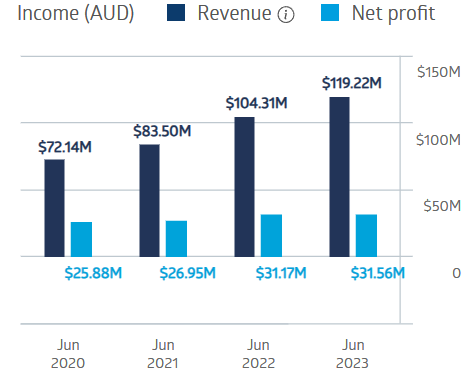

- Jumbo Interactive has grown both revenue and profit in each of the last four fiscal years.

- Jumbo has been creating lottery software programs for more than twenty years.

- The company has paid dividends every year since FY 2016.

Jumbo Interactive serves global government and charitable lottery providers with integrated services, from lottery game design to digital ticket sales software as a service platform to campaign marketing and lottery management services.

The company’s financial performance over the last four fiscal years has been steady, with FY 2023’s performance exceeding financial and operational metrics guidance despite modestly declining ticket sales and outsized jackpot payments.

Jumbo Interactive Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Over five years, the share price is up 132%. JIN shares hit an all-time high in November 2019 before investors headed for the exit with apparent concerns over excessive valuation in light of a respectable but less-than-expected profit outlook.

Source: ASX

Over five years, Jumbo Interactive shareholders have received average dividend payments of $0.36 per year, with a five-year average yield of 2.57%. The company’s share buyback program raised the current total yield to 3%.

An analyst at Marcus Today has a BUY recommendation on Jumbo Interactive shares, citing the growth potential of the company’s four-year extension of its SaaS agreement with Western Australia’s Lotterywest.

Overall, the analyst consensus is OUTPERFORM, with four analysts with a BUY recommendation, one at OUTPERFORM, and one each at HOLD and SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy