Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

BUY – Johns Lyng Group (JLG)

This building services group operates in the restoration space in Australia and New Zealand. We expect an already strong pipeline of work to be bolstered from recent storm damage in Queensland and Victoria. Management has a history of exceeding expectations, with fiscal year 2023 net profit after tax of $62.8 million above consensus forecasts of $50 million. The shares are enjoying favourable momentum in 2024, with the price rising from $6.08 on January 2 to trade at $6.78 on January 11.

BUY – GQG Partners Inc. (GQG)

The company has delivered consistent growth in funds under management. GQG is our standout alternative in the funds management space that has been under pressure. The company was recently managing more than $100 billion, and we believe continuing fund inflows paired with fund outperformance should deliver share price upside.

HOLD RECOMMENDATIONS

HOLD – Santos (STO)

Santos and Woodside Energy held discussions last year about a potential merger. But a deal remains uncertain. Santos has quality energy assets and was recently trading at an attractive price that may put it on the radar screens of other big players in the energy space. Prior investments are now delivering strong cash flows, and management plans to pay out 40 per cent of those cash flows as dividends.

HOLD – NexGen Energy (Canada) (NXG)

We like NXG and consider it as a higher risk opportunity in the uranium space. This Canadian explorer is focused on developing the Rook I project in Saskatchewan, which is a high-grade undeveloped uranium deposit. A 2021 feasibility study forecasts the project to generate more than $CAD1 billion in after-tax free cash flow from operations within the first five years, primarily due to low production costs. NXG may also be an attractive acquisition target for bigger global players.

SELL RECOMMENDATIONS

SELL – Woolworths Group (WOW)

The supermarket group operates in a fiercely competitive space, which, in our view, leaves minimal scope for big margin improvements. Price inflation tailwinds have eased. But shoppers may still trim their purchases due to higher cost of living pressures. Or they may shop around for cheaper alternatives. We doubt whether top line sales growth is strong enough for the company to deliver significant profit growth or share price upside in the near term.

SELL – Telstra Group (TLS)

The share price of this telecommunications giant has been under pressure since mid 2022. The shares have fallen from $4.42 on June 20 to trade at $3.915 on January 11, 2024. Investors shifting out of defensive investments may look to reduce their exposure to the telecommunications sector in search of potentially bigger returns from turnaround stocks in the healthcare and information technology sectors.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – AGL Energy (AGL)

The energy giant looks undervalued following a share price retreat in November 2023. In our view, the longer-term outlook remains solid. AGL was recently trading on a low forecast fiscal year 2024 price/earnings multiple below 10 times and offers an attractive dividend yield, mostly franked from fiscal year 2025 onwards. We’re forecasting relatively flat earnings over the long term, as investments in renewable energy and batteries offset the expiry of cheap long-term coal contracts and the closure of coal power stations.

BUY – Service Stream (SSM)

The recent analyst day presentation highlighted Service Stream’s increasingly diverse portfolio of infrastructure maintenance projects, the depth of expertise required to service these projects, longer average contract duration and improving risk profile as the company cycles away from fixed price, lump sum work. Service Stream carries $5 billion of work in hand, excluding contract extensions, underpinned by unprecedented levels of investment from government and private asset owners. We prefer companies with nearer term earnings visibility and positive earnings momentum. We believe SSM’s free cash flow generation deserves a higher multiple.

HOLD RECOMMENDATIONS

HOLD – Metcash (MTS)

Metcash is a wholesale distribution and marketing company involved in food, liquor and hardware. We expect consumer demand for food and liquor to remain robust in the second half, while hardware sales are underpinned by incremental acquisitions and the lapping of weaker trading conditions in the previous corresponding period. Challenges include rising cost of living pressures and intensifying competition as stronger supply meets softer demand.

HOLD – Medibank Private (MPL)

At its recent annual general meeting, MPL management reiterated fiscal year 2024 outlook statements. Our forecasts are in line with management guidance, which includes up to 2 per cent growth in policyholder numbers. We expect average claims per policyholder to modestly outpace premium growth, with price increases not completely offsetting the impact of an ageing population. The private health insurer still generates attractive margins of about 8 per cent and a return on equity above 25 per cent.

SELL RECOMMENDATIONS

SELL – Xero (XRO)

This accounting software provider posted subscriber growth in line with our expectations at its first half 2024 results. Subscribers of 3.945 million were up 13 per cent on the prior corresponding period. Growth in average revenue per user was marginally stronger than expected. The shares have risen from $99.17 on November 28, 2023, to close at $110.13 on January 11, 2024. Investors may want to consider cashing in some gains.

SELL – EBOS Group (EBO)

EBOS is an Australasian marketer, wholesaler and distributor of healthcare, medical and pharmaceutical products. It’s also an animal care brand owner, product marketer and distributor. In our view, the company operates in a highly competitive and relatively mature industry. We believe the shares are expensive at this point, so investors may want to consider taking a profit.

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

BUY – Vinyl Group (VNL)

The music company recently announced it had entered into a binding share sale agreement to acquire Australia’s biggest youth publisher, The Brag Media, for $8 million in cash, with a further $2 million payable in cash or stock at Vinyl Group’s discretion. Titles include Rolling Stone and Variety in Australia and New Zealand. It was announced in December that WiseTech Global founder and chief executive Richard White is investing $11 million by way of a placement and debt facility. We believe the acquisition is a positive move, as it will generate increasing revenue. We expect VNL to be re-rated higher.

BUY – The Star Entertainment Group (SGR)

Shares in the casino operator have fallen from $1.61 on January 16, 2023, to trade at 54 cents on January 11, 2024. The company reported a statutory loss of $2.435 billion, which includes non-cash impairments, in fiscal year 2023. We believe the shares have been oversold. The market hasn’t priced in the possibility of a recovery, or the company appealing as a potential takeover target.

HOLD RECOMMENDATIONS

HOLD – JB Hi-Fi (JBH)

The market is pricing in interest rate cuts, which will boost disposable income and consumer sentiment. This consumer electronics giant is a proven performer. The shares have risen from $44.47 on October 30, 2023, to trade at $56.46 on January 11, 2024. Management continues to surprise to the upside.

HOLD – Ramelius Resources (RMS)

Shares in this gold company have risen from 83 cents on February 17, 2023, to trade at $1.547 on January 11, 2024. The share price has been supported by rising gold prices, which helped this gold producer deliver statutory net profit after tax of $61.6 million in fiscal year 2023, up 396 per cent on the prior corresponding period. We believe the shares are worth holding, as there’s a good chance the gold price will continue its rally in calendar year 2024.

SELL RECOMMENDATIONS

SELL – Harvey Norman Holdings (HVN)

The share price of this retail giant has risen from $3.57 on November 27, 2023, to trade at $4.225 on January 11, 2024. This is despite the company reporting a sales slump in Australia and abroad between July 1 and November 25, 2023, when compared to the prior year. HVN operates in a fiercely competitive environment. Another challenge for discretionary retailers is high interest rates impacting disposable income. Investors may want to consider taking a profit.

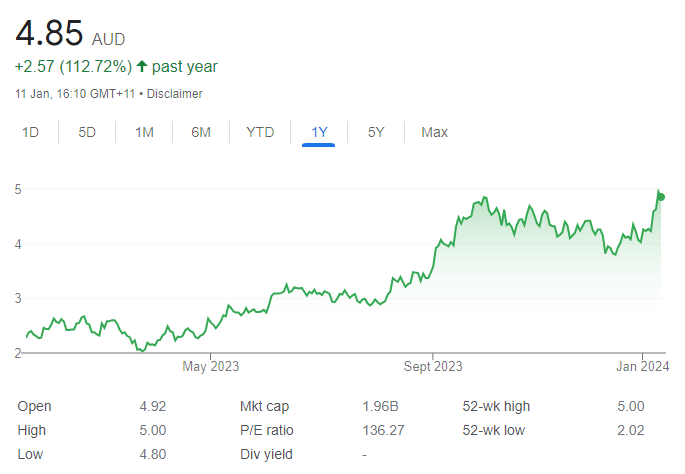

SELL – Boss Energy (BOE)

The company is focused on re-starting the Honeymoon uranium project in South Australia. We are bullish on uranium prices, but this company’s share price has more than doubled in a year. Shares have jumped from $2.28 on January 12, 2023, to trade at $4.83 on January 11, 2024. In our view, the shares have risen too quickly and appear priced to perfection, leaving little or no room for error. Investors may want to consider pocketing a profit.

Related Articles:

- CFD Brokers in Australia

- How to Trade Commodities in Australia

- How to Start Day Trading in Australia

- Australian Automated Trading Software

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.