Investing in shares of publicly traded companies has seen an influx of new retail investors over the last few years, with trading levels accelerating during the pandemic and stock trading apps springing up. Many of these investors are new and lacking in knowledge of markets. Of the many oddities encountered in their search to learn, the sometimes conflicting views of investing in a company’s Initial Public Offering (IPO) has to be near the top.

On the one hand, they read article after article warning of the dangers of IPO investing, especially in start-ups with little or no history of significant revenue generation and only a dream of profit sometime in the future.

On the other hand, there are articles hyping a stock, heralding the company as “the next Afterpay Group”, reminding the readers that if they had only invested in Afterpay’s IPO they would have been handsomely rewarded.

IPO hype lures investors to buy. Share markets prosper when investors are buying, in a “rising tide lifts all boats” mentality. Students of the mechanics of IPO listings know most companies wait for the right moment to list to maximise their returns. The ideal time comes when a sector gets hot, with investors eyeing rising prices in the sector as an indicator of good fortune for a prospective IPO.

During the tech bubble in the late 1990’s companies that literally existed only on paper rushed to list, often with nothing more than a “.com” in the company name. There are now some really big players in the ASX tech stock space now that warrant a little closer inspection.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

When Fintechs arrived on the ASX there was a rush to get in on IPOs of companies in the sector. Although the bloom is beginning to fade somewhat, the same could be said of companies piling into the BNPL sector (Buy Now Pay Later.)

The ASX website publishes a list of upcoming floats, including basic details and links to companies in the process of listing. As of the close of the trading week of 18 June, there were 46 companies on the list, with 32 mining companies and 2 mining services companies.

The hard truth investors of all ages and investing strategies need to keep in mind is there is no easy path to selecting an IPO in which to invest. Too much of the financial coverage of upcoming IPOs is designed to attract buyers more than to evaluate the company’s prospects.

To do that there is no substitute for consulting the IPO prospectus listing companies are required to file. However, the size of these documents and the minute details make thorough due diligence a daunting task.

The critical questions most market experts advise investors to consider include:

- What does the company do to make money?

- How many customers need what the company provides?

- What other companies provide the same or similar products or services? the future?

- What could go wrong?

The most bearish of bearish experts advise retail investors to avoid any IPO that is not generating sufficient revenue to either provide a profit now or in the near future.

Most IPO Prospectus documents follow a standard format with the answers to those critical question found in the first five sections.

- Investment Overview

- Industry Overview

- Company overview

- Financial Information

- Risks

- Key people, interests, and benefits

- Details of the Offer

- Investigating Accountant’s Report

- Additional information

In a well-written prospectus, many investors can find the answers they need in the Investment Overview section.

For risk averse investors there are a number of upcoming listings already generating revenue and making a profit, although not all have an IPO prospectus available as of 18 June.

Many retail investors are attracted to listings in glamorous sectors, like biotechnology and high tech. There is not much glamor in logistics, but for investors interested in getting in on a company with a strong performance track record, Silk Contract Logistics is worth more than a look.

Silk Logistics Group was formed in 2008 when two Australian logistics companies with decades of experience – Kagan Logistics and Hoffmann Transport – came together, with a management buyout in 2014 resulting in Silk Contract Logistics.

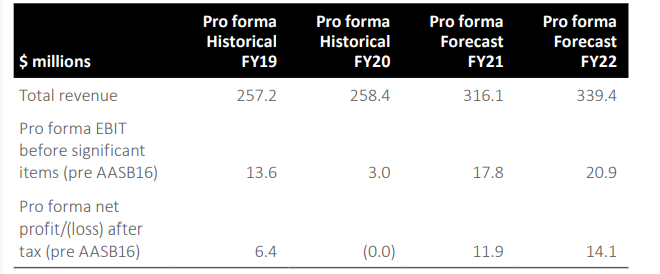

A 31 May article in the Australian Financial Review (AFR) covering the final details of the term offer revealed prospective investors were told the company was expected to notch $310 million revenue in the 12 months to June 30 of 2021, while earnings before interest and tax (EBIT) was pegged at $17.8 million.

The IPO prospectus upgraded the revenue forecast to $316.1 million dollars and highlighted the company’s track record of a 19.7% compound annual growth rate (CAGR) since the buyout in 2014. Silk also announced its EBIT forecast to FY 2022 at $20.9 million.

The company boasts a high-tech technology platform and an impressive list of blue chip Australian business customers. Silk operates in all mainland Australian states with three distinct services offered through two operating divisions. The Port Logistics Division provides wharf cartage, and the Contract Logistics division provides warehousing and distribution services.

Silk’s customer base includes FMCG (fast moving consumer goods), light industrial, food, specialised retail, and containerised agriculture.

The following chart of financial performance is from the company’s IPO Prospectus.

The company sees its future growth stemming from the fragmented nature of the logistics sector in Australia as well as the growing trend to outsource logistics needs to large operators with state of the art technology.

There are two upcoming listings with an abundance of hype, but no apparent public availability of an IPO Prospectus. However, both operate in hot sectors and have products in the market generating revenue.

For investors who may have missed the start of the BNPL boom, an article appearing on businessnewsaustralia.com back in February had this to say about Butn, a B2B BNPL provider:

- Think Zip Co or Afterpay, but for B2B transactions.

Founded in 2018 to cater to the unique needs of the small to medium (SME) business sector, Butn offers a platform that integrates with the client company’s systems to transfer money in as little as fifteen minutes. The company founder won the 2020 Australian Young Entrepreneur Award in the digital disruption category.

What prompted the comment in businessnewsaustralia.com was Butn’s taking a page out of the Zip Co (ZIP) playbook, raising $12.5 million in a pre-IPO capital raise following a contract signing with food delivery platform EASI.

Unlike many large businesses, most SMEs have cash flow problems as they await payment on accounts receivables. The uneven cash flow stream affects the company’s ability to pay its own bills and purchase its own equipment. Butn steps in and essentially lends its SME clients the money to tide them over for a fee.

The company has a solid transaction record, providing its SME customers with more than half a billion dollars since its inception to cover needed goods and services. In calendar year 2020 Butn lent $166 million.

The company has four platforms. Butn Pay allows its SME clients to pay their customers immediately. Butn Now eliminates waiting time for commission payments. Butn X provides advanced payment of invoices. Butn Plus allows direct loans up to $600,000.

On 26 April Butn announced the integration of its payment platforms into small business accounting firm MYOB’s Essentials Accounting Product by the end of June and into MYOB’s expenses and invoicing platform AccountRight by the end of the year.

The Butn offer closed on 9 June and is expected to begin trading on 28 June. The issue price was $0.50.

The final IPO operating in an attractive growth sector is Australian bookmaker, and online racing and sports betting operator BlueBet.

The company is already attracting interest given the phenomenal success of ASX listed Pointsbet Holdings (PBH) – up 513% since listing in June of 20-19 – and Betmakers Technology Group (BET) – up 617% since listing in December of 2015.

BlueBet has an experienced owner with no plans to exit his creation. The company’s technology is proprietary, and its founder thinks BlueBet’s mobile-first strategy gives it a competitive edge over traditional website based digital betting sites. BlueBet does maintain a betting website as well. The company is readying a launch into the US market, with its first licence in hand.

In 2018 the US Supreme Court lifted a betting ban on that country’s most popular sports, creating a market estimated to be worth between USD$8.5 billion and USD$13.5 billion dollars by 2025. The projections are based on only 19 of the 50 US states. With fully legalised sports betting in place the forecast rises to USD$22 billion dollars.

BlueBet’s strategy in the US will focus on small states as a proving ground. The company is targeting regional casinos with minimal sportsbook experience, if any, as joint venture partners.

The company has 92,000 registered users and saw revenues for the Half Year 2021 increase by 144%.

A 13 June article in the Sydney Morning Herald cited the BlueBet prospectus forecasting revenues of $36 million dollars and a profit of $21 million for the Full Year 2021.

The offer is expected to close on 23 June and begin trading on 2 July. The issue price is $1.14.