- The Treasury Wine Estates share price went into a downward slide in November of 2019.

- Chinese tariffs on imported Australian wines cemented the downward slide.

- With the expectation tariffs will be listed, analysts have turned bullish.

The TWE share price was in an upward trend since listing with an interruption in 2018 before Goldman Sachs reiterated a SELL rating on the stock, citing softening demand in both China and the US. The stock price has yet to recover, with the China situation accelerating the trend.

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

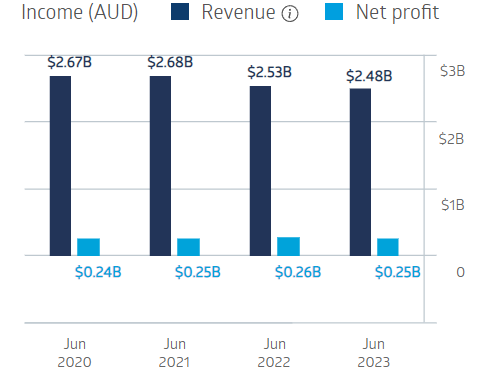

The company has internationally recognised branded wines and despite challenging conditions has maintained profitability over the past four fiscal years, albeit flat. Revenues have declined.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

In the FY 2023 Financial Reporting management expressed confidence in FY 2024 growth, driven by demands for luxury wine and premium brands.

Treasury Wine Estates has a five year average dividend yield of 2.61% with five year average payments of $0.32 per share per year. FY 2023 dividends of $0.34 were fully franked.

Treasury Wine Estates Financial Performance

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

An analyst at Shaw and Partners has a BUY recommendation on – Treasury Wine Estates, citing increased demand from the cessation of Chinese tariffs, strong brands, a quality management team and a strong track record.

Marketscreener.com has an analyst consensus OUTPERFORM rating on TWE shares, with seven of the fourteen analysts reporting at BUY, four at OUTPERFORM, two at HOLD, and one at SELL.

The Wall Street Journal has an analyst consensus BUY rating on TWE shares, with ten analysts at BUY and two at OVERWEIGHT.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy