In the first quarter of 2020, major brokerage houses in the US began to report a surge in new account openings. It was attributed to young people being spurred into action by the onset of the COVID-19 Pandemic.

With the Great Financial Crisis (GFC), the percentage of US investors began a downward spiral from 65% to a low of 52% in 2013. Since the beginning of 2020, the number has grown from 55% to 58% in 2022.

Newcomers to any endeavour need to learn what to do before acting. Upon researching the subject of investing, newcomers quickly discover that the advice is to put their dollars into diversified holdings.

Commodities are a unique asset class that investors should not ignore. They provide needed diversification away from the dominant investment asset classes of stocks and bonds. As an added benefit, commodities typically move in the opposite direction from stocks.

Commodity trading started long before the buying and selling of ownership shares in companies. Historically, commodity trading was mainly the province of experienced professional traders, given the expertise and the time and money to acquire it. Today, rank-and-file retail investors have multiple opportunities to diversify their holdings with commodities.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Commodities are vital components of economic life, defined as raw materials traders can buy and sell. Commodities are categorised as “hard” – primary raw materials extracted from the earth, or “soft” – agricultural products that can be bred, grown, and harvested.

Of all the available hard commodities from which to choose, oil arguably has been for over a century the most valuable commodity on the planet, still fulfilling much of the world’s energy needs.

Here in Australia, oil is one of the most popular assets in which to invest. This article explains what investors need to know about adding oil to their investments.

The Benefits of Trading Oil

Two of the most important benefits of crude oil trading – stability and liquidity – come from the reliance of the oil price on the US dollar. At the end of World War II, the Bretton Woods Agreement established the US dollar as the world’s reserve currency. The US dollar has a long and stable history, although the recent political problems about raising the country’s debt ceiling may have tarnished that somewhat.

The 1973 oil crisis led to an agreement between the US, Saudi Arabia, and other oil-producing countries to price oil in US dollars, the so-called Petrodollars Agreement.

In addition, as of the close of 2022, the US remained the largest economy in the world, adding to the liquidity benefit of the US dollar as the global medium of exchange for oil transactions.

Crude oil is a crucial energy source and is used to produce various other products, from plastics to fertilisers to medical products.

Oil will remain in high demand in the immediate future, with an increasingly limited supply. It is hyper-sensitive to geopolitical events, with wars and conflicts in producing countries threatening supply, leading to higher oil prices.

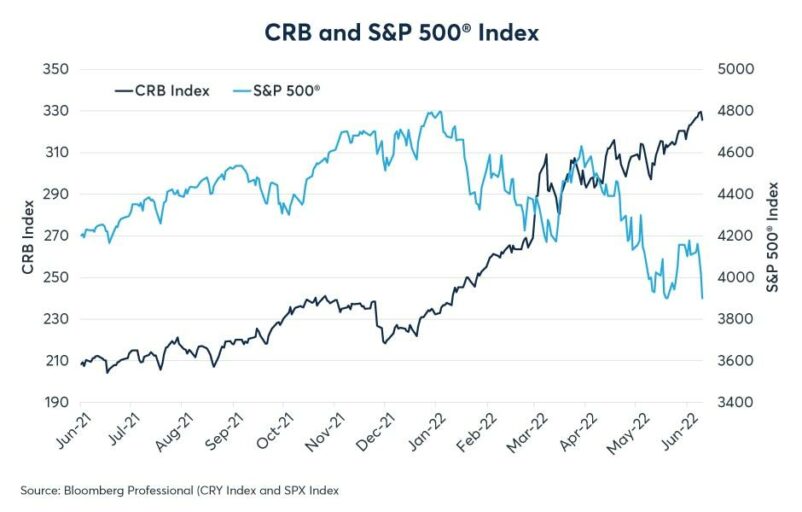

Finally, all commodities are seen as a hedge against inflation, with oil leading the way. Back in June of 2022, while inflation raged, the price of crude oil rose 48% since the start of the year. The Carbine Resources Index (CRB), which is composed of 19 different commodities, including gold, oil, and corn, has been in a non-stop upward trend while the US S&P 5000 Index was collapsing from January through June of 2022.

How to Trade Oil

There are several ways to trade oil, but the path chosen depends on the core strategy of the investor. The generic term “investor” includes everyone interested in making money through assets purchased. Within that total population, there are differences between those categorised as “traders” and those classified as “investors.” The difference is timing. Traders are interested in short-term movements leading to short-term profits. True “investors” are interested in asset purchases that will generate continued returns over time.

The distinction is not hard and fast, as some “traders” may invest in long-term holdings while some “investors” may make short-term investments.

Traders are attracted to quickly moving and frequently volatile oil prices. The main trading vehicles eliminate the burden of possessing physical oil, as airlines and other businesses that rely on oil will do. The retail trader can open futures contracts or purchase CFDs (contracts for difference), speculating on whether the price will rise or fall. As the contracts near expiration, the trader can sell futures contracts and make a profit if the price moves in the right direction. With a CFD, the trader pockets the difference between the contract price at the opening and the closing.

Spread betting is another more complex and riskier option where the trader bets on each point of movement in the oil price, up or down.

The US-based WTI (west Texas intermediate) and Brent Crude out of the North Sea are the two tradeable oil pricing options. Traders can purchase CFDs on the spot, at the current price, or a future price.

Reputable sources on futures, spread betting, and CFDs for trading oil warn potential retail traders or investors that the leverage involved can lead to sizable gains but equally sizable losses. The advice is to leave this form of trading crude oil to experienced investors. Trustpilot posts a warning on the spread betting introductory page of IG Markets, a leading UK brokerage house with operations in Australia, that 75% of IG retail clients lose money with spread betting and CFDs on oil.

The safer but potentially less lucrative option for retail investors is investing in individual oil-producing companies, exchange-traded funds (ETFs), or mutual funds.

Major oil companies are aware of the potential of the electric vehicle. Some are already expanding into non-petroleum operations. The former Woodside Petroleum, now Woodside Energy Group (ASX: WDS), has added “New Energy” and will invest over five billion dollars in hydrogen and solar projects by 2030.

UK’s BP plans to cut oil production by 40% and invest five billion dollars annually in renewable energy projects to become a global leader in green energy.

ETFs and mutual funds offer various options for crude oil trading, with some focusing on oil-producing companies, others tracking the oil price, and others providing pooling of oil futures contracts. ETFs have a significant liquidity advantage over mutual funds since they trade like stocks, available to buy or sell at any time the market in which they trade is open. Mutual funds cannot be settled until the end of the trading day.

What Factors Affect the Price of Oil

The balance between the supply of oil and its demand is the primary factor affecting the oil price. Other considerations depend on their impact on that balance. The last three years have demonstrated this, first with the COVID-19 Pandemic. The supply was intact, but border closures, lockdowns, stay-at-home requirements, and flight cancellations crushed the demand side of the equation.

More recently, another factor – the geopolitical environment has come into play with the war in Ukraine. Another major geopolitical consideration is the role the world’s largest oil-producing country – Saudi Arabia – has in controlling the price of oil. The Saudis can protect the price simply by cutting back on the amount of oil they produce.

Choosing a Broker

The choice of a broker depends on how you plan to trade crude oil. While investors and traders are concerned with fees, a more important consideration – especially for traders – is the number of resources available on the brokerage website. Spread betting, futures, and CFDs are complex transactions, and a “best choice” broker should provide learning resources on its website.

The Bull reviews some of Australia’s top brokers.

Oil Trading Strategies

Strategies for trading crude oil follow most of the same ones employed with any investing class, with the critical difference being the primary focus on supply and demand.

A news-based strategy reacts to events seen in basic fundamental analysis of economic, political, and supplier-specific changes that could impact supply and demand. Mine and refinery weather-related shutdowns on a wide scale will reduce supply.

Technical analysis requires understanding historical price movements and trading volumes rising or falling. Exit and entry points are investor specific, but the strategy here is to set them before entering any crude oil trading vehicle – stocks, CFDs, funds, or future contracts.

Hedging is a strategy unique to trading crude oil futures and CFDs where the trader takes a position opposite the initial trade.

Summary

Commodities are the raw materials the world needs to function, from the hard commodities of copper and oil to the soft commodities of wheat, corn, and soybeans. Investing in commodities provides diversification to any investment portfolio. An investor can trade oil for short-term gains through CFDs, futures contracts, or long-term gains through individual stocks or ETFs.

Supply and demand determine the oil price and any factor influencing that supply and demand. Trading strategies for crude oil include news watching, fundamental and technical analysis and hedging.