- Altium Limited provides software solutions for the design and manufacture of electronic products including printed circuit boards (PCBs).

- The company’s Full Year 2024 financial results included double-digit revenue guidance for FY 2024.

- Dividend payments have averaged $0.40 per share over a five-year period.

Altium Limited’s design software for PCB creators is augmented by Altium 365, a software platform connecting all aspects of the development process.

The company has also created and operates the world’s largest marketplace for sourcing the electronic components needed to create a PCB.

In FY 2023, Altium grew revenues 19.2%, with profit after income tax up 19.6%.

For FY 2024, the company is forecasting revenues of between $315m and $325m, an increase of between 20% and 23%.

Altium has an “aspirational target” of $500m in revenue by FY 2026.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

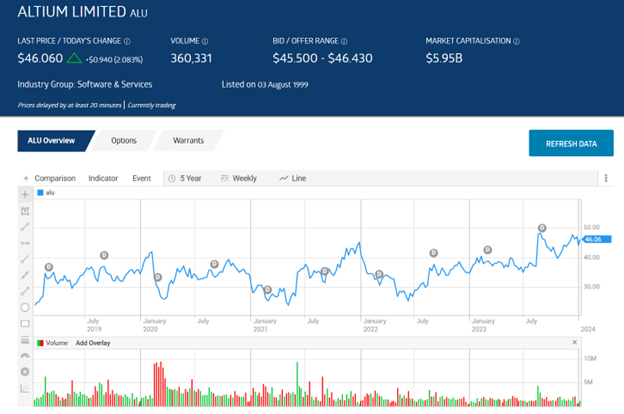

Over five years, the share price is up 112.2%. Year over year, the share price is up 29.6%.

Source: ASX

The company has not missed a dividend payment in the last decade, with a five-year average dividend payment of $0.40 per share and a five-year average dividend yield of 1.16%.

Analysts are bullish on ALU shares. Marketscreener.com is reporting an OUTPERFORM consensus rating, with four of the 15 analysts reporting at BUY, three at OUTPERFORM, six at HOLD, and two at UNDERPERFORM.

The Wall Street Journal has an OVERWEIGHT consensus rating on ALU shares, with three at BUY, one at OVERWEIGHT, and two at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy