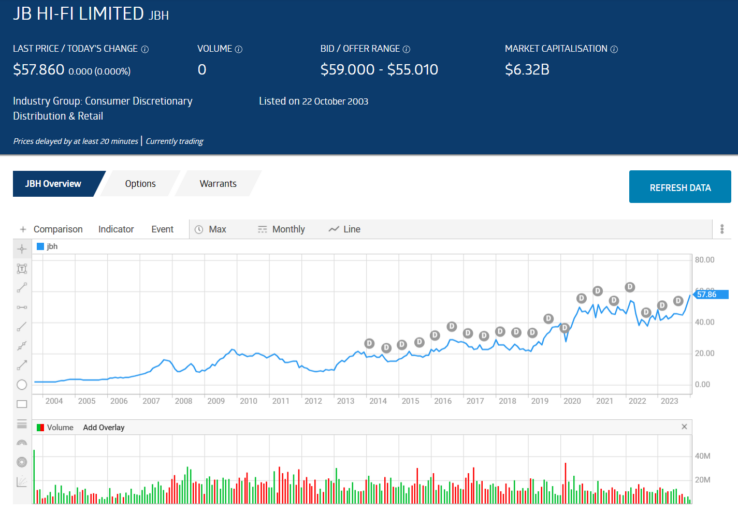

- A longtime favorite target of short sellers, JB HiFi has dropped out of the TOP TEN, falling to the 20th most shorted stock.

- Short interest of 8.3% in August of 2023 has fallen to 5.17% and the twentieth position on the TOP 100 list.

- Despite a challenging environment, JBH reached an all-time high days ago.

JB HiFi built its reputation on the promise to be Australia’s low price leader. Facing stiff challenges to that proposition from foreign import websites, short sellers piled on the company, only to see JBH slip out or their grasp time and time again.

The company survived COVID and shifts in their product mix into home appliances as well as traditional consumer electronics staples has earned accolades from investment analysts.

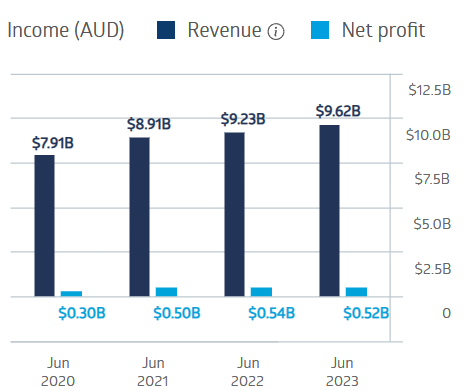

JB HiFi Financial Performance

Source: ASX

While COVID 19 had minimal impact on JB HiFi’s financial performance in the early days of the pandemic, inflation, high interest rates, and recession concerns took their toll in FY 2023.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A 25 October trading update to the market, JB HiFi management pointed to the minimal drop in sales growth for the first quarter of 2024, -1%. The share price is now sitting at an all-time high.

Source: ASX

JBH began paying dividends in 2014, with a full year dividend payment of $0.83 per share. Payments have increased every year over the last decade rising to FY 2023’s $3.12 per share, fully franked. Over five years dividend payments have averaged $2.37 per share with an average yield of 5.65%.

An analyst at Red Leaf Securities has a HOLD recommendation on JBH shares, pointing to the company’s “proven track record and management’s continual surprising to the upside“.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy