Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

BUY – Lynas Rare Earths (LYC)

Revenue of $112.5 million in the second quarter of fiscal year 2024 was down on the first quarter in response to lower production levels and weaker rare earths prices. However, first feed of material from Mt Weld was introduced to the Kalgoorlie rare earths processing facility. The company’s amended operating licence in Malaysia is valid to March 2, 2026. The share price has recently retreated, but rare earths tend to be the first commodity to bottom and then the first to recover. Investors can consider buying when the share price downtrend reverses.

BUY – ResMed Inc (RMD)

RMD makes medical devices to treat sleep disordered breathing. The shares were slashed between August and October 2023 as investors feared diabetes and weight loss medicines would negatively impact RMD’s sleep apnoea business. Obesity is widely considered a contributing factor to sleep apnoea. However, the shares have risen from $21.56 on October 27, 2023, to trade at $29.21 on February 1, 2024. In the second quarter of fiscal year 2024, the company grew revenue by 11 per cent on a constant currency basis compared to the prior corresponding period. We expect the sleep apnoea business to grow moving forward.

HOLD RECOMMENDATIONS

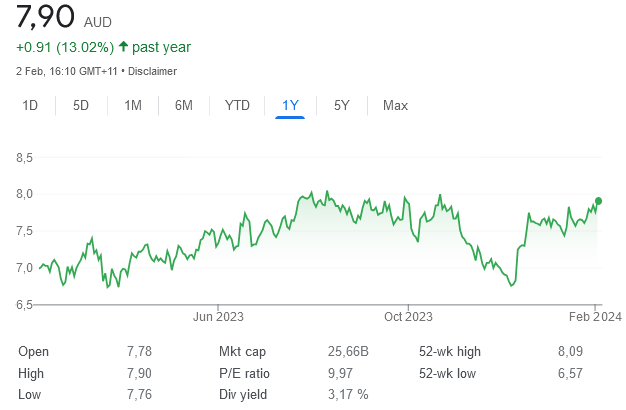

HOLD – National Storage REIT (NSR)

The self-storage provider operates in Australia and New Zealand. In a recent market update, unaudited first half 2024 underlying earnings per share of 5.6 cents represented an increase of 1.8 per cent on the second half of fiscal year 2023. Revenue per available metre marginally rose during the half, and, in our view, gearing is low around 23 per cent at December 2023. The valuation is undemanding at current levels.

HOLD – Telstra Group (TLS)

The telecommunication giant’s latest full year results were solid and in line with expectations, without positive or negative surprises, in our view. The company’s valuation is undemanding around $4 a share. The company’s recent fully franked dividend yield above 4 per cent makes it an attractive core holding for income focused investors. The shares were trading at $4.04 on February 1, 2024.

SELL RECOMMENDATIONS

SELL – Netwealth Group (NWL)

This financial services company reported funds under administration (FUA) of $78 billion for the quarter ending December 31, 2023. FUA net inflows of $2.6 billion for the quarter were up 25 per cent on the prior corresponding period. The shares have risen from $12.45 on October 26, 2023, to trade at $16.61 on February 1, 2024. While we view NWL as an attractive long term growth story, we believe recent strength is a good time to bank some profits by trimming holdings. (Please note: NWL has been put forward as a buy and sell recommendation this week as experts take different positions on the stock.)

SELL – JB Hi-Fi (JBH)

This consumer electronics giant has successfully navigated an environment of higher interest rates and soaring cost of living expenses. The shares have risen from $44.47 on October 30, 2023, to trade at $56.62 on February 1, 2024. Although not uncomfortably expensive, investors may want to consider cashing in some gains by trimming holdings before chasing more attractive valuations elsewhere.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Langford, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – New Hope Corporation (NHC)

New Hope is an Australian coal producer. It has associated coal port, oil and gas and agricultural operations. The company delivered a net profit after tax of $1.087 billion in fiscal year 2023, up 11 per cent on the prior corresponding period. New Hope finished the year with a healthy $731 million in net cash. The company declared total fully franked dividends of 70 cents a share. Continuing demand for quality thermal coal makes New Hope particularly attractive for investors searching for yield at value.

BUY – PEXA Group (PXA)

PEXA operates a leading digital property settlements platform in Australia and is expanding its business to the UK. We expect an improvement in Australian settlement activity volumes led by stronger than forecast market sales and continued refinancing. With central banks expected to ease interest rates, increasing transaction volumes should support the share price.

HOLD RECOMMENDATIONS

HOLD – Santos (STO)

The energy giant produced 23.4 million barrels of oil equivalent in the fourth quarter of 2023, a small increase on the previous quarter. The company generated strong free cash flow of more than $500 million from operations in the fourth quarter and $2.1 billion for the full year. We believe the stock provides good value at these levels on top of appealing capital returns. Santos is in early stage discussions to evaluate the merits of a potential merger with Woodside Energy Group.

HOLD – ResMed Inc (RMD)

The share price has rallied from $21 levels in October 2023 to trade at $29.21 on February 1, 2024. Between August and October 2023, investors slashed the share price over concerns that RMD’s sleep apnoea business may be negatively impacted by diabetes and obesity medicines. However, ResMed’s second quarter results in fiscal year 2024 showed strong double-digit growth across masks and accessories. The residential care software business is benefiting from strong patient flows in recent quarters. We expect the share price to continue outperforming.

SELL RECOMMENDATIONS

SELL – CSL (CSL)

At its annual general meeting, this blood products company forecast 2024 revenue to grow between 9 per cent and 11 per cent at constant currency compared to fiscal year 2023. In November 2023, we argued the share price was undervalued given this outlook. The shares have recovered from $234.98 on November 1, 2023, to trade at $298.50 on February 1, 2024. I have a trading sell on the stock. Investors may want to consider reducing exposure.

SELL – Paladin Energy (PDN)

Paladin owns a global portfolio of uranium exploration and development assets. It’s focused on resuming commercial production at its Langer Heinrich mine in Namibia in the first quarter of calendar year 2024. After a strong lift in uranium prices, Paladin’s share price has risen from 54.5 cents on May 31, 2023, to trade at $1.285 on February 1, 2024. Investors may want to consider selling into strength.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

BUY – IDP Education (IEL)

We consider IEL as a world leader in student placement services and language testing. We believe it’s poised to benefit from continuing growth in university enrolments in emerging economies and from higher international student mobility. We believe the shares offer value at these levels.

BUY – Netwealth Group (NWL)

The company’s high quality investment platform is poised to deliver strong earnings growth driven by market share gains, in our view. Funds under administration (FUA) stood at $78 billion at December 31, 2023. FUA increased by 24.9 per cent for the year to December 31, 2023. FUA net inflows accounted for $9.5 billion and a positive market movement accounted for $6 billion. This wealth management business offers an appealing outlook.

HOLD RECOMMENDATIONS

HOLD – Liontown Resources (LTR)

The company’s Kathleen Valley lithium project remains on budget and schedule for first production in mid-2024. Weaker lithium prices prompted LTR to conduct a review of Kathleen Valley’s planned expansion and associated ramp-up to preserve capital and reduce near-term funding requirements. The company has started discussions on a revised smaller debt facility after announcing a previous $760 million debt funding package will be terminated. LTR had a cash balance of $516.9 million at December 31, 2023. Investors should continue to monitor developments.

HOLD – Baby Bunting Group (BBN)

Baby Bunting is a nursery retailer, selling prams, car seats, cots and high chairs, among other products. It has 70 stores in Australia and four in New Zealand. Sales metrics in the second quarter of fiscal year 2024 showed an improving performance relative to the first quarter. The gross margin of 37.2 per cent in the first half remained flat. We remain cautious about full year performance, so investors should continue monitoring the news flow.

SELL RECOMMENDATIONS

SELL – Nanosonics (NAN)

The share price of this infection prevention company plunged after a preliminary first half trading update for fiscal year 2024. Total revenue of about $79.6 million represents a 2.4 per cent fall on the prior corresponding period, according to unaudited results. Lower than expected capital unit sales were primarily behind the fall. The company expects to report a profit before tax of about $4.9 million for the half compared with $11.4 million in the prior corresponding period.

SELL – South32 (S32)

This diversified global miner posted mixed production results in the December 2023 quarter. Payable silver, zinc and nickel production rose when compared to the previous quarter. However, metallurgical coal and payable copper production fell. Group copper equivalent production guidance has been reduced by 3 per cent in fiscal year 2024. The shares have been trending down since April 2023. Investors may want to consider cashing in some gains.

Related Articles:

- A Guide to Day Trading ASX Shares

- How to Trade CFDs in Australia

- The Best Australian Apps for Investing

- CFD Brokers in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.