John Edwards, Novus Capital

BUY RECOMMENDATIONS

BUY – Perseus Mining (PRU)

PRU is a profitable West African gold producer with three operating mines. PRU guided to second half gold production of between 226,000 ounces and 254,000 ounces in fiscal year 2024 at an all-in-sustaining cost of between $US1180 and $US1340 an ounce. The company had available cash and a bullion balance of $US642 million and no debt at the end of the second quarter. Our 12-month price target is $2.80. The shares were trading at $1.66 on February 15. I own shares in Perseus Mining.

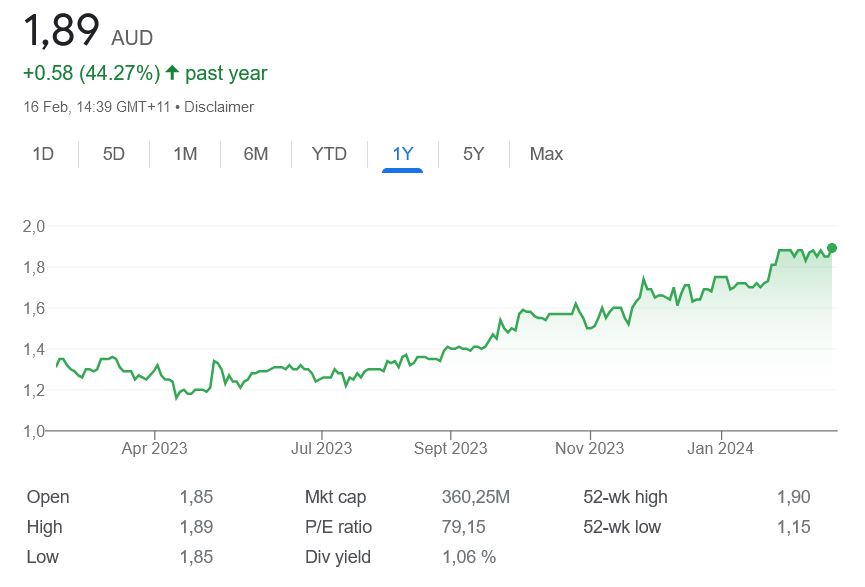

BUY – Generation Development Group (GDG)

The recent move by GDG to partner with MetLife, one of the biggest insurance companies in the world, brings GDG’s new LifeIncome annuities product into sharp focus. GDG’s annuities product has been strengthened after an external quality of advice review was seen as positive. GDG can take its product to industry fund clients to support member retention. Total funds under management stood at $2.928 billion at December 2023, up 24 per cent on the previous corresponding period. Our 12-month price target is $3. The shares were trading at $1.85 on February 15.

HOLD RECOMMENDATIONS

HOLD – ANZ Group Holdings (ANZ)

The bank’s first quarter update suggests a solid first half in fiscal year 2024. The shares have risen from $24.07 on November 17, 2023, to trade at $28.185 on February 15, 2024. Investors can consider holding for potential capital growth, or the bank’s appealing dividend yield.

HOLD – Breville Group (BRG)

The kitchenware company delivered earnings before interest and tax of $131 million in the first half of fiscal year 2024, up 8.2 per cent on the prior corresponding period. Revenue of $905.8 million was up 2 per cent, but below market expectations. However, a reduction in inventory is a good sign and is forecast to continue moving forward.

SELL RECOMMENDATIONS

SELL – Commonwealth Bank of Australia (CBA)

CBA’s consumer banking bias leaves it more exposed than its competitors to intense mortgage and deposit competition and the difficulties experienced by households suffering from high interest rates. Statutory net profit after tax of $4.837 billion in the first half of fiscal year 2024 was down 8 per cent on the prior corresponding period. The net interest margin of 1.99 per cent was down 11 basis points. Investors may want to consider cashing in some gains.

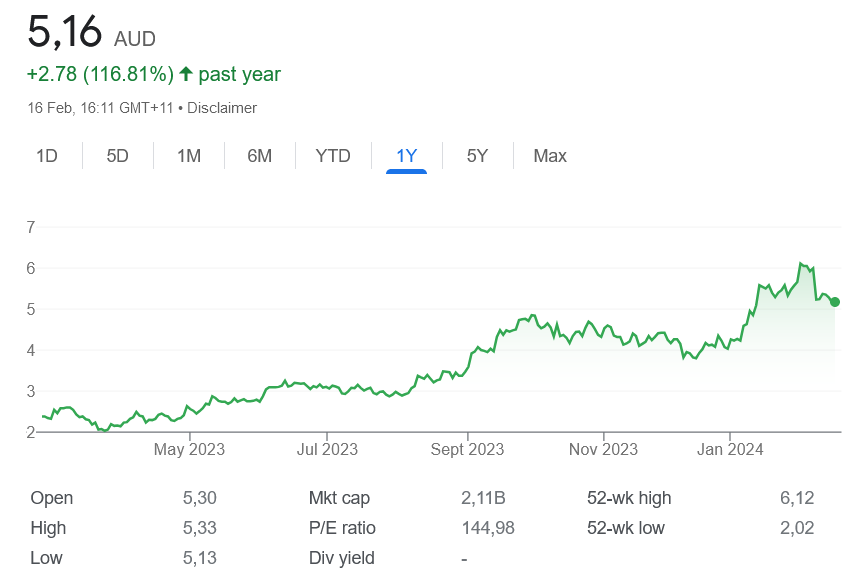

SELL – JB Hi-Fi (JBH)

The consumer electronics giant posted total group sales of $5.162 billion in the first half of fiscal year 2024, a fall of 2.2 per cent on the prior corresponding period. Net profit after tax of $264.3 million was down 19.9 per cent. The company’s share price has risen from $52.77 on January 8 to trade at $64.27 on February 15. Investors may want to consider taking a profit.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

BUY – Zip Co (ZIP)

ZIP is a buy now, pay later provider in Australia, New Zealand and the US. The company delivered a strong 2024 second quarter result. Revenue of $225.6 million was up 26.1 per cent on the prior corresponding period. The revenue margin improved to 8.2 per cent in response to competitors leaving the industry. ZIP is a growth story leveraged to a relatively strong consumer economy.

BUY – Mineral Resources (MIN)

MIN operates a diversified mining services business. It’s also involved in iron ore and lithium mining. MIN has been sold off from $92.16 on January 23, 2023, to trade at $57.34 on February 15, 2024. While lithium prices have nosedived, MIN’s January update showed its lithium operations are still profitable. The iron ore price is buoyant. In our view, MIN is poised to benefit from any recovery in the lithium price.

HOLD RECOMMENDATIONS

HOLD – Boss Energy (BOE)

BOE is re-starting the Honeymoon uranium project in South Australia. The uranium spot price was recently bouncing around $US100 a pound, a price last recorded in 2007. The current feasibility plan involves producing 2 million pounds of uranium a year. At a recent market capitalisation of about $2.31 billion on February 15, 2024, the market is forecasting higher uranium prices to justify the company’s share price.

HOLD – Aristocrat Leisure (ALL)

The technology company makes gambling terminals and creates content for gaming providers. The company generated 71.4 per cent of its revenue from recurring sources in fiscal year 2023. Another major revenue stream is generated by Pixel United, the company’s diverse mobile-first game unit. The stock has performed well in calendar year 2024, so we retain a hold recommendation.

SELL RECOMMENDATIONS

SELL – Mirvac Group (MGR)

Mirvac develops residential, office and industrial properties. The stock price has recovered from a low of $1.82 on October 31, 2023. The shares were trading at $2.28 on February 15, 2024. The past six months revealed a tougher operating environment for the business. The company reported a statutory loss of $201 million in the first half of fiscal year 2024. The loss was driven by investment property devaluations of $396 million. We’re cautious on real estate listed stocks in this uncertain environment.

SELL – WiseTech Global (WTC)

WiseTech develops software for the global logistics industry. The company has generated strong and consistent revenue growth during the past 10 years. In our view, the stock is trading on lofty financial metrics, leaving it susceptible to any global technology correction.

Nathan Lodge, Securities Vault

BUY RECOMMENDATIONS

BUY – PointsBet Holdings (PBH)

PBH is a corporate bookmaker via its cloud based wagering platform. The company has operations in Australia and Canada. This company is well managed. It also communicates well with investors. In Australia, it posted a total net win of $59.5 million in the second quarter of fiscal year 2024, up 3 per cent on the prior corresponding period. The total net win in Canada was $10.5 million, up 109 per cent. The company expects cash active clients to grow in the second half. We like the outlook.

BUY – Centrepoint Alliance (CAF)

CAF provides business services to financial advice firms throughout Australia. The company generated gross revenue of $271.6 million in fiscal year 2023, up 19 per cent on the prior corresponding period. Profit before tax of $6.6 million was up $4 million. The shares have been edging higher since November, but we believe the company still offers good value.

HOLD RECOMMENDATIONS

HOLD – Aumake (AUK)

AUK operates an Australian-based social e-commerce marketplace that connects Asian influencers and consumers with quality Australian and New Zealand brands. The company strengthened its cash position following a capital raising in the second quarter of fiscal year 2024. Cash sales in the second quarter were $9.6 million, up 49.6 per cent on the first quarter. We expect the company to benefit if China lifts or significantly reduces tariffs on Australian food and wine.

HOLD – Red Metal (RDM)

The share price has soared from 9.6 cents on January 31 to trade at 17 cents on February 15. On February 1, RDM announced outstanding leach results from initial metallurgical testing at the company’s new Sybella discovery in north-west Queensland. The company has perceived it as a heap leachable source of rare earth oxide minerals. The results are most encouraging. Investors should continue to monitor the news flow.

SELL RECOMMENDATIONS

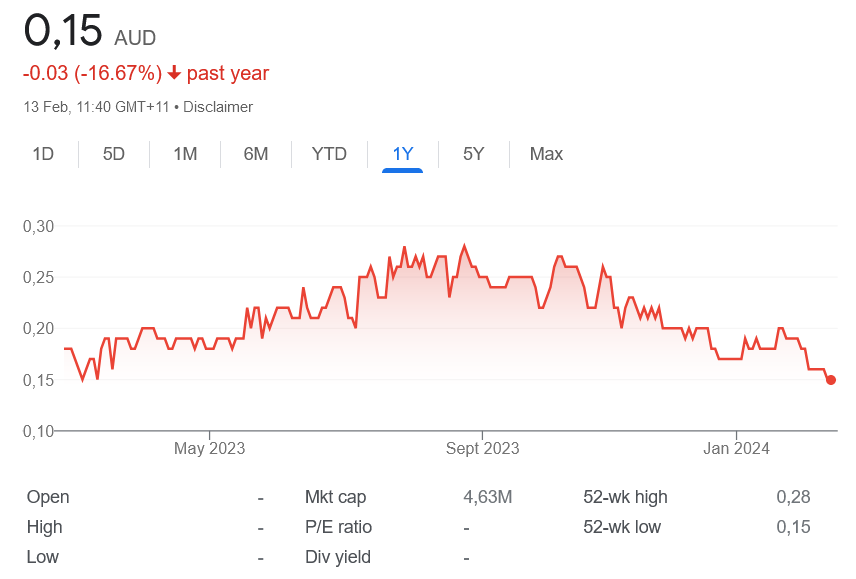

SELL – Critical Minerals Group (CMG)

CMG is a battery metals company. Its flagship is the Lindfield Vanadium Exploration project in the Julia Creek area of north-west Queensland. The company has other exploration tenements. On December 7, 2023, CMG announced it had executed a non-binding term sheet for a farm-in agreement with True North Copper. However, the shares have fallen 22 cents on November 21, 2023, to be priced at 15 cents on February 15, 2024. Other stocks appeal more at this point.

SELL – Koba Resources (KOB)

Koba explores a portfolio of lithium and cobalt projects in Australia and North America to support the growth of electric vehicles. Recently, the company announced it was expanding its Yarramba uranium project in South Australia with two new tenements. KOB recently appointed an experienced uranium geologist. The shares have risen rapidly from 7.1 cents on January 4 to be priced at 16 cents on February 15. Investors may want to consider cashing in some gains.

Related Articles:

- Australian Stock Trading Apps

- The Best Australian Cryptocurrency Brokers

- Forex Trading Platforms in Australia

- CFD Brokers in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.