- Rural Funds Group is a Real Estate Investment Trust (REIT) focusing on agricultural assets.

- The trust owns and maintains farmland and agricultural infrastructure assets leased to commodity producers.

- Most of the company’s customers are corporate agricultural producers.

The company’s properties are located throughout Australia, with almonds being the top revenue-generating commodity. Rural Funds Group also owns farmland assets in macadamias, poultry, cattle, vineyards, crop rotation, and water.

Since listing on the ASX in 2014, Real Estate Investment Trust (REIT) Rural Funds Group has seen its share price rise 133.21%, but the share price has fallen 24.19% year over year.

Source: ASX

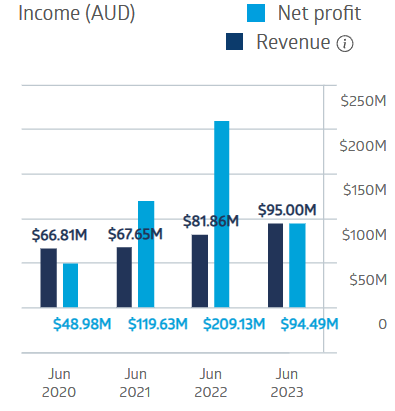

Agriculture can be a wildly volatile sector, but Rural Funds has a solid record of financial performance, with the decline in FY 2023 net profit resulting from one-off charges with the wind-up of the Macgrove Project.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Rural Funds Group Financial Performance

Source: ASX

Rural Funds Group has a five-year average dividend per share payment of $0.11 with a five-year average yield of 4.91%. The current yield is 6.24%.

An analyst at Bell Potter Securities has a BUY recommendation on Rural Funds Group, stating: “A buying opportunity exists for an undervalued stock recently trading on attractive dividend yield above 6 per cent.”

Bargain hunters should take note of the company’s book value statistics. The current Price to Book ratio is 0.75, which translates to a book value per share of $2.59 as of the most recent quarter, well above the current price.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy