Energy has many definitions, but for investors looking for some of the best energy stocks on the ASX, they need only pay attention to one: Energy is the power needed to provide light, heat, and to work machines. ASX energy stocks are producers of that power.

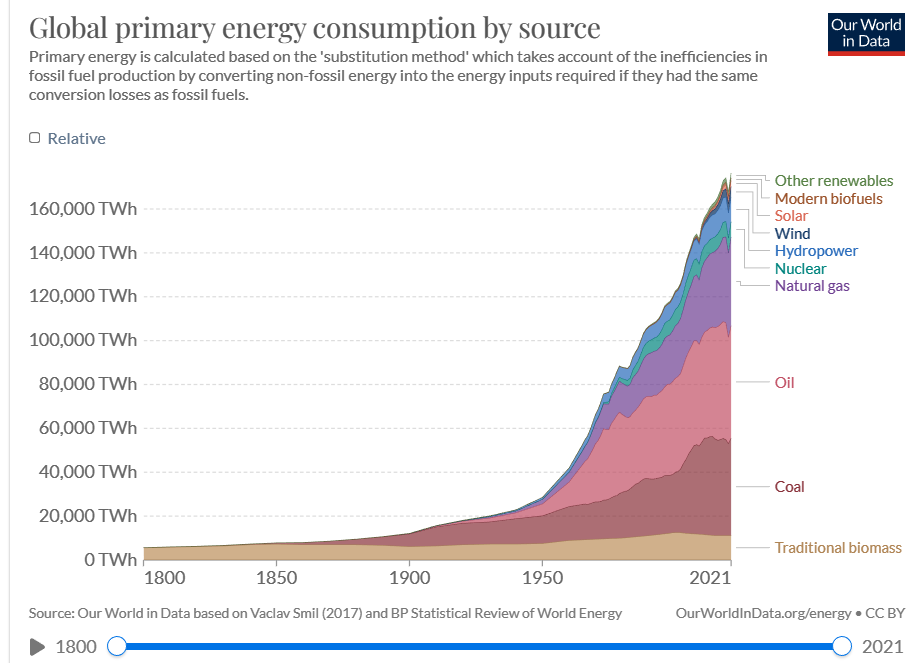

Investors in the mid-1900’s had three energy-producing sources to consider – petroleum, gas, and coal. Choices from ASX energy stocks proliferated as multiple other sources came into play. This can be as seen in the following graph from ourworldindata.org/energy:

Source: ourworldindata.org/energy

The graph tells us that investors looking for some of the best ASX energy stocks to buy now have choices beyond the more traditional producers of coal and oil.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Businesses and governments around the world are growing in their conviction that the pollution associated with energy production from oil and coal necessitates the replacement of oil and coal with clean energy. The International Energy Agency (IEA) claims governments are increasingly investing in clean energy startup companies.

Of the many available renewable resources such as solar and wind, hydrogen, and nuclear energy all are entering the global energy mix through a growing number of energy producers.

For traders looking to invest in energy, at the close of the first quarter of FY 2024 we picked some of the best ASX energy stocks to buy , particularly from the hydrogen, nuclear energy, and renewable energy sources sectors.

We now look at how these stocks performed at the end of calendar year 2024, extending into the first trading month of 2025.

The Best ASX Hydrogen Stocks to Buy

Hydrogen as a fuel can trace its origins back to hot-air balloons and airships, before progressing to liquid hydrogen, and to power space exploration. It gained its prominence in the 1970s but failed to reach its fully potential for two primary reasons.

First, hydrogen is extremely flammable.

Second, although hydrogen is the most abundant element on the planet, the process of producing hydrogen is costly and inefficient.

Hydrogen does not exist in isolation and must be separated from other elements via electrolysis. Historically, it was the source of the power needed to run an electrolyser that caused both experts and investors to dim their view of hydrogen as a best energy stock. Hydrogen produced using coal and petroleum emits high levels of carbon dioxide.

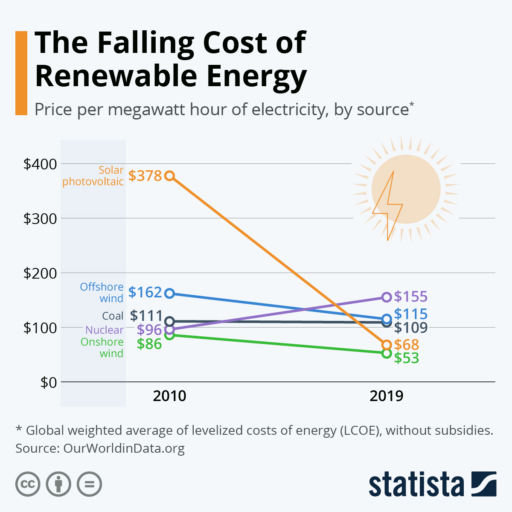

The dramatic declines in the cost of solar and wind energy have pushed hydrogen back into the forefront as “green hydrogen”. Green hydrogen is produced using the carbon free renewable energy sources of solar and wind.

ASX listed stocks are taking notice of the “green energy” movement, with some of the best ASX hydrogen stocks to buy including three existing large cap companies and one promising small cap.

Woodside Energy Group (ASX: WDS)

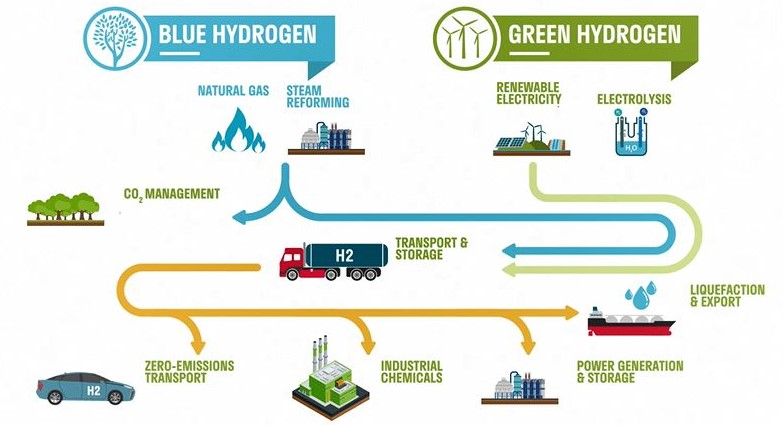

Known for its massive presence in the petroleum and liquefied natural gas (LNG) market, Woodside made the decision to move into the hydrogen market space with its first operation – H2Perth – producing both blue and green hydrogen. The following pictogram from Woodside was featured in an article appearing on abc.net.au. It depicts the difference between blue and green hydrogen.

Source: abc.net.au

The company is taking a staged approach, migrating towards green hydrogen production. Its latest efforts include green hydrogen using renewable energy sources at H2TAS in Tasmania, and H2OK in the US state of Oklahoma.

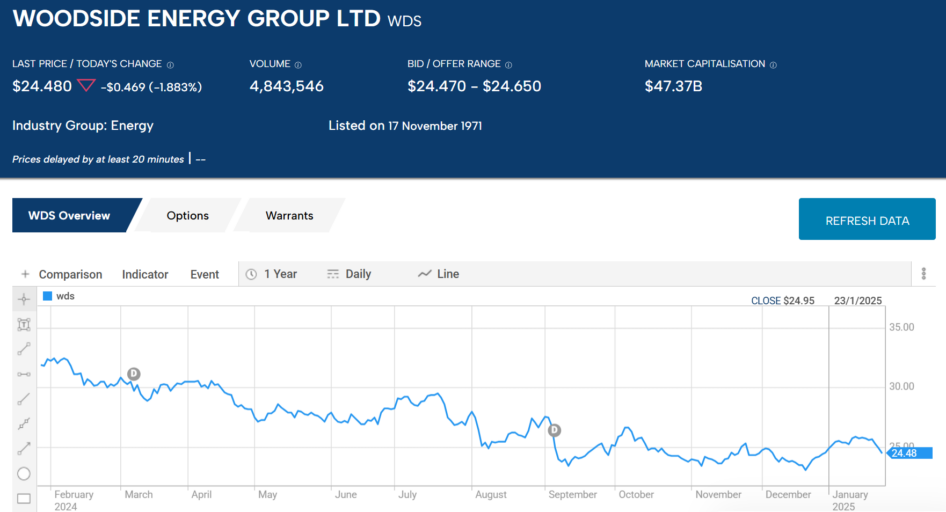

On 16 May of 2022 Woodside Petroleum changed its name to Woodside Energy Group to reflect its focus on green hydrogen. The stock price closed at $28.77 per share, rising to five-year high of $38.39, before falling to $30.31 as of 27 March of 2024.

The share price continued its downward slide in share price into 2025., down 21.4% as of 23 January.

Source: ASX Website

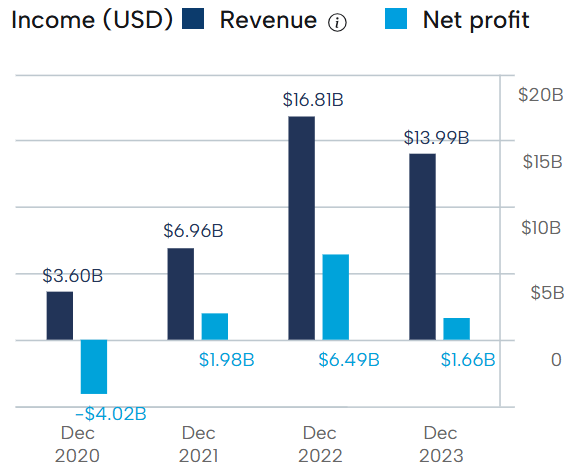

FY 2023 was a challenging year for the company’s finances.

Woodside Energy Financial Performance

Source: ASX Website

Half-Year 2024 financial results continued the declining trend, with operating revenues falling

g 19% and nett profit after tax (NPAT) dropping 11%.

Fortescue Metals Group (ASX: FMG)

Iron ore giant Fortescue Metals has expanded its efforts toward green hydrogen production from providing clean energy for its own operations to producing and exporting green hydrogen from renewables around the world. To that end, the parent Fortescue spawned a child – Fortescue Futures Industries (FFI). The subsidiary generated some controversy with its early prediction of fifteen million tonnes of green hydrogen per annum by 2030. FFI maintains the goal is achievable, given the company’s technology enhancements, global presence, and exploding demand for green hydrogen. Fortescue is in the hunt to become one of the best hydrogen stocks ASX investors can buy.

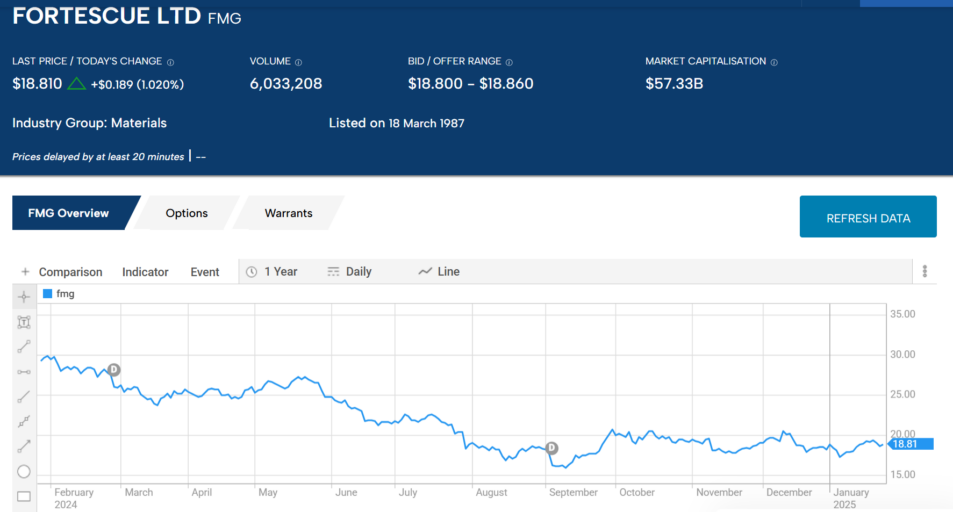

Fortescue made the announcement of its commitment to producing green hydrogen on 10 December of 2021 when the share price was trading around $18.00 per share. FMG shares hit an all-time high of $29.07 on the first trading day of January of 2024 but has been in a downtrend since, now down 355 year over year.

Source; ASX Website

The company’s financial performance has been steady if not spectacular over the last four fiscal years.

Fortescue Metals Financial Performance

Source: ASX Website

Sparc Technologies (ASX: SPN)

Sparc is a small cap company with big plans. It has disruptive technologies in play to produce both graphene-based additives and green hydrogen.

The company is at the forefront of Sparc Hydrogen, a three-way joint venture between Sparc, Fortescue Futures, and the University of Adelaide. The Sparc technology uses the sun, in a single step. The technology uses a photocatalytic water splitting process that eliminates the need for electricity from solar or wind. Development of a pilot plant is ongoing.

The share price got a big boost at the start of 2021 on the announcement of the JV with Fortescue and the University of Adelaide but had lost its way until the 9 January of 2025 announcement the company’s JV had moved into the second stage of the JV. Year over year the share price is still down 26.7%.

Source: ASX Website

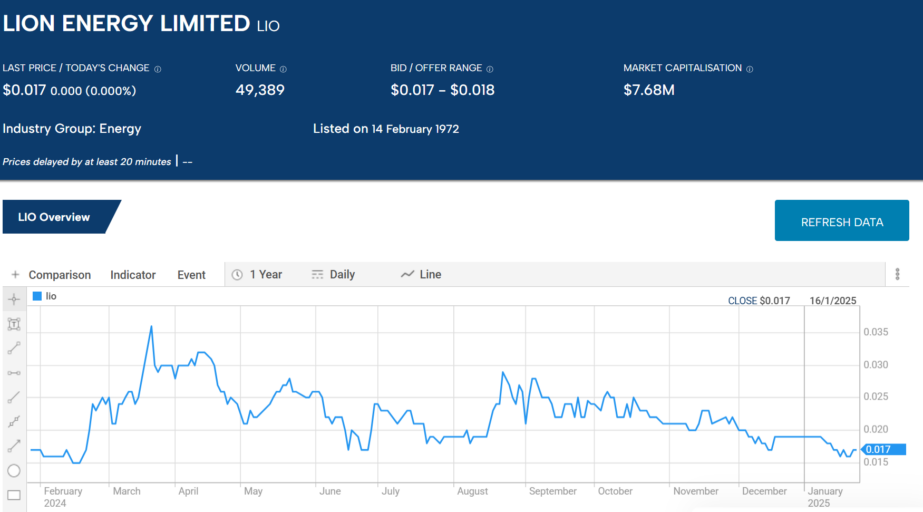

Lion Energy (ASX: LIO)

Lion Energy is an oil and gas exploration and development company that has expanded its focus to green hydrogen production.

The company’s penny stock status means a high risk for investors, but its success in oil explorations, alongside its sharply defined strategy for entering the green hydrogen space, seem to qualify Lion as a best ASX hydrogen stock.

On 13 April of 2021, the Lion share price shot up 142% intraday on the release of the news the oil reserves at one of its assets had risen 203% from previous estimates.

Ten days later the stock price saw another major boost, up 65% intraday, on the announcement of a capital raise to advance its oil development asset, and to enter the green hydrogen space with developmental approval for its hydrogen generation and refuelling hub project in the Port of Brisbane coming in March 0f 2023. The stock price is down 22.7% over five years and 5.8% year over year.

Source: ASX Website

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

The Best ASX Uranium Stocks

The Fukushima nuclear accident in Japan in 2011 pushed nuclear power out of serious consideration for clean energy. However, nuclear is back due to several reasons.

Key among them is the daunting challenge that governments face around the world. Due to the increased risk of climate change and global warming, governments are asked to commit to

carbon reduction goals. Some of these commitments are seen by experts as unattainable without nuclear power. New technology has bred a line of modular nuclear reactors, smaller in size and capable of moving from one location to another.

The UK is going ahead with plans to build a series of modular reactors, while France and Germany appear ready to scrap previous plans to shutter some of their operational plants. China reportedly has seventeen new plants under construction. Small modular reactor designs have been approved in the United States

Here are some of the best uranium stocks on the ASX.

Paladin Energy (ASX: PDN)

Paladin produces uranium at its Langer Heinrich mine in Namibia and has diversified exploration assets in Australia and Canada. The company has a 70% stake in the mine, which went into care and maintenance in May of 2018 due to falling uranium prices. With an improved outlook, the company’s planned restoration of mining operations at the Langer Heinrich Mine is now complete.

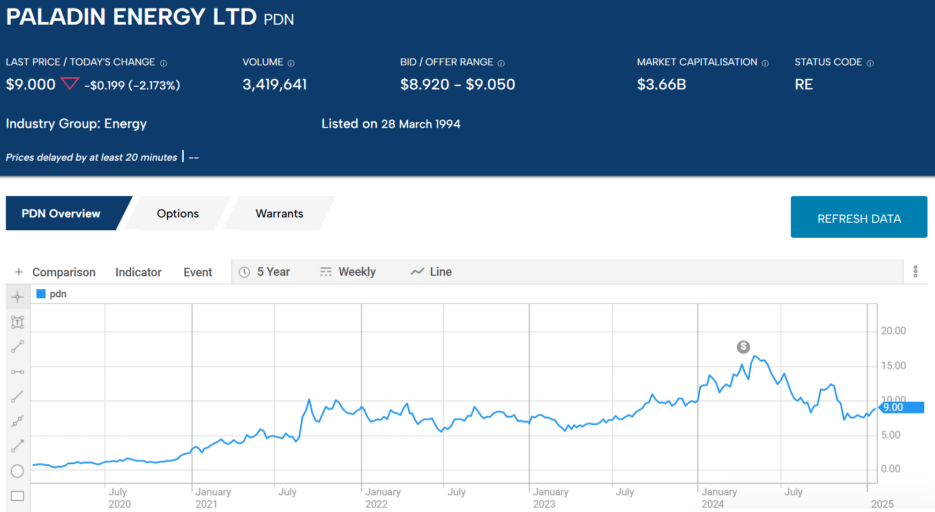

Paladin has posted years of consecutive losses with a stock price in decline since 2013 reversing course, with some upward movement beginning in 2021 Over five years the share price is now up 945%, although year over year the price has dropped 26.8%.

Source: ASX Website

The company has two additional exploration sites in Canada and two more in Australia, including the Mt Isa project in advanced stages of development.

Boss Energy (ASX: BOE)

Boss Energy is the sole owner of the Honeymoon uranium project in South Australia. The Honeymoon mine was shuttered in 2013 by the previous owner, Canada’s Uranium One, after a failed attempt to keep the mine going. Boss has now completed an EFS (enhanced feasibility study) confirming the company’s decision to alter the mine operations from Uranium One’s approach.

The study corroborated the company’s view that the operational changes would lower cost and increase production. Honeymoon remains on track to become Australia’s next uranium producer, with offtake agreements in progress. On 27 February of 2024 Boss announced the acquisition of a 30% stake in a joint venture at the Alta Mesa Uranium Project in Texas.

Over five years the Boss share price has risen f709% but year over year the share price has fallen 43%.

Source: ASX Website

Deep Yellow Limited (ASX: DYL)

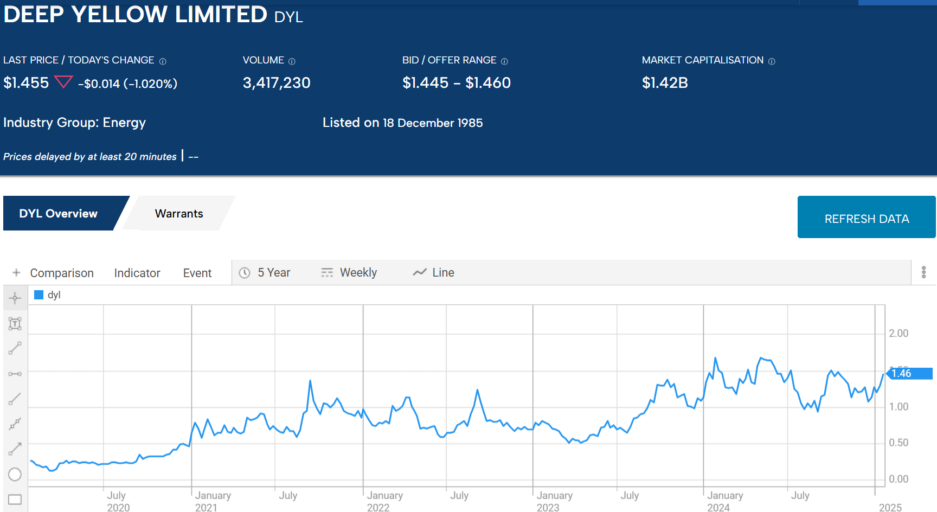

The company has multiple assets both here in Australia – two – and four in Namibia (Africa). The Mulga project in Australia is also in later-stage developments, giving Deep Yellow the potential to begin production from two mines in rapid succession – Mulga plus the further advanced Tumas Project in Africa.

The Tumas Project in Namibia is the flagship operation, with a highly positive completed DFS (definitive feasibility study) on the project in place. On 21 January of 2025 the company delayed is Final Investment Decision (FID0 on the project until March, with management expressing confidence in the project as “one of the most advanced greenfield development projects available globally.”

Over five years the share price is up 449% and 4.3% in a volatile year over year trading period.

Source: ASX Website

Deep Yellow has the potential to become Australia’s largest pure play uranium miner when Mulga and Tumas are operational.

An 11 March of 2024 market release the company announced a successful capital raise of $220 million dollars for development activities at Tumas and Mulga.

The Best ASX Renewable Energy Stocks

Renewable energy sceptics long ago claimed that the cost of solar and wind power would take decades (and longer) to become competitive with natural gas, coal, and petroleum. This has happened in a single decade.

Renewable energy sources are expected to continue to gain market share from coal, oil, and natural gas, though to a lesser extent from gas. The World Resources Institute predicts that if solar and wind continue at their historical growth rate, renewables could capture 45% of the electricity generation market by 2030, and 100% by 2033.

Here are some of the best renewable energy stocks ASX investors can buy.

Renewable energy sources are expected to continue to gain market share from coal, oil, and natural gas, though to a lesser extent from gas. The World Resources Institute predicts that if solar and wind continue at their historical growth rate, renewables could capture 45% of the electricity generation market by 2030, and 100% by 2033.

Here are some of the best renewable energy stocks ASX investors can buy,.and how they have performed going into the first month of trading in calendar year 2025.

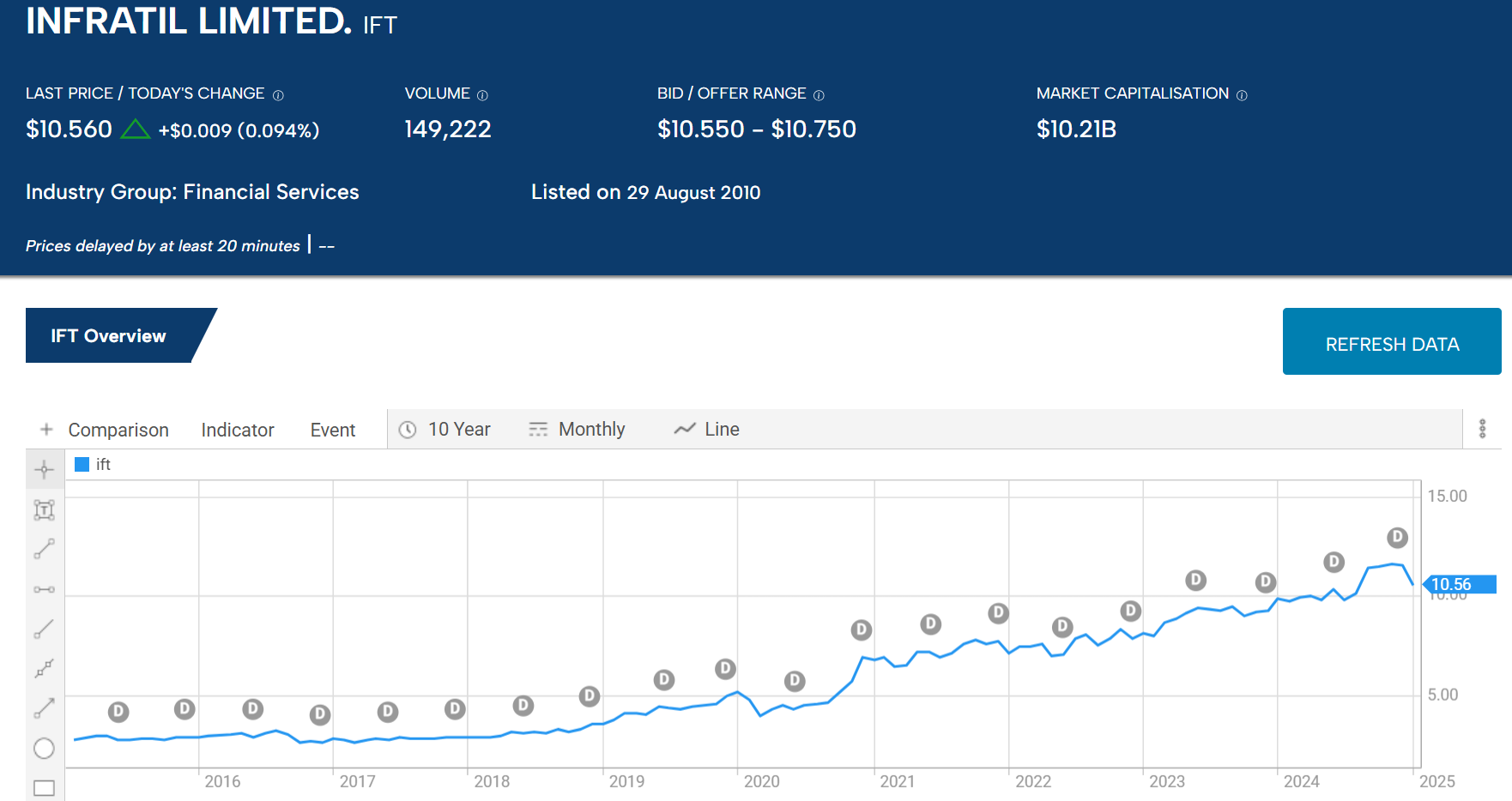

Infratil Limited (ASX: IFT)

New Zealand-based Infratil is an investment fund focusing on companies in digital and social infrastructure, healthcare, and renewable energy. The company has been in business since 1984 with an impressive run of dividend payments and share price appreciation over the last decade. The company has paid dividends over the last decade, with the share price appreciating 303.3%. Over five years the share price has risen 98.5% and 9.5% year over year.

Source: ASX Website

Infratil has a five-year average dividend yield of 2.15%.

The company’s investments in renewable energy companies span the globe, from Australia to New Zealand, to the US to Europe, and to Singapore. The largest holding is a 95% controlling interest in Gurin Energy, a Singapore-based company with a pipeline of renewable energy projects throughout Asia.

Next is a 75% stake in Australia’s Mint Renewables, who are also developing wind and solar projects. Infratil holds a 51% interest in Manawa Energy, the fifth largest electricity producer in New Zealand, operating twenty-six hydro power generating stations.

Europe’s Galileo Energy is developing wind and solar projects across Europe; Infratil holds a 40% interest.

Finally, Infratil holds 37.1% of the shares of US-based Longacre Holdings, with operational holdings developed internally and acquired across the United States.

Genex Power Limited (ASX: GNX)

Genex is a diversified renewable energy developer that extends beyond wind and solar to large scale hydro and battery storage. The company has seven projects underway, with four clustered in the flagship project of Genex Power – the Kidston Clean Energy Hub in Queensland. There are four projects that make up the Kidston Hub –the operational Kidston Solar 1 (KS1) is the first. The Kidston Solar 2 project will power what the company calls the flagship of the Kingston Hub. This is the Kingston pumped hydro storage project, the first of its kind in Australia in over forty years. Genex has formed a joint venture to develop wind power at Kidston.

The company also has a BESS (battery energy storage system) project in progress, which is an additional solar power operation in development, as well as a battery energy storage system in conjunction with a solar project.

On 3 March Genex received a non-binding takeover proposal from one of its JV partners – J-Power at a 49% premium to the Genex closing price on 1 March. On 1 August of 2024, Genex was acquired by J-Power – a Japanese utility giant electric power development company for $381 million dollars. Genex will continue operating as a subsidiary of J-Power.

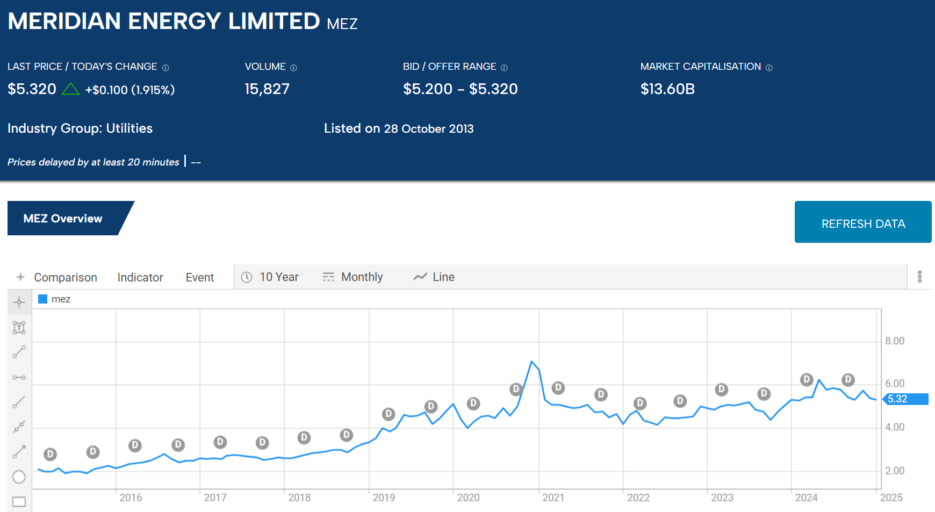

Meridian Energy (ASX: MEZ)

New Zealand-based Meridian Energy is that country’s largest generator of electricity, with its hydro power plants producing 90% and the remainder from wind farms. The company retails the electricity produced for residential, commercial, and industrial use in New Zealand, Australia, and the UK.

Meridian appears to have a competitive edge due to the range of electricity services it offers to a broad range of customers, serving individuals to businesses both large and small. Meridian is building a network of EV charging stations to support the company’s charging plans offered to its customers.

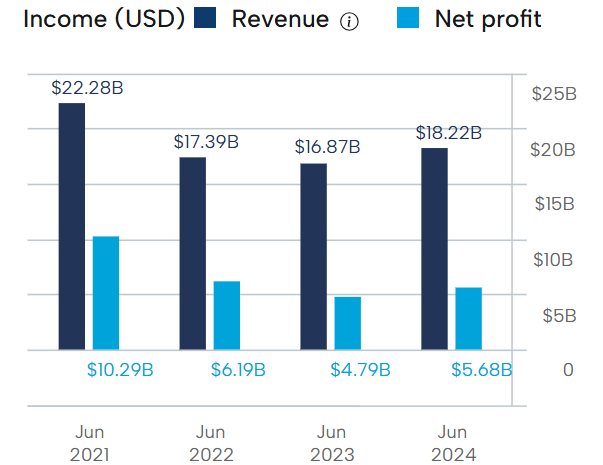

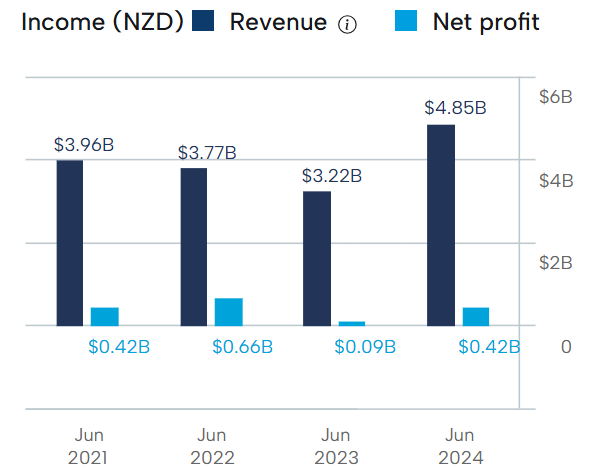

Meridian is generating revenue and is profitable.

Meridian Energy Financial Performance

Source: ASX Website

Meridian has been a consistent dividend payer over the last decade, with a five-year average dividend yield of 3.19%. Over ten years the share price has risen 198.8%, with the share price sliding since hitting an all time high in late 2020.

Source: ASX Website

To power the machines we need in our lives, as well as provide ourselves with heat and light, we need energy. Energy has always come from a mix of sources.

In the distant past, investors wishing to take advantage of the never-ending and ever-increasing demand for energy had limited choices (coal, oil, or gas). Today that has changed dramatically, with the entry of new sources into the energy mix, including that of solar, wind, hydro, geo-thermal, nuclear, and hydrogen.

The ASX features some of the best hydrogen stocks; the best uranium stocks; and the best renewable energy stocks, giving investors a wide variety of best choices.

FAQs

What Are Energy Stocks?

Energy stocks are share of companies involved with the production and supply of energy. This can include the development of oil and gas reserves, renewable energy, power utility companies and more.

How to Buy Energy Stocks?

Energy stocks are widely available. Many Australian brokers will offer a range of energy stocks. To buy them you will first need to choose a broker and open an account. You will then need to do your own research and decide which stocks to invest in.

Is Nuclear Energy Renewable?

Although nuclear energy is a clean energy source that produces no carbon emissions, it is not renewable. It relies on the burning of nuclear fuels such as uranium and so it is not renewable like solar, wind and hydroelectric power are.

How Much of Australia’s Energy is Renewable?

According to a report by the Clean Energy Council renewable energy accounted for 35.9% of Australia’s total electricity generation in 2022, up from 32.5% in 2021. Coal still provides the majority of Australia’s power, accounting for 59.1% with gas at 7.7%.