Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

BUY – Pilbara Minerals (PLS)

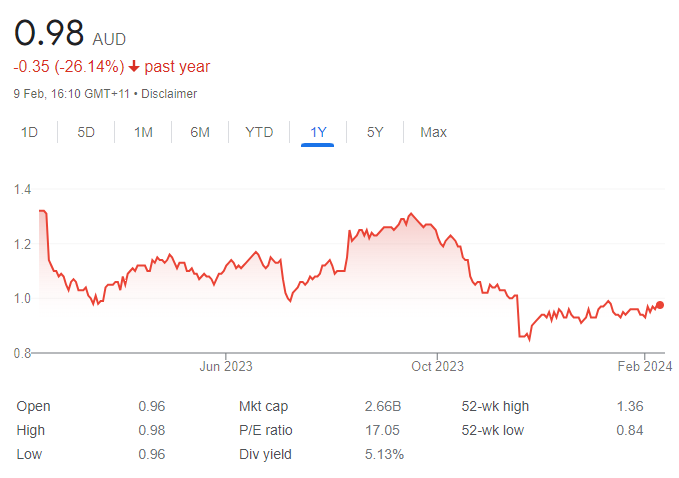

The December 2023 quarterly activities update demonstrated Pilbara’s ability to remain profitable throughout the cycle. The lithium miner maintains a strong balance sheet to withstand any further declines in lithium prices. We expect the lithium market to recover in the long term and believe recent share price weakness in PLS presents a buying opportunity.

BUY – Domino’s Pizza Enterprises (DMP)

In a recent trading update, the fast food giant reported disappointing preliminary group earnings for the first half of fiscal year 2024. The business in Japan is underperforming and weighing on group performance. However, results in Australia and New Zealand were positive. We believe the stock has been oversold as Domino’s remains a leader in the sector. The shares have fallen from $58.08 on January 23 to trade at $40 on February 8.

HOLD RECOMMENDATIONS

HOLD – ResMed Inc (RMD)

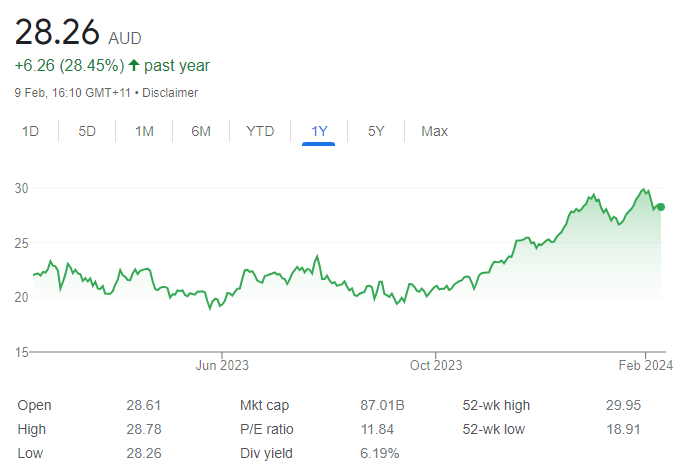

RMD makes medical devices to treat sleep apnoea. Second quarter revenue in fiscal year 2024 grew by 11 per cent on a constant currency basis compared to the prior corresponding period. Investor fears that ResMed’s sleep apnoea business would be negatively impacted by diabetes and weight loss medicines appears to be waning. We believe the share price will continue to recover. The shares have risen from $21.56 on October 27, 2023, to trade at $28.58 on February 8, 2024.

HOLD – James Hardie Industries PLC (JHX)

This building products maker continues to gain market share after delivering strong second quarter results and guidance in fiscal year 2024. We believe the sector will continue to benefit from an expected decline in US mortgage rates and falling input costs. In our view, James Hardie is one of the highest quality names in the sector.

SELL RECOMMENDATIONS

SELL – Commonwealth Bank of Australia (CBA)

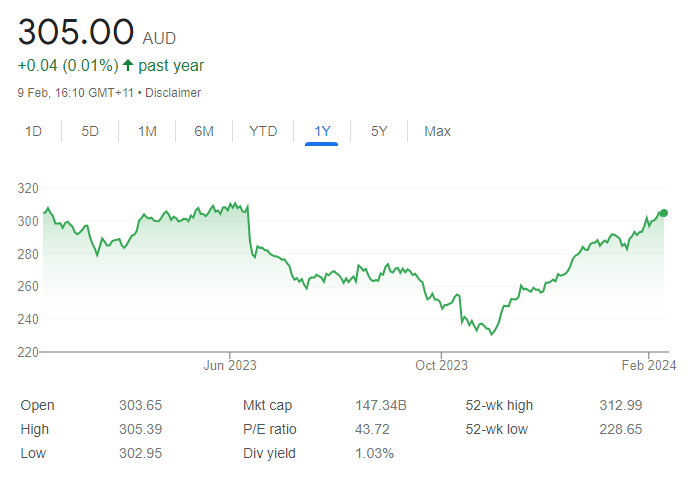

Sustaining existing high earnings for full year 2024 will be a challenge in an environment of slowing credit growth and increasing competition. The share price has risen from $96.56 on October 31, 2023, to trade at $115.745 on February 8, 2024. Investors may want to consider reducing their exposure in favour of better risk-adjusted returns elsewhere.

SELL – Fortescue (FMG)

Recent strength in this iron ore producer’s share price has elevated Fortescue’s price/earnings multiple when compared to peers. We expect global steel demand to slow and iron ore prices to weaken. Also, a ramp-up to full production at the Iron Bridge magnetite project may be pushed into fiscal year 2025. Given these headwinds, we believe investors should take advantage of the elevated share price and consider cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

BUY – Chrysos Corporation (C79)

The company’s flagship product PhotonAssay analyses gold, copper, silver and other elements. C79 was recently sold down after missing revenue expectations in the second quarter of fiscal year 2024. Delays in the number of PhotonAssay unit installations reflect timing issues as opposed to a reduction in demand. We view the share price reaction as overdone, presenting attractive entry levels for investors.

BUY – Treasury Wine Estates (TWE)

A review of punitive tariffs imposed on Australian wine in China is expected to be completed at the end of March. Lifting tariffs, or significantly reducing them should ignite demand for TWE’s Penfolds brand. The company offers strong brands and a quality management team. TWE has established a strong track record.

HOLD RECOMMENDATIONS

HOLD – CSL (CSL)

CSL is one of Australia’s greatest growth companies. CSL continues to grow at double digit rates. Management has flagged potentially expanding beyond its influenza and COVID-19 businesses into exploring and treating other respiratory viruses, which is a positive strategic move for the company, in our view. The company’s research and development potential drives innovation.

HOLD – Seek (SEK)

SEK is a quality online employment marketplace. The share price has risen from $20.77 on November 1, 2023, to trade at $26.14 on February 8, 2024. The company grew revenue from continuing operations by 10 per cent in fiscal year 2023 when compared to the prior corresponding period. EBITDA was up 7 per cent. We like the company’s global growth opportunities.

SELL RECOMMENDATIONS

SELL – AMP (AMP)

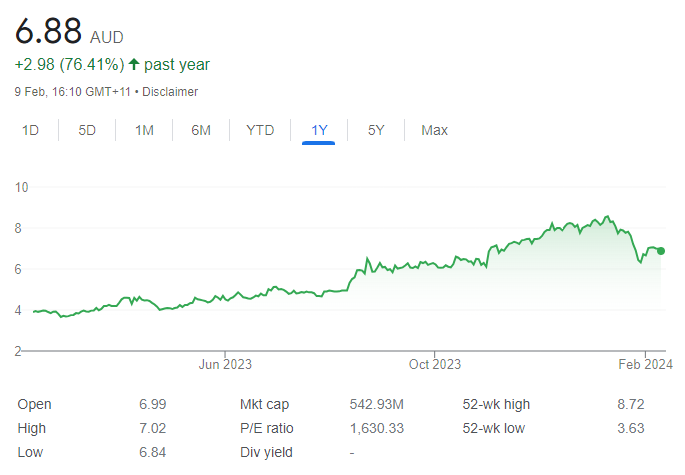

The share price of this diversified financial services company has fallen from $1.345 on February 9, 2023, to trade at 96.5 cents on February 8, 2024. AMP’s smaller scale compared to bigger competitors means cost pressures remain an issue, in our view. AMP has been a disappointing performer for a long time as the company battled regulatory and operational issues. Total revenue and statutory net profit after tax fell in the first half of fiscal year 2023. In our view, other stocks offer much brighter prospects.

SELL – Commonwealth Bank of Australia (CBA)

While CBA is the highest quality bank in Australia, we cannot justify its valuation at current levels. The share price was recently trading at all-time highs. We believe this is an opportune time to take some profits and reinvest the funds into better opportunities elsewhere.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

BUY – Mineral Resources (MIN)

While still under pressure from falling lithium prices, we’re encouraged by the company’s recent update regarding the development of the Onslow iron ore project. The project is on track to deliver first ore-on-ship in June 2024. It will provide excellent cash flow ahead of what we expect will be an eventual lithium market recovery.

BUY – Macquarie Group (MQG)

Downgrades in mid to late 2023 were due to difficult corporate transaction conditions. However, we believe financial conditions are improving. The global outlook includes interest rate cuts, which, in our view, positions this diversified financial services company to benefit from improving transaction volumes and earnings in fiscal years 2024 and 2025.

HOLD RECOMMENDATIONS

HOLD – ResMed Inc (RMD)

The sleep apnoea device maker delivered impressive results in the second quarter of fiscal year 2024, including a surprise improvement in gross margins. The stock has positively re-rated in recent months after investors slashed the share price last year on concerns that weight loss and diabetes medicines may negatively impact the company’s sleep apnoea business. We see potential for further gains and regard RMD as a long-term growth story.

HOLD – IGO Limited (IGO)

The company recently delivered a necessary set of restructuring news, including a curtailment of nickel operations and a re-worked pricing mechanism for lithium sales to key customers. These initiatives are rational and should help preserve the balance sheet while the company weathers the present downturn.

SELL RECOMMENDATIONS

SELL – Boral (BLD)

Suppliers of building materials have benefited from strong construction demand in recent quarters. In November, BLD upgraded fiscal year 2024 guidance. The shares have risen from $4.34 on October 4, 2023, to trade at $5.42 on February 8, 2024. Boral shares were recently trading about 25 per cent above our valuation, so we see better opportunities elsewhere over the medium term. Investors may want to consider cashing in some gains.

SELL – Orora (ORA)

This packaging company recently acquired French high-end bottle maker Saverglass for about $2.2 billion. The acquisition gives ORA a quality asset in Europe, but we believe the acquisition price looks full and brings integration risk in a region that Australian firms historically had limited success.

Related Articles:

- A Guide to Day Trading ASX Shares

- The Best Australian Apps for Investing

- CFD Brokers in Australia

- How to Trade CFDs in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.