare better than those serving consumer markets.

As far back as October of 2022, an analyst from Citi and others presented what was at the time a moderately contrarian view – tech stocks would begin to recover in 2023. In both Australia and the US, they have begun the year in a modestly rising trend.

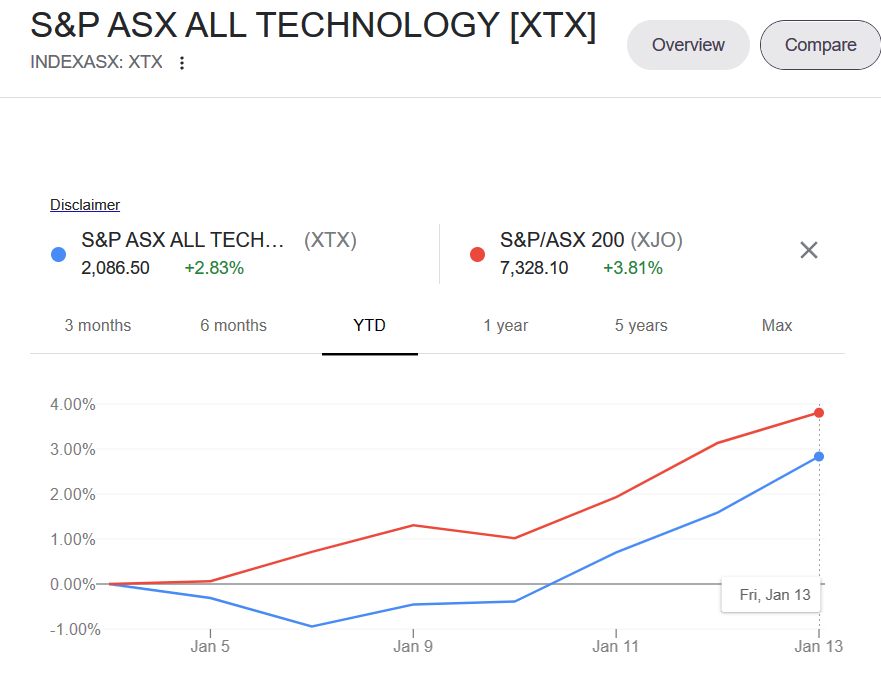

The US NASDAQ Index where technology stocks trade is up 5.6% while the S&P 500 Index is up 3.7%. The following graph from Google Finance compares the year to date performance of the ASX All Technology XTX index with the ASX 200.

For most interested investors, the search for potential bargains in the ASX technology sector begins with two of the most battered stocks in the once favored group known as the WAAAX stocks – Appen Limited (APX) and XERO Limited (XRO) – both B2B companies.

Appen and XERO were among the worst performing ASX tech stocks in 2022 , but Appen is currently rising in what may be a developing positive upward tide of some tech stocks – up 8.23% year to date, while XERO’s rise seems more tentative – up 1.37% following a one day uptick from a drop of 1.08%.

There are other badly beaten down ASX technology stocks up more than 5% year to date in addition to Appen, including Megaport Limited (MP1) and FINEOS Corporation (FCL).

The following price performance graph from googlefinance.com tracks the share price performance of the three year-to-date:

FINEOS provides software and services to life, accident and health insurers, and employee benefits insurers globally The majority of revenues coming from the US market – 79.4% in FY 2022

The company is located in Dublin Ireland and trades on the ASX, debuting on 19 August of 2019. The FINEOS platform provides a comprehensive set of tools to some of the largest insurers on the planet.

FINEOS operates as a SaaS (software as a service) with a core platform – the FINEOS AdminSuite. The platform can manage billing, payments, claims, policy administration, underwriting, and new business as a single suite platform or individual platforms to meet specific needs.

Additional platforms include FINEOS Engage, a machine-learning platform opening digital communication pathways across customers and partners; and a predictive analytics and reporting platform – FINEOS Insight.

In FY 2022 the company won multiple awards, including the Digital Project Technology of the Year Award and the Business and Finance Elevation Award. Full Year 2022 Financial Results disappointed investors with a profit loss increasing 108% from FY 2021 – attributed to a one off goodwill write down on an acquisition. The remainder of the report was outstanding, with revenues up across the board – total revenues up 17.5%; subscription revenues up 34.2%, and services revenues up 7.4%. Gross profit rose 15.3% and EBITDA (earnings before interest taxes depreciation and amortisation) up 28.8%.

The growth in the US market has risen from 45% of total revenue in 2019 to the current 79.4%. The company has maintained its track record of significant investment in research and development (R&D) to drive revenue growth by expanding with existing customers, adding new customers, and entering new markets.

On 25 July of 2022 FIENOS released a case study – “New York Life Group Benefit Solutions: Core Administration System Total Digital Transformation,” highlighting the achievements NYL Benefits Solutions obtained with the FINEOS AdminSuite platform.

During 2022 the company finalised the acquisition of the Spraoi suite of machine learning and artificial intelligence products for the Group Life and Employee Benefits industry.

Of the three potential targets, FINEOS has gotten off to the best start in 2023 and fell the least year over year.

Appen endured the worst beating of all ASX technology stocks in FY 2022, but in reality the share price has been in free fall for some time. Over five years the Appen share price is down 69.2% while over the same period the Megaport share price is up 103.5%.

The company is a leader in the adoption of artificial intelligence. Appen was an early entry in the field, using artificial intelligence in its robust language identification and translation software for its client companies. The company is now a leader in data annotation for advancing artificial intelligence powered applications for technology companies, government agencies, and large scale businesses.

Organisations of all kinds are moving towards artificial intelligence systems that can “learn” from data collected by the organisation for analytic and predictive use. The data must first be prepared in a format recognisable by the machine. This is the process of data annotation, where a human annotator categorises and labels data to be readable by machines.

Appen can provide that contextual annotation to individual images, videos, audio recordings and signals, text, as well as multi-modal annotation. For some clients, the company offers pre-defined data annotations.

The rush to adopt artificial intelligence is driven in large part by the need for increasingly targeted marketing and advertising. The COVID 19 pandemic doused ice water on the advertising programs of a host of businesses. Appen remains in the throes of “challenging external operating and macro conditions” according to the company’s Half Year 2022 Financial Results. The company closes its book at the end of December.

Management attributed the dismal results to weaker advertising and reduced spending from major customers, and others. Revenue dropped 7% while EBITDA fell 24% . Earnings per share (EPS) dropped 130.2% as did underlying net profit. The company outlook for the full year was for more of the same.

The financial performance coupled with the rapid withdrawal of a takeover bid from Canada-based technology firm Telus International may have contributed heavily to the resignation of the Appen CEO on 15 December.

Appen counts among its customers many of the world’s leading technology companies, including Microsoft, Google, Adobe, Amazon, and Salesforce.

Megaport has a software platform that enables its customers to connect their own internal networks to data centres around the world housing cloud and other digital services providers. The company operates as a Network as a Service (NaaS) provider where customers create a network to most of the world’s leading cloud services providers, including Amazon Web Services; Google Cloud Platform; IBM Cloud; Microsoft Azure; Alibaba Cloud; and Salesforce.com.

The company also operates the Megaport Marketplace, an online hub where service providers and enterprise customers can connect.

The customers that make use of Megaport software network services are equally impressive, from Adobe to FedEx to Tesla to BHP to ZOOM, and others.

Financial Results for the Full Year 2022 were positive in every metric. The company still posted a profit loss but it was a 12% improvement over the 2021 loss. Total revenues were up 40%; total customers were up 16%; and total services rose 26%.

The following table includes market cap, price movements, and trading volume for each of the three.

|

Company (CODE) |

Market Cap |

Share Price |

52 Week High |

52 Week Low |

90 Day Average Trading Volume |

|

Megaport Limited (MP!) |

$1.05B |

$6.84 |

$19.2 |

$4.7 |

1.2M |

|

FINEOS Corporation (FCL) |

$575M |

$1.85 |

$4.24 |

$1.20 |

279K |

|

Appen Limited (APX) |

$321M |

$2.63 |

$10.69 |

$2.20 |

967K Shares |