Oliver Matthew, Marcus Today

BUY RECOMMENDATIONS

BUY – Webjet (WEB)

This online travel agency posted impressive results in late 2023. The company’s WebBeds business was a standout, posting revenue of $171.8 million in the first half of fiscal year 2024, an increase of 50 per cent on the prior corresponding period. We expect the company to generate solid growth in the second half as global airline passenger traffic has returned to normal levels post the pandemic.

BUY – ASX Limited (ASX)

We expect the share price of Australia’s biggest securities exchange to move higher in the next six months as global interest rates peak, bond yields fall and equities rise. The average daily number of trades in cash markets in December 2023 was up 13 per cent on the prior corresponding period. Cash markets include equities, interest rate and warrant trades. The average daily value traded on market was $5.371 billion, up 2 per cent on the prior corresponding period. Shares in the ASX have risen from $57.95 on December 1, 2023, to trade at $64.16 on January 18, 2024.

HOLD RECOMMENDATIONS

HOLD – Macquarie Group (MQG)

This diversified financial services giant reported a net profit after tax of $1.415 billion in the first half of fiscal year 2024, a fall of 39 per cent on the prior corresponding period. The company retained a strong capital position, with a group capital surplus of $10.5 billion at September 30, 2023. The share price has risen from $158.53 on November 13, 2023, to trade at $180.78 on January 18, 2024. The company often beats conservative guidance.

HOLD – REA Group (REA)

REA is a digital advertising group specialising in property. The company delivered a strong sharemarket performance in calendar year 2023 as Australian property prices rose by about 8 per cent. The shares have risen from $123.57 on January 19, 2023, to trade at $175.70 on January 18, 2024. We expect property price growth to moderate in calendar year 2024 in response to higher mortgage rates and cost of living pressures.

SELL RECOMMENDATIONS

SELL – Pilbara Minerals (PLS)

Pilbara recently expanded its offtake agreement with Chinese lithium group Ganfeng. PLS will increase spodumene concentrate supplies from 160,000 tonnes a year up to 310,000 tonnes a year over a three- year period, starting in calendar year 2024. This is positive news for a company with plenty of cash in the bank. However, lithium prices were slashed by about 80 per cent in 2023, as supply exceeded demand, which we expect to continue for some time.

SELL – Worley (WOR)

Worley is a global engineering and project services company. In 2021, the company announced a target of generating 75 per cent of revenue from sustainability related projects by fiscal year 2026. However, investors have sold down the stock after an international arbitration tribunal recently dismissed Worley’s attempts to recover unpaid trade receivables from a state-owned enterprise in Ecuador. Worley was recently considering its options for further legal proceedings and denied allegations of any wrongdoing. Shares in Worley have fallen from $17.52 on December 22, 2023, to trade at $15.51 on January 18, 2024. We expect the shares to remain under pressure – at least in the short term.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – Champion Iron (CIA)

We remain bullish regarding the outlook for iron ore in 2024. This Canadian based producer is trading on valuations which compare favourably to its peers. Also, the share price recently broke above a major resistance level near $8, and we believe this should lead to substantial upside from here. The shares have risen from $6.11 on October 24, 2023, to trade at $7.73 on January 18, 2024.

BUY – Woodside Energy Group (WDS)

We continue to retain a bright outlook for crude oil. Supply constraints and increasing global demand should elevate energy prices. Woodside shares are attractive at these levels. The share price chart also indicates strong support at current prices. The shares have fallen from $36.88 on October 18, 2023, to trade at $30.43 on January 18, 2024.

HOLD RECOMMENDATIONS

HOLD – Paladin Energy (PDN)

In early January, I tipped PDN as a stock that will start to move higher in calendar year 2024 based on low uranium supplies and increasing interest in sector. The shares have risen from $1.01 on January 2 to trade at $1.247 on January 18. I see substantial upside from here. Increasing global uranium supplies are still months away and this will support the share price.

HOLD – Pilbara Minerals (PLS)

Lithium prices have fallen to levels which is causing smaller mines to temporarily cease operations. Closing mines is often seen at the lows of the commodity cycle. The share price chart for PLS recently showed solid buying support with possible short covering. In our view, the PLS share price is close to, or at the bottom of its trading range, so we soon expect it to improve.

SELL RECOMMENDATIONS

SELL – Qantas Airways (QAN)

The airline enjoyed a bumper ride from passengers eager to travel when COVID-19 lockdowns were lifted. However, we expect travel spending to decline to normal levels in an environment of higher interest rates and soaring cost of living expenses. We also expect Qantas to increase capital expenditure to maintain its fleet. A weaker price chart could see the share price trend lower. The shares have fallen from $6.69 on July 24, 2023, to trade at $5.18 on January 18, 2024.

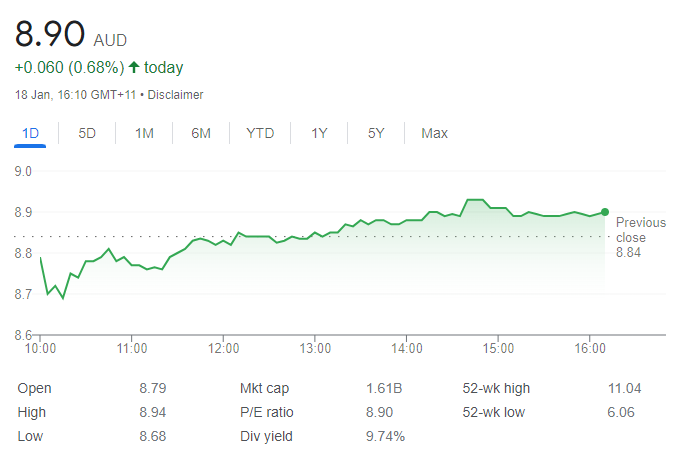

SELL – Magellan Financial Group (MFG)

The fund manager’s share price has risen from $6.22 on October 26, 2023, to trade at $8.89 on January 18, 2024. Recent share price strength provides investors with an opportunity to consider selling some stock. In our view, Magellan needs to outperform the market over time to generate increasing fund inflows. This may take time. In December 2023, Magellan experienced net outflows of $200 million.

Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

BUY – Beach Energy (BPT)

Beach produces oil and gas from five basins across Australia and New Zealand. Beach also has a suite of exploration permits. The share price can be volatile, but has edged higher since June 2023 to close above a technical resistance level at $1.645 on December 20, 2023. The shares were trading at $1.532 on January 18, 2024. Any breakout above $1.70 should push the price to higher levels.

BUY – Macquarie Technology Group (MAQ)

The group has four businesses involved in data centres, cloud services, cyber security and telecommunications. The technical chart pattern and earnings growth outlook highlights increasing investor interest. The shares have risen from $53.11 on February 20, 2023, to trade at $68.33 on January 18, 2024. Any confirmed breakout above $70 is likely to attract more investors and potentially push the price towards $80.

HOLD RECOMMENDATIONS

HOLD – Bannerman Energy (BMN)

Bannerman is a uranium development company. The company’s flagship Etango project is in Namibia. The company has benefited as the uranium bull run continues. The share price has risen from $2.36 on November 9, 2023, to trade at $3.56 on January 18, 2024. The longer term technical picture looks positive, although I expect to see some short term profit taking at potentially $4 levels.

HOLD – Boss Energy (BOE)

Boss is another uranium company that’s benefited from the uranium bull run. The share price has risen from $3.80 on December 13, 2023, to trade at $5.445 on January 18, 2024. Although the price was recently trading at all-time highs, I don’t see investor enthusiasm waning anytime soon, although traders may want to consider reducing risk and locking in some profits.

SELL RECOMMENDATIONS

SELL – CSL (CSL)

At its annual general meeting on October 11, 2023, this biopharmaceutical company forecast 2024 fiscal year revenue to grow between 9 per cent and 11 per cent at constant currency compared to fiscal year 2023. Shares in the company have risen from $230.65 on October 30, 2023, to trade at $283.97 on January 18, 2024. In my view, the share price is trading in extended territory, which may trigger some profit taking. Investors may want to consider cashing in some gains.

SELL – Qantas Airways (QAN)

On October 30, 2023, the company announced it had filed its defence with the Federal Court after the Australian Competition and Consumer Commission launched legal proceedings, alleging Qantas sold tickets for cancelled flights. The shares remain under pressure after drifting down since July, 2023. We believe any share price recovery will take time, so investors may want to look for more appealing options at this stage.

Related Articles:

- CFD Brokers in Australia

- How to Start Trading Stocks

- How to Trade Commodities in Australia

- The Best Australian Trading Apps

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.