- Economists and financial experts have wavering convictions on the impact of inflation and interest rates on consumer spending.

- Investors willing to weather the stormy economic conditions were quick to bail on the news of insider selling at Nick Scali.

- However, furniture retailer Nick Scali has navigated well through the storm, with the share price on an upward trend and strong FY23 results, including a 15.1% rise in net profit after tax.

Nick Scali is an importer and multi-channel retailer of a range of quality furniture to meet customer’s budget needs.

The company’s online presence meant a reduced impact of the COVID-19 pandemic on the company’s financial performance, with a ten-million-dollar profit drop in the second wave of the pandemic. Although sceptics might credit the federal government’s largesse in direct payments to consumers to withstand the COVID downturn, Nick Scali in FY 2023 more than doubled pre-COVID profit.

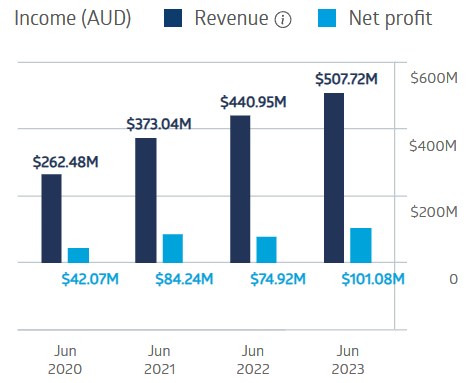

Nick Scali Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The Full Year 2023 results showed revenues up 15.1%, net profit after tax up 26.1%, and total dividends up 7.1%. The company has an admirable track record of dividend payments, with a five-year average payment of $0.57 per share and a five-year average dividend yield of 6.54%.

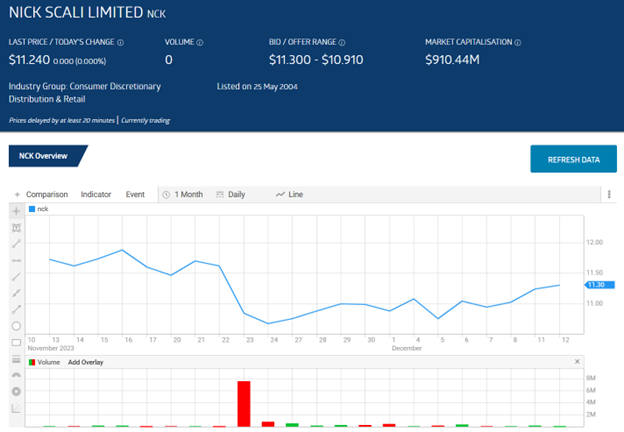

On 23 November, the company announced that CEO and Managing Director Nick Scali had sold 4.6 million shares to diversify the family’s assets. The share price dropped 10% in early trade but is back on an upward trend.

Source: ASX

An analyst at BW Equities has a HOLD recommendation on Nick Scali, citing the company’s solid FY 2023 Financial Results as evidence that “competent management should be able to navigate higher interest rates,” but added the caveat “higher interest rates can impact consumer spending.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy