- Orora’s current Price/Sales ratio of 0.54 beats the Index P/S of 2.16.

- Orora’s current Price/Earnings ratio of 12.53 beats the Index P/E of 15.33.

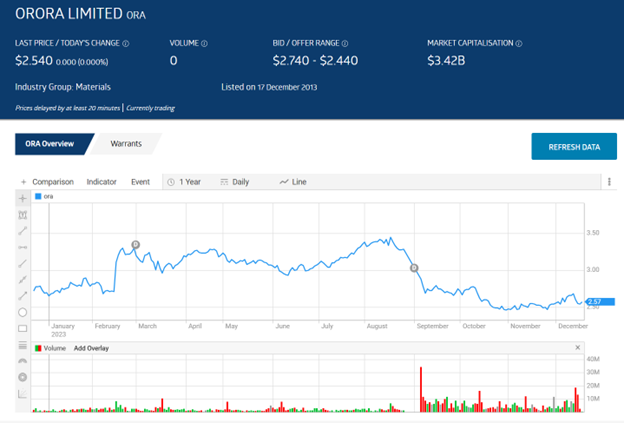

- The share price has been dropping since the company posted positive FY 2023 financial results.

Orora provides packaging solutions to the grocery, fast-moving consumer goods, and industrial sectors in Australasia and North America. The company also offers in-store visual display solutions.

The company’s Half Year 2023 Financial Results released on 15 February were solid, with a 13.9% revenue increase and a 5.3% increase in underlying net profit after tax, with investors rewarding the company with a boost in the stock price.

Source: ASX

Full Year 2023 Financial Results released on 17 August were also solid, with revenues increasing 4.9%, underlying net profit after tax up 8.5%, and dividend payments up 6.1%. The stock went into a trading halt, pending a transaction, which was updated on 31 August with the announcement of the potential acquisition of Saverglass, a manufacturer of high-end glass bottling. The stock price began to slide.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The cost of the acquisition, the capital raise, and debt financing to pay for it soured investor appetite for the shares; however, it piqued the interest of analysts as Orora announced Saverglass would contribute to corporate earnings in its first year of operation.

Orora’s current dividend yield is 6.44%, with a five-year average yield of 4.7% and five-year average dividend payments of $0.14 per share, unfranked.

An analyst at Seneca Financial Solutions has a BUY recommendation on Orora shares, pointing to the share price “trading below average price/earnings ratio levels,” pushing the stock into trading at a discount. In addition, the Saverglass acquisition gives Orora new market share opportunities.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy