- HY 2023 financial results continued Amcor’s strong record of dividend payments.

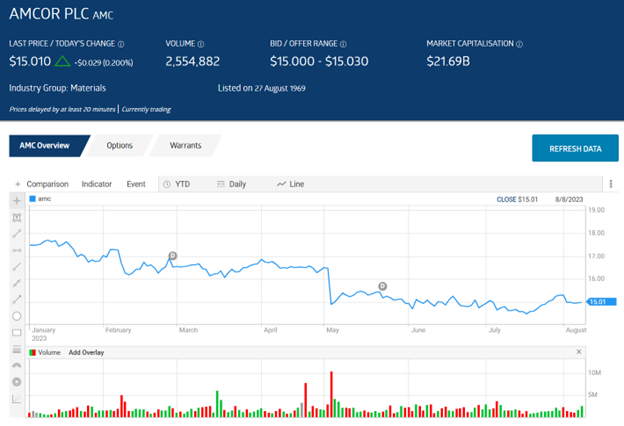

- Despite a solid financial performance, a cautious forward-looking outlook drove down the share price.

- Investors may be ignoring the defensive nature of the company’s packaging products.

Virtually everything that consumers buy comes in packaging. Amcor provides a variety of packaging solutions for home and healthcare products, food and beverages, pharmaceutical and medical products, and more. The company has a presence in 43 countries.

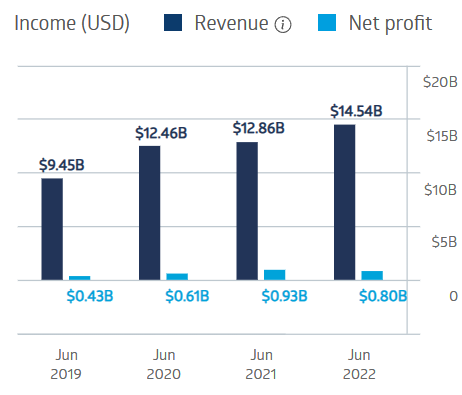

Amcor’s financial performance weathered the initial impact of the COVID-19 pandemic and its aftermath before showing a drop in net profit in FY 2022.

Amcor Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The Amcor share price took its first significant drop year to date in February following a positive HY 2023 Financial Performance announcement that included a cautionary outlook for global packaging demand in the near term.

Source: ASX

Overall, the analyst community in the US, where Amcor trades on the New York Stock Exchange under the ticker AMCR, are bearish on Amcor shares, with a consensus REDUCE recommendation from five analysts.

Here in Australia, an analyst at Seneca Financial Solutions has a HOLD recommendation, claiming that the company’s negative outlook is short term. An Australian analyst at Seneca has a SELL recommendation, claiming that investors should wait for evidence that Amcor’s business conditions have improved.

Amcor is a strong dividend payer, with a five-year average dividend yield of 4.37%.

A funds manager at Australia’s Investors Mutual Limited has a positive outlook on Amcor’s dividend performance.

An analyst at Australian asset management firm Elston likes Amcor for its defensive position.

The company plans to have all its packaging products recyclable and reusable by 2025. Amcor has contracted with waste analytics company Greyparrot to incorporate AI into its waste management systems.