Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

BUY – PolyNovo (PNV)

The company provides dermal regeneration solutions via its NovoSorb biodegradable polymer technology. PNV supplies more than 600 hospitals across the world, including the UK and the US. The huge Indian market provides an opportunity to increase market share. Total revenue of $66.5 million in fiscal year 2023 was up 58.8 per cent on the prior corresponding period. The company generated record monthly sales of $8.8 million (unaudited) for November 2023.

BUY – Aeris Resources (AIS)

This gold and copper company is undertaking a $30 million capital raising at 11 cents a share. Proceeds will provide general working capital and financial flexibility. It’s encouraging that high quality investor Washington H. Soul Pattinson is taking up its full entitlement and will sub-underwrite the entitlement offer up to an aggregate amount of $12.3 million. The shares have fallen significantly in calendar year 2023. The share price may rise from here for investors prepared to take on risk.

HOLD RECOMMENDATIONS

HOLD – ResMed Inc (RMD)

The medical device maker generated revenue of $1.1 billion in the first quarter of fiscal year 2024, up 16 per cent on the prior corresponding period. Operating profit was up 5 per cent. Investor concerns that diabetes and obesity medicines would significantly impact RMD’s sleep apnoea business appear to be an over-reaction. The share price is gradually recovering, but is significantly down in 2023.

HOLD – Northern Star Resources (NST)

The gold price recently exceeded $US2000 an ounce in response to a weaker US dollar and possible interest rate cuts appearing on the horizon in the US. We expect higher gold prices and gradually reducing inflation to expand margins for this quality gold producer. For the longer term, NST is investing $1.5 billion to double the output of its Kalgoorlie super pit, which is expected to be the largest mine in Australia by 2029.

SELL RECOMMENDATIONS

SELL – Unibail-Rodamco-Westfield (URW)

Owns and operates shopping centres in the US and Europe. Like-for-like gross rental income was up 11.5 per cent in the first nine months of fiscal year 2023 when compared to the prior corresponding period. Tenant sales were up 7.9 per cent. The shares have risen from $3.44 on October 26 to trade at $5.21 on December 7. Investors may want to consider cashing in some gains as the retail sector can be fiercely competitive.

SELL – Magellan Financial Group (MFG)

Total funds under management of $35.2 billion at November 30, 2023 were up from $34.3 billion at October 31, 2023. However, in November, Magellan experienced net outflows of $1 billion, which included net retail outflows of $300 million and net institutional outflows of $700 million. The share price has risen from $6.22 on October 26 to trade at $8.14 on December 7. Investors may want to consider cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – BHP Group (BHP)

We retain our bullish view on resources. The global miner’s share price has been gaining momentum. The shares have risen from $43.36 on October 23 to trade at $47.30 on December 7. The recent break-out points to a higher share price moving forward. Copper production increased by 11 per cent in the first quarter of fiscal year 2024 when compared to the prior corresponding period. Production guidance in fiscal year 2024 remains unchanged.

BUY – ResMed Inc (RMD)

ResMed makes medical devices to treat sleep disordered breathing. The share price fell from $33.85 on August 3 to close at $21.56 on October 27 over investor concerns about the potential impact on its sleep apnoea products business from diabetes and obesity medicines. The share price was trading at $24.78 on December 7. ResMed revenue rose 16 per cent in the first quarter of fiscal year 2024 compared to the prior corresponding period. We expect the shares to recover fuelled by short covering.

HOLD RECOMMENDATIONS

HOLD – Evolution Mining (EVN)

We’re bullish about the outlook for the gold price. EVN’s share price recently broke free of its trading range to coincide with the gold price making new highs. The company recently completed a $525 million institutional placement to partly fund the acquisition of an 80 per cent interest in the Northparkes Copper-Gold mine. The company outlook appears brighter. In October, the gold producer retained fiscal year 2024 guidance of 770,000 ounces at an all-in-sustaining cost of $1370 an ounce.

HOLD – Paladin Energy (PDN)

The share price of this uranium company has risen from 53.5 cents on May 30 to trade at 94 cents on December 7. Wider global interest in uranium as an energy source has generated increasing investor interest. Production at the company’s Langer Heinrich mine is planned to resume in the first quarter of calendar year 2024. We believe the upward trend is likely to continue as more investors chase the stock closer to production at the Langer Heinrich mine.

SELL RECOMMENDATIONS

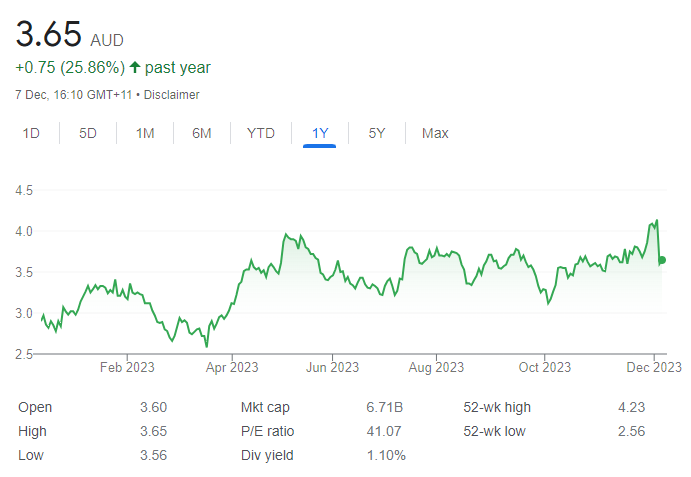

SELL – Bendigo and Adelaide Bank (BEN)

The bank generated cash earnings after tax of $576.9 million in fiscal year 2023, up 15.3 per cent on the prior corresponding period. The bank’s share price has been volatile in calendar year 2023. However, it has risen from $8.58 on November 17 to trade at $9.15 on December 7. Investors may want to consider cashing in some gains as we expect stiffer competition in the banking sector to benefit the major banks.

SELL – EML Payments (EML)

This payment solutions provider operates in Australia, the UK, Europe and the US. The shares have fallen from $1.255 on November 9 to trade at 85.7 cents on December 7. The shares fell following a trading and strategic review update. The company has guided for an increase in underlying EBITDA of between 40 per cent and 56 per cent in fiscal year 2024. However, the review revealed the company is hampered by several EBITDA and cash flow negative business lines in response to deteriorating customer performance and increasing costs. EML will re-focus on core, profitable and cash flow positive businesses, but this may take time.

Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

BUY – Tabcorp Holdings (TAH)

Group revenue for this wagering company was down by 6.1 per cent in the first quarter of fiscal year 2024 when compared to the prior corresponding period. Digital wagering turnover was up by 1 per cent, but digital wagering revenue was down by 3.9 per cent. The company’s plan is to increase revenue and reduce costs under its transformation strategy. In our view, the share price is trading at a significant discount after falling from $1.10 on September 5 to close at 69.5 cents on December 7.

BUY – Mineral Resources (MIN)

MIN operates a diversified mining services business. It’s also involved in iron ore and lithium mining. MIN has accumulated substantial stakes in quality lithium companies Wildcat Resources and Azure Minerals. MIN’s lithium exposure leaves it in a strong position as the industry matures. The stock is significantly down since early March, so we believe it offers good value.

HOLD RECOMMENDATIONS

HOLD – Future Metals NL (FME)

This exploration company owns the Panton platinum group metals (PGM) project in the eastern Kimberley region of Western Australia. The company recently announced that a scoping study demonstrated potential for a long life globally significant PGM operation. Patrick Walta brings skills and immense experience to his role as recently appointed executive chairman.

HOLD – Nick Scali (NCK)

The furniture retailer generated revenue of $507.7 million in fiscal year 2023, up 15.1 per cent on underlying revenue in fiscal year 2022. Net profit after tax of $101.1 million was up 26.1 per cent. Competent management should be able to navigate higher interest rates, although higher rates can impact consumer spending.

SELL RECOMMENDATIONS

SELL – Eagers Automotive (APE)

This automotive retail group operates in Australia and New Zealand. Revenue of $4.817 billion from continuing operations in the first half of fiscal year 2023 was up 14.3 per cent on the prior corresponding period. The share price has retreated from $16 on August 31 to close at $13.70 on December 7. Sustaining sales moving forward may be a challenge in an Australian economy of higher interest rates and soaring cost of living expenses. Investors may want to consider cashing in some gains.

SELL – Sayona Mining (SYA)

SYA has an operating lithium mine and exploration tenements in Western Australia. Sayona is continuing to ramp up operations at North American Lithium in Quebec, Canada. Lithium prices have declined in 2023. Sayona’s share price has fallen from 29.5 cents on January 30 to finish at 5.4 cents on December 7. Other stocks appeal more at this stage of the cycle.

Related Articles:

- The Best CFD Trading Platform in Australia

- Share Trading in Australia

- A Guide to Day Trading ASX Shares

- How to Buy Commodities in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.